How To File Form 1120-H

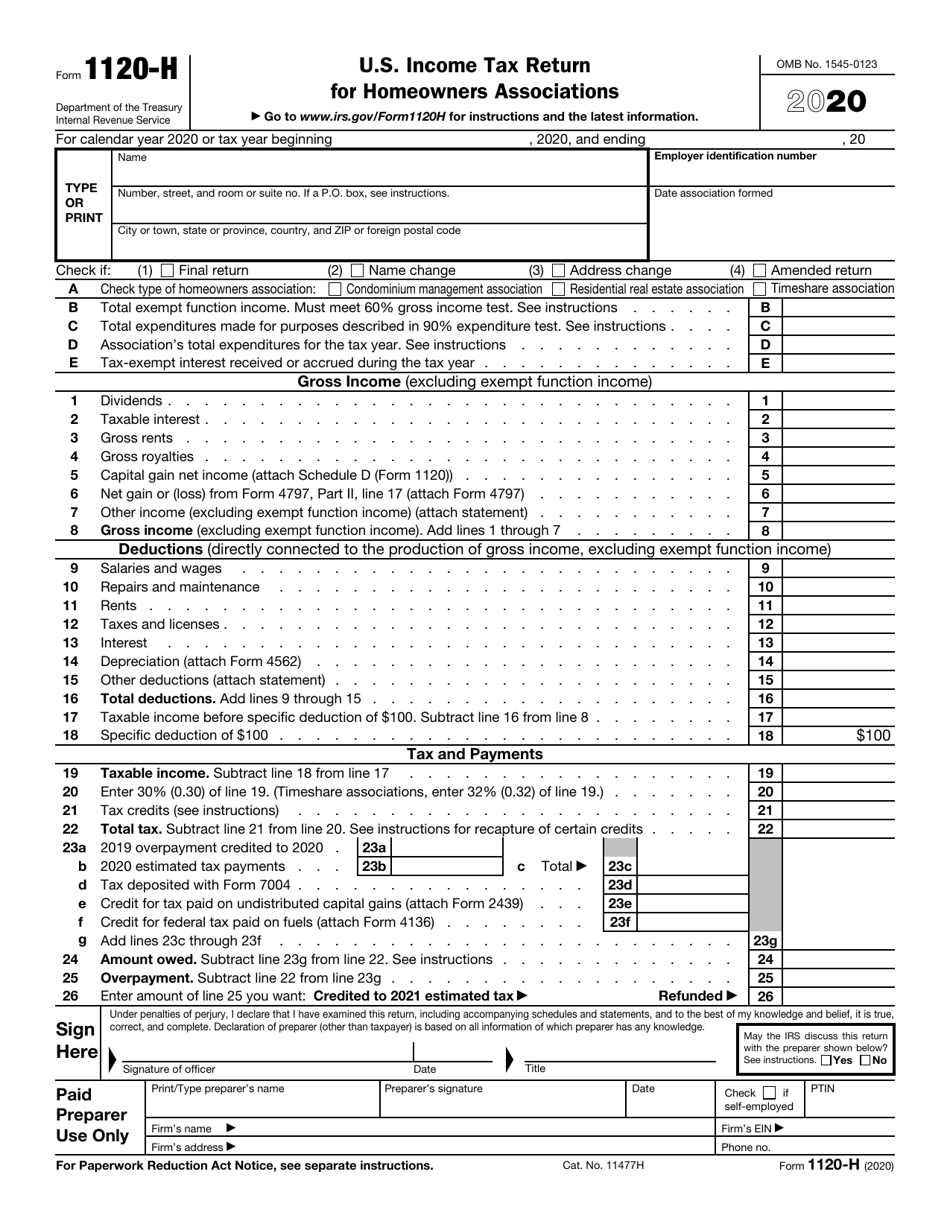

How To File Form 1120-H - Top section the image above is the top section of the form. Continue with the interview process to enter all of the appropriate information. Web tax liability & payment section: Web there are two different forms that can be filed; Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. Hoa's are generally only subject to corporate inc. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. If the association's principal business or office is located in. Use the following irs center address.

Web tax liability & payment section: There are a few things you can do to make filing an hoa tax return easier. Domestic homeowners association to report its gross income and expenses. Web click basic information in the federal quick q&a topics menu to expand, then click special filings. It details some of the basic information of the homeowners association. Web there are two different forms that can be filed; Number, street, and room or suite no. Use the following irs center address. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Web timeshare association there are five requirements to qualify as an hoa:

Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. Domestic homeowners association to report its gross income and expenses. Continue with the interview process to enter all of the appropriate information. Web there are two different forms that can be filed; However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Web timeshare association there are five requirements to qualify as an hoa: For calendar year 2020 or tax year beginning, 2020, and ending, 20type or print. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Web click basic information in the federal quick q&a topics menu to expand, then click special filings. Web tax liability & payment section:

IRS Form 1120H Download Fillable PDF or Fill Online U.S. Tax

On the screen titled special filings, check homeowners association, then click continue. Number, street, and room or suite no. At least 60% of gross income should be exempt function income at least 90% of annual expenses should be for the association’s business no private shareholder or individual should benefit from the association’s earnings at least 85% of housing units should.

File 1120 Extension Online Corporate Tax Extension Form for 2020

A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Web tax liability & payment section: There are a few things you can do to make filing an hoa tax return easier. It details some.

Form 1120 Filing Instructions

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Web click basic information in the federal quick q&a topics menu to expand, then click special filings. Web tax liability & payment section: Web timeshare association there are five requirements to qualify as an hoa: On the.

Form 1120 Amended Return Overview & Instructions

However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Continue with the interview process to enter all of the appropriate information. Web tax liability & payment section: Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information..

How to File Form 1120 S U.S. Tax Return for an S Corporation

Number, street, and room or suite no. On the screen titled special filings, check homeowners association, then click continue. Hoa's are generally only subject to corporate inc. Top section the image above is the top section of the form. If the association's principal business or office is located in.

Do I Need to File Form 1120S if no Activity? YouTube

Domestic homeowners association to report its gross income and expenses. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Web tax liability & payment section: Continue with the interview.

IRS Form 7004 Automatic Extension for Business Tax Returns

On the screen titled special filings, check homeowners association, then click continue. Top section the image above is the top section of the form. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year. Income tax return for homeowners associations go to www.irs.gov/form1120h.

Form 1120H Example Complete in a Few Simple Steps [Infographic]

Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. For calendar year 2020 or tax year beginning, 2020, and ending, 20type or print. Number, street, and room or suite no. There are a few things you can do to make filing an hoa tax return easier. A homeowners association files this form as its.

Form 8879I IRS efile Signature Authorization for Form 1120F (2015

Web timeshare association there are five requirements to qualify as an hoa: Web click basic information in the federal quick q&a topics menu to expand, then click special filings. Web tax liability & payment section: At least 60% of gross income should be exempt function income at least 90% of annual expenses should be for the association’s business no private.

How to File Form 1120H for a Homeowners Association YouTube

If the association's principal business or office is located in. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Hoa's are generally only subject to corporate inc. For calendar year 2020 or tax year beginning, 2020, and ending, 20type or print. Web there are two different forms that can be filed;

Hoa's Are Generally Only Subject To Corporate Inc.

For calendar year 2020 or tax year beginning, 2020, and ending, 20type or print. Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. Web timeshare association there are five requirements to qualify as an hoa: Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania.

There Are A Few Things You Can Do To Make Filing An Hoa Tax Return Easier.

Number, street, and room or suite no. On the screen titled special filings, check homeowners association, then click continue. At least 60% of gross income should be exempt function income at least 90% of annual expenses should be for the association’s business no private shareholder or individual should benefit from the association’s earnings at least 85% of housing units should be residential Top section the image above is the top section of the form.

Web Tax Liability & Payment Section:

Domestic homeowners association to report its gross income and expenses. If the association's principal business or office is located in. Continue with the interview process to enter all of the appropriate information. However, an association with a fiscal year ending june 30 must file by the 15th day of the 3rd month after the end of its tax year.

Web There Are Two Different Forms That Can Be Filed;

Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. It details some of the basic information of the homeowners association. Use the following irs center address.

![Form 1120H Example Complete in a Few Simple Steps [Infographic]](http://hoatax.com/wp-content/uploads/2017/07/1120-h-5.png)