Is Drawings A Debit Or Credit

Is Drawings A Debit Or Credit - Debit the increase in drawings to cash (or) bank a/c: It’s debit balance will reduce the owner’s capital account balance and. However, when learning how to post business transactions, it can be. All normal asset accounts have a debit balance. If goods are withdrawn, the amount recorded is at cost value. Understanding debits and credits is a critical part of every reliable accounting system. Web the accounting transaction typically found in a drawing account is a credit to the cash account and a debit to the drawing account. Web checking accounts and debit cards work together but can serve different purposes. When a business transaction occurs, it. Webb) draws $5,000 of cash from her business, the accounting entry will be a debit of $5,000 to the account l.

Debits increase asset or expense accounts and decrease liability,. Web in the drawing account, the amount withdrawn by the owner is recorded as a debit. Web checking accounts and debit cards work together but can serve different purposes. In the context of drawing accounts, when an owner. Some accounts are increased by a debit and some are increased by a credit. Last editedapr 2023 — 2 min read. Checked for updates, april 2022. Webb) draws $5,000 of cash from her business, the accounting entry will be a debit of $5,000 to the account l. An increase to an account on the left side of the equation (assets). Web the drawing account is a capital account.

Understanding debits and credits is a critical part of every reliable accounting system. When a business transaction occurs, it. To answer your question, the drawing account is a capital account. It is not an expense of the business. Checked for updates, april 2022. Cash is withdrawn from the business and taken by the owner. Last editedapr 2023 — 2 min read. The withdrawal of cash by the owner for personal use is recorded on a temporary drawings account and reduces the owners equity. Web the accounting transaction that is typically found in a drawings account is a credit to the cash account and a debit to the drawings account. Webb, drawings and a credit.

Accounting Debit vs. Credit Examples & Guide QuickBooks

Drawings accounting bookkeeping entries explained. The drawing account is a contra. Drawings account is a contra account to owner’s equity in. It’s debit balance will reduce the owner’s capital account balance and. If goods are withdrawn, the amount recorded is at cost value.

Drawings Debit or Credit? Financial

Web the drawing account is a capital account. Web the accounting transaction that is typically found in a drawings account is a credit to the cash account and a debit to the drawings account. Web the company can make the drawings journal entry by debiting the drawings account and crediting the cash account. It is not an expense of the.

What is Debit and Credit? Explanation, Difference, and Use in Accounting

Webb) draws $5,000 of cash from her business, the accounting entry will be a debit of $5,000 to the account l. Cash is withdrawn from the business and taken by the owner. If goods are withdrawn, the amount recorded is at cost value. Web the company can make the drawings journal entry by debiting the drawings account and crediting the.

Drawings Accounting Double Entry Bookkeeping

Some accounts are increased by a debit and some are increased by a credit. All normal asset accounts have a debit balance. Last editedapr 2023 — 2 min read. Credit the decrease in assets Web in the drawing account, the amount withdrawn by the owner is recorded as a debit.

Drawing Credit at Explore collection of Drawing Credit

Web the accounting transaction that is typically found in a drawings account is a credit to the cash account and a debit to the drawings account. Some accounts are increased by a debit and some are increased by a credit. Debit the increase in drawings to cash (or) bank a/c: To answer your question, the drawing account is a capital.

Share more than 156 drawing is debit or credit best vietkidsiq.edu.vn

Debits increase asset or expense accounts and decrease liability,. Web the left side of a general ledger is known as the debit (dr.) side, while the right side of a general ledger is known as the credit (cr.) side. The drawing account is a contra. Let us recall what an account is first. Web in the drawing account, the amount.

Debit and Credit in Accounting Explained StephanyqoJames

All normal asset accounts have a debit balance. Web the accounting transaction that is typically found in a drawings account is a credit to the cash account and a debit to the drawings account. Last editedapr 2023 — 2 min read. Drawings account is a contra account to owner’s equity in. The meaning of drawing in accounts is the record.

Drawings Accounting Debit Credit Ppt Powerpoint Presentation Visual

To answer your question, the drawing account is a capital account. At the time of the distribution of funds to an owner, debit the owner’s drawing account and credit the cash in bank account. Debit the increase in drawings to cash (or) bank a/c: The meaning of drawing in accounts is the record kept. It’s debit balance will reduce the.

What is Double Entry Bookkeeping? Debit vs. Credit System

It’s debit balance will reduce the owner’s capital account balance and. At the time of the distribution of funds to an owner, debit the owner’s drawing account and credit the cash in bank account. Web in the drawing account, the amount withdrawn by the owner is recorded as a debit. It is not an expense of the business. Web the.

Debit vs Credit in Accounting Accounting Education

Last editedapr 2023 — 2 min read. Debits increase asset or expense accounts and decrease liability,. Webb, drawings and a credit. Cash is withdrawn from the business and taken by the owner. Some accounts are increased by a debit and some are increased by a credit.

Web The Rules Of Debits And Credits.

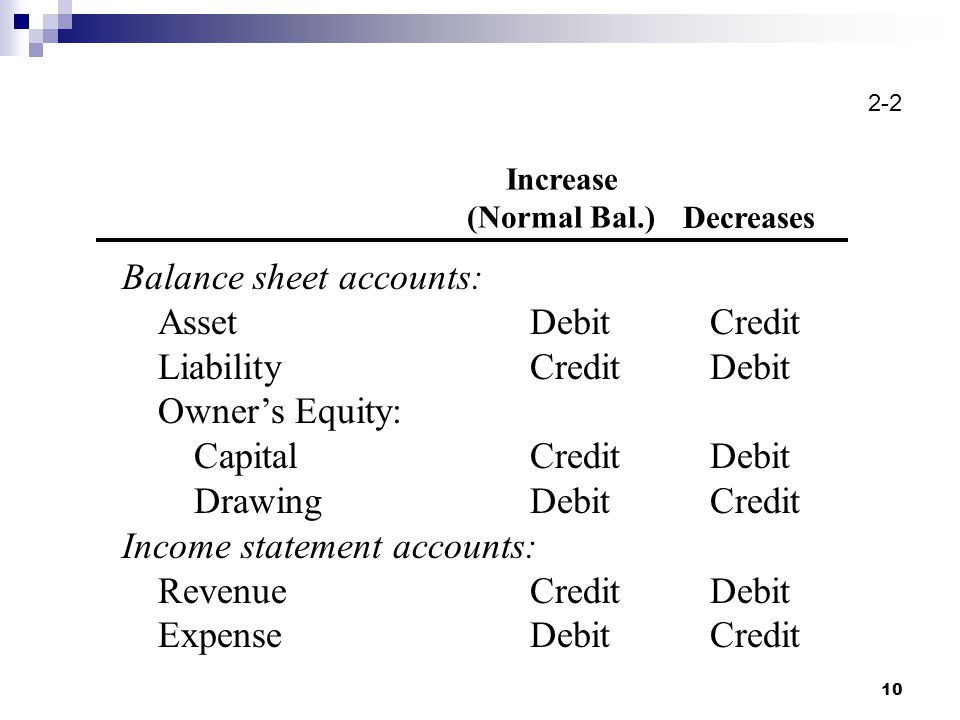

Web rules of debit and credit. Web drawing accounts serve as a contra account to owner's equity, with debits in drawing accounts offset by credits in cash accounts. Debits and credits are used in a company’s bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability,.

To Answer Your Question, The Drawing Account Is A Capital Account.

When a business transaction occurs, it. Checked for updates, april 2022. In the context of drawing accounts, when an owner. The drawing account is a contra.

Some Accounts Are Increased By A Debit And Some Are Increased By A Credit.

It’s debit balance will reduce the owner’s capital account balance and. Web the company can make the drawings journal entry by debiting the drawings account and crediting the cash account. Drawings accounting bookkeeping entries explained. Last editedapr 2023 — 2 min read.

All Normal Asset Accounts Have A Debit Balance.

Web the accounting transaction typically found in a drawing account is a credit to the cash account and a debit to the drawing account. A debit entry in an. The withdrawal of cash by the owner for personal use is recorded on a temporary drawings account and reduces the owners equity. Web the accounting transaction that is typically found in a drawings account is a credit to the cash account and a debit to the drawings account.