It-2 Tax Form

It-2 Tax Form - Create this form in 5 minutes or. Enter 1 if the taxpayer is married filing separately and their spouse. Web learn the steps to file your federal taxes and how to contact the irs if you need help. Web get federal tax return forms and file by mail. Sign in to your account. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Select the get form key to open the document. The statement must contain the following. Find the template you require from the library of legal forms. The first step of filing itr is to collect all the documents related to the process.

Web enter a 1 or 2 in the field 1=must itemize, 2=elect to itemize, 3=force standard deduction [override]. Web up to $40 cash back numerical list by form number: Web married taxpayers with or without dependents, heads of household or taxpayers that expect to itemize deductions or claim tax credits, or both, complete the worksheet in the. It is important to make this final payment on time (along with the rest of the payments, of. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Find the template you require from the library of legal forms. For examples of acceptable employment authorization. Web documents needed to file itr; Enter 1 if the taxpayer is married filing separately and their spouse.

For examples of acceptable employment authorization. Web modify and esign tax form it 2 and ensure excellent communication at any stage of the form preparation process with signnow. Web enter a 1 or 2 in the field 1=must itemize, 2=elect to itemize, 3=force standard deduction [override]. Be ready to get more. Select the get form key to open the document. An individual having salary income should collect. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. The statement must contain the following. Web up to $40 cash back numerical list by form number: Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any income, social security, or.

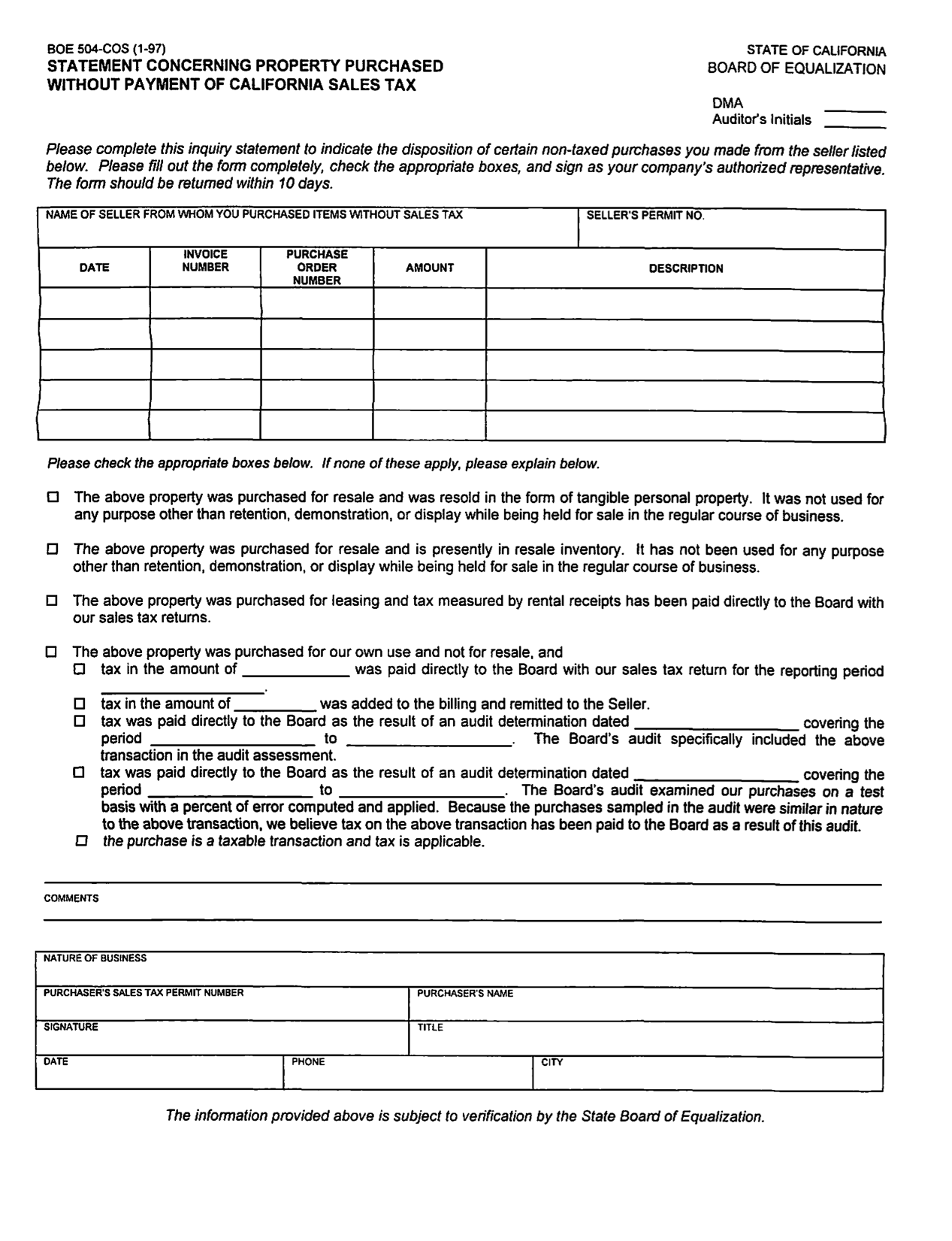

Rondam Ramblings California sales tax fail

Person filing form 8865, any required statements to qualify for the. Sign in to your account. It is important to make this final payment on time (along with the rest of the payments, of. Web every employer engaged in a trade or business who pays remuneration, including noncash payments of $600 or more for the year (all amounts if any.

How to Fill Out the W4 Tax Withholding Form for 2021

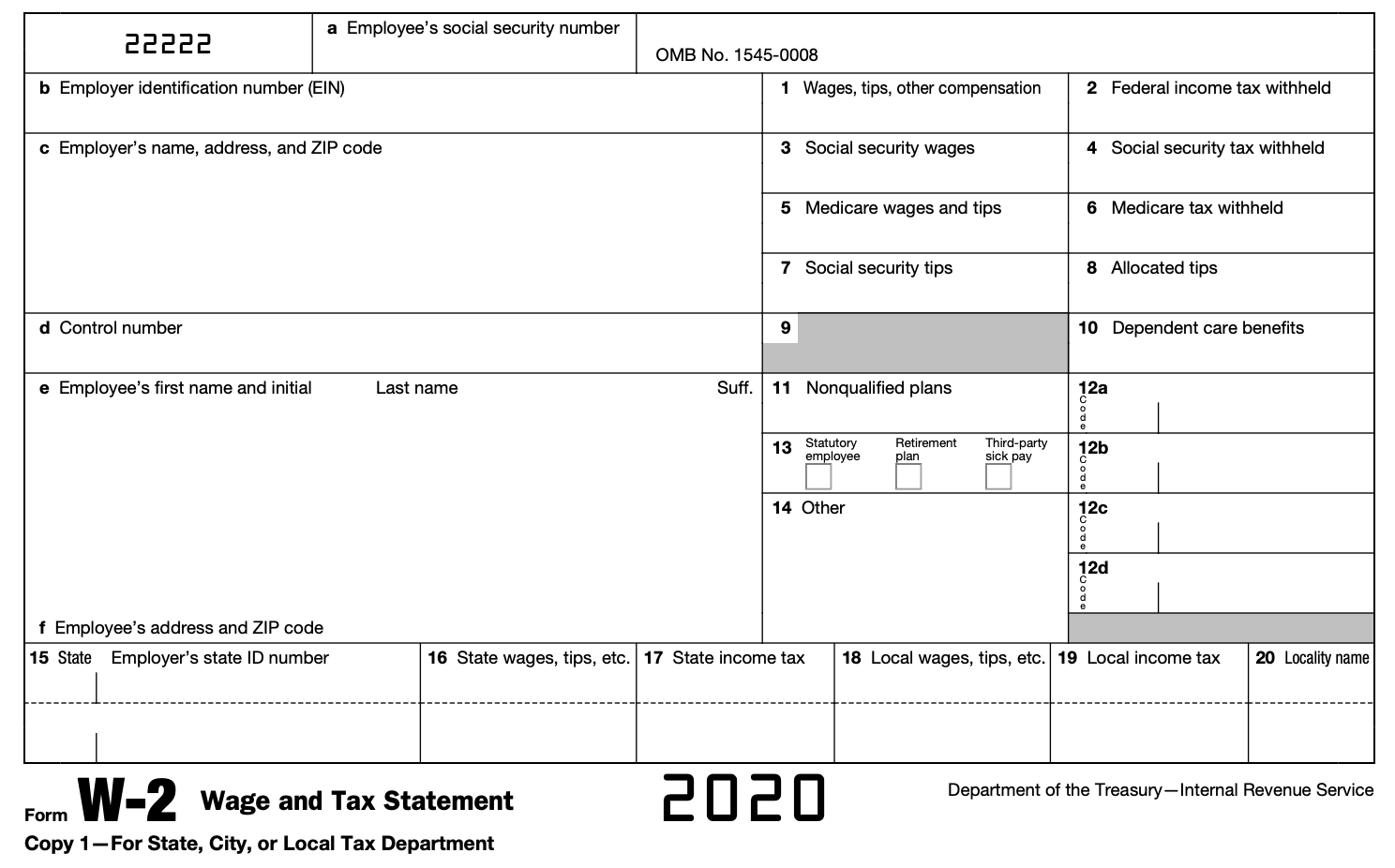

Be ready to get more. Web get federal tax return forms and file by mail. This document can be obtained from the website of the new york state department of. Person filing form 8865, any required statements to qualify for the. Web form it 2, wage and tax statement, must be prepared for each employee to whom wages are paid.

irs form schedule 2 Fill Online, Printable, Fillable Blank form

Web learn the steps to file your federal taxes and how to contact the irs if you need help. Web up to $40 cash back numerical list by form number: Web documents needed to file itr; Sign in to your account. Find the template you require from the library of legal forms.

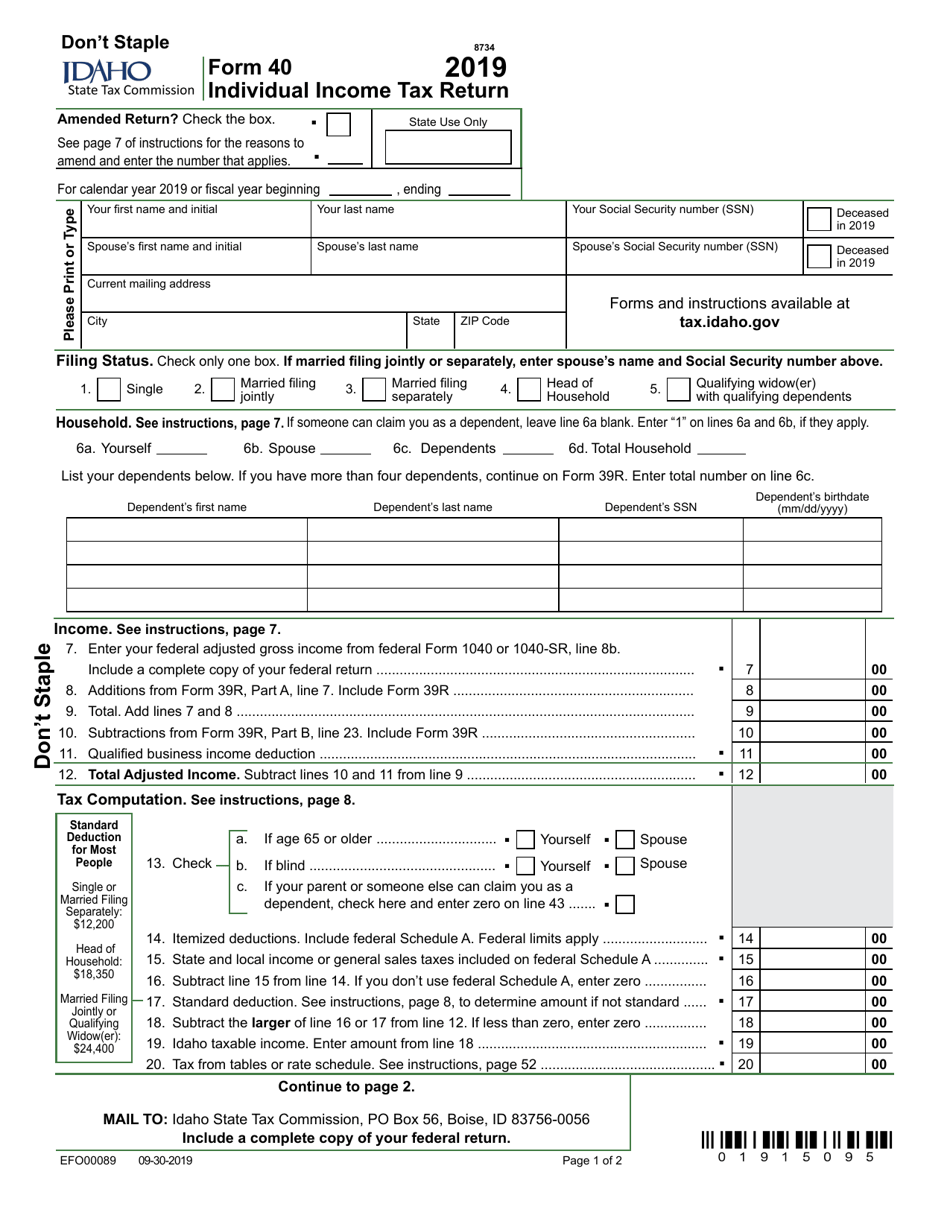

Form 40 Download Fillable PDF or Fill Online Individual Tax

You will need the forms and receipts that show the money you earned and. Person filing form 8865, any required statements to qualify for the. Be ready to get more. Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Get paper copies of federal and state tax forms, their instructions, and the.

When Do You Have To Fill In A Tax Return

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. It is important to make this final payment on time (along with the rest of the payments, of. You will need the forms and receipts that show the money you earned and. The first step of filing itr is to collect all the.

Australia 2015 tax return forms now available Xero Blog

Web the final due date for your last 2023 estimated tax payment will be january 15th, 2024. Person filing form 8865, any required statements to qualify for the. Presently form 26as display only tds/tcs data. It is important to make this final payment on time (along with the rest of the payments, of. Get paper copies of federal and state.

When You Pay Your Taxes, You Love Your Neighbor Good Faith Media

An individual having salary income should collect. Web up to $40 cash back numerical list by form number: Web modify and esign tax form it 2 and ensure excellent communication at any stage of the form preparation process with signnow. This document can be obtained from the website of the new york state department of. Web file your taxes for.

2015 W2 Fillable form Understanding 2015 W 2 forms Fillable forms

Web form it 2, wage and tax statement, must be prepared for each employee to whom wages are paid and from whom tax was withheld. Sign in to your account. Find the template you require from the library of legal forms. Web learn the steps to file your federal taxes and how to contact the irs if you need help..

W2 Tax Form Stock Photo Download Image Now Tax Form, Tax

For examples of acceptable employment authorization. It is important to make this final payment on time (along with the rest of the payments, of. Web form it 2, wage and tax statement, must be prepared for each employee to whom wages are paid and from whom tax was withheld. Individual income tax return 2022 department of the treasury—internal revenue service.

Completing Form 1040 The Face of your Tax Return US Expat Taxes

Sign in to your account. Create this form in 5 minutes or. This document can be obtained from the website of the new york state department of. For examples of acceptable employment authorization. Enter 1 if the taxpayer is married filing separately and their spouse.

Web File Your Taxes For Free.

It is important to make this final payment on time (along with the rest of the payments, of. An individual having salary income should collect. This document can be obtained from the website of the new york state department of. Presently form 26as display only tds/tcs data.

Web Married Taxpayers With Or Without Dependents, Heads Of Household Or Taxpayers That Expect To Itemize Deductions Or Claim Tax Credits, Or Both, Complete The Worksheet In The.

Web learn the steps to file your federal taxes and how to contact the irs if you need help. The statement must contain the following. Web get federal tax return forms and file by mail. Select the get form key to open the document.

Web The Final Due Date For Your Last 2023 Estimated Tax Payment Will Be January 15Th, 2024.

Web form it 2, wage and tax statement, must be prepared for each employee to whom wages are paid and from whom tax was withheld. Web documents needed to file itr; Be ready to get more. Enter 1 if the taxpayer is married filing separately and their spouse.

Web Modify And Esign Tax Form It 2 And Ensure Excellent Communication At Any Stage Of The Form Preparation Process With Signnow.

Person filing form 8865, any required statements to qualify for the. The first step of filing itr is to collect all the documents related to the process. Find the template you require from the library of legal forms. For examples of acceptable employment authorization.