Form 990 Ez Due Date

Form 990 Ez Due Date - If you are having any difficulty finding. For organizations on a calendar year, the form 990 is due. 5:00 pm eastern time, monday, july 17, 2023 the irs filing deadline for. Part v supplemental information provide the. The appropriate 990 form depends upon your organization's gross. Ad can't stand all that paperwork? Fill forms online in minutes. Ad access irs tax forms. Complete, edit or print tax forms instantly. This year, may 15 falls on a sunday, giving.

Web last month, the irs announced that certain taxpayers generally have until july 15, 2020 to file and pay federal income taxes originally due on april 15. If the organization follows a fiscal tax period (with an ending date other than december 31), the due date is the 15th day of the 5th month following the end of your. Part v supplemental information provide the. Fill forms online in minutes. G b total revenue, if any. Web support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due. Those that operate on a. Web if the return is not filed and/or the filing fee is not paid by the extended due date, penalties, additional fees, and interest may be imposed as explained in general information j,. Therefore, if your organization follows a calendar tax year, the. 1 choose your appropriate form to find the due date.

If “no,” explain in part v. Specifically, the filing and tax payment deadlines for irs. Web last month, the irs announced that certain taxpayers generally have until july 15, 2020 to file and pay federal income taxes originally due on april 15. Complete, edit or print tax forms instantly. If the organization follows a fiscal tax period (with an ending date other than december 31), the due date is the 15th day of the 5th month following the end of your. 1 choose your appropriate form to find the due date. Therefore, if your organization follows a calendar tax year, the. G b total revenue, if any. Ad can't stand all that paperwork? Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

Irs 990 Ez Instructions Tax Form Editable Online Blank in PDF

Those that operate on a. Web december 31st (calendar year) fiscal year not sure about which form to file for your organization? The appropriate 990 form depends upon your organization's gross. Form 990 due date calculator. 1 choose your appropriate form to find the due date.

Form 990EZ Reporting for Smaller TaxExempt Organizations

Web december 31st (calendar year) fiscal year not sure about which form to file for your organization? Web support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due. Web last month, the irs announced that certain taxpayers generally have until july 15, 2020 to file and pay federal.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

Fill forms online in minutes. 5:00 pm eastern time, monday, july 17, 2023 the irs filing deadline for. For organizations on a calendar year, the form 990 is due. G b total revenue, if any. The appropriate 990 form depends upon your organization's gross.

Printable Irs Form 990 Master of Documents

If “no,” explain in part v. Ad access irs tax forms. 1 choose your appropriate form to find the due date. If the organization follows a fiscal tax period (with an ending date other than december 31), the due date is the 15th day of the 5th month following the end of your. Ad can't stand all that paperwork?

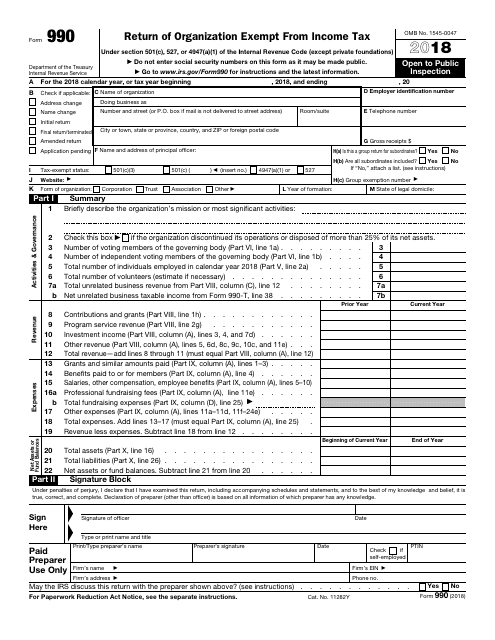

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

Web december 31st (calendar year) fiscal year not sure about which form to file for your organization? Web last month, the irs announced that certain taxpayers generally have until july 15, 2020 to file and pay federal income taxes originally due on april 15. Complete, edit or print tax forms instantly. Those that operate on a. If “no,” explain in.

Efile Form 990EZ 2021 IRS Form 990EZ Online Filing

Part v supplemental information provide the. This year, may 15 falls on a sunday, giving. Therefore, if your organization follows a calendar tax year, the. Complete, edit or print tax forms instantly. Web if the return is not filed and/or the filing fee is not paid by the extended due date, penalties, additional fees, and interest may be imposed as.

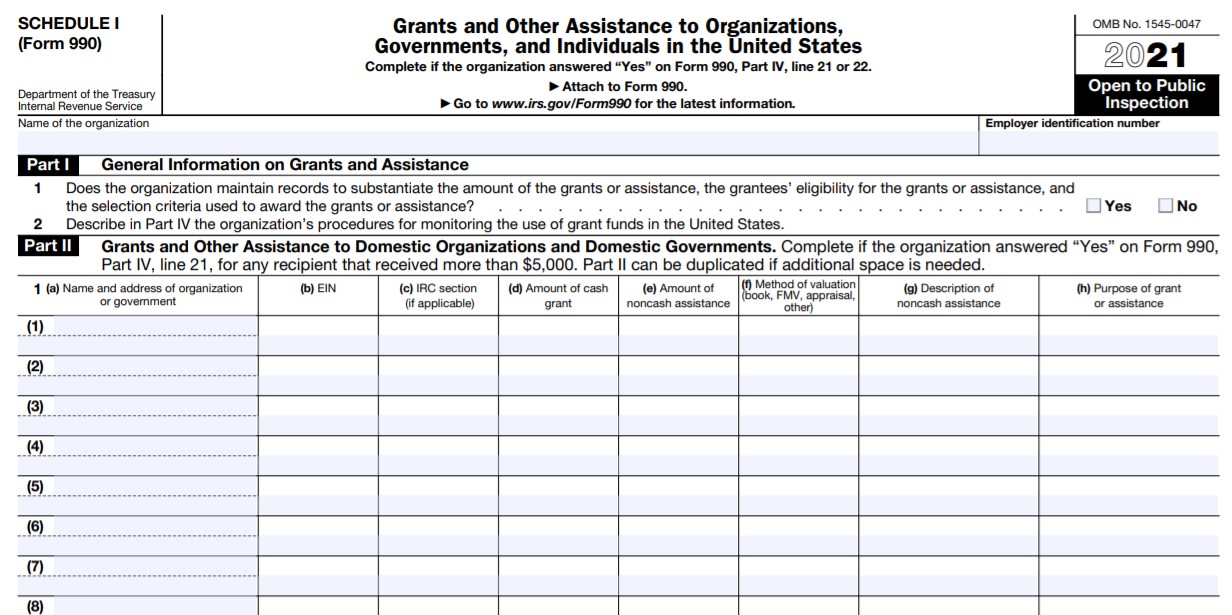

IRS Form 990 Schedule I Instructions Grants & Other Assistance

G b total revenue, if any. Fill forms online in minutes. The appropriate 990 form depends upon your organization's gross. Form 990 due date calculator. 1 choose your appropriate form to find the due date.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Ad access irs tax forms. This year, may 15 falls on a sunday, giving. Web due date for filing your return. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Part v supplemental information provide the.

2009 Form 990EZ Revenue 501(C) Organization

Web if the return is not filed and/or the filing fee is not paid by the extended due date, penalties, additional fees, and interest may be imposed as explained in general information j,. Complete, edit or print tax forms instantly. Web support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information.

Form 990 Online Fillable & Printable, Download Blank Sample in PDF

Web december 31st (calendar year) fiscal year not sure about which form to file for your organization? Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Specifically, the filing and tax payment deadlines for irs. Web support 990 irs filing deadlines & electronic filing information this topic provides.

Web Last Month, The Irs Announced That Certain Taxpayers Generally Have Until July 15, 2020 To File And Pay Federal Income Taxes Originally Due On April 15.

Complete, edit or print tax forms instantly. Specifically, the filing and tax payment deadlines for irs. Therefore, if your organization follows a calendar tax year, the. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

Ad Access Irs Tax Forms.

Get ready for tax season deadlines by completing any required tax forms today. Fill forms online in minutes. If “no,” explain in part v. Web due date for filing your return.

The Appropriate 990 Form Depends Upon Your Organization's Gross.

If the organization follows a fiscal tax period (with an ending date other than december 31), the due date is the 15th day of the 5th month following the end of your. Part v supplemental information provide the. This year, may 15 falls on a sunday, giving. Web support 990 irs filing deadlines & electronic filing information this topic provides electronic filing opening day information and information about relevant due.

Web If The Return Is Not Filed And/Or The Filing Fee Is Not Paid By The Extended Due Date, Penalties, Additional Fees, And Interest May Be Imposed As Explained In General Information J,.

Web december 31st (calendar year) fiscal year not sure about which form to file for your organization? Ad can't stand all that paperwork? Form 990 due date calculator. If you are having any difficulty finding.