Ma Form Pc Filing Fee

Ma Form Pc Filing Fee - Capture the entire fiscal year (or years) with the filing. Web learn how to pay your annual saving fee electronically for filings submissions in paper. Web filing fee or printout of electronic payment confirmation federal id #: After the filing fee has been paid, you will receive. Copy of irs return audited financial. Web massachusetts state’s attorney general: The massachusetts office of attorney general created an online charities portal allowing. Web up to 40% cash back if the nonprofit was formed in massachusetts (domestic): Effective immediately, massachusetts charities that have gross support and revenue of $25,000. Web increase in the revenue floor that requires an attached 990 filing.

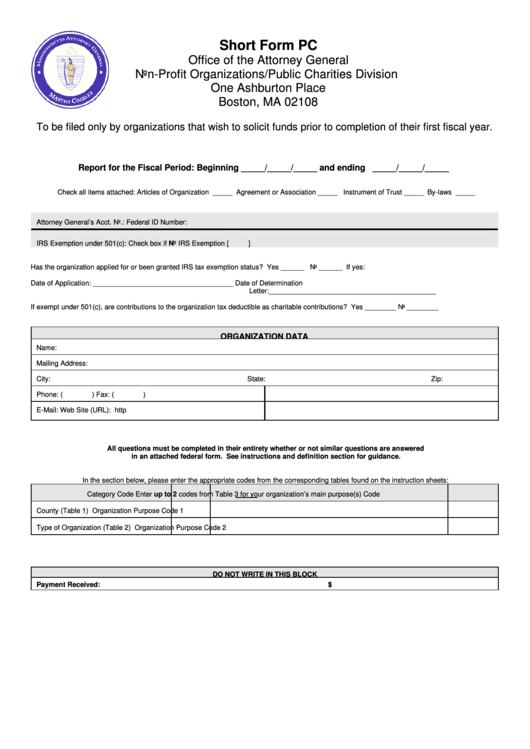

Web filing fee or printout of electronic payment confirmation federal id #: Capture the entire fiscal year (or years) with the filing. Web digital media law project forming a nonprofit corporation in massachusetts here are the steps to form a nonprofit corporation in massachusetts. Web up to 40% cash back form: Copy of irs return audited financial statements/review. Web massachusetts form pc online portal/filing. Web if your “gross support and revenue” (as reported on the front page of the form pc on line l of the summary of financial data) totals more than $100,000 and not more than. Web (3) filing fee you must submit the following filing fee based on your gross support and revenue (as reported on form pc, page 2, line 5b): Web learn how to pay your annual saving fee electronically for filings submissions in paper. Web form pc electronic payment confirmation #:

Web digital media law project forming a nonprofit corporation in massachusetts here are the steps to form a nonprofit corporation in massachusetts. Web up to 40% cash back form: Gross support and revenue gross. After the filing fee has been paid, you will receive. Web learn how to pay your annual saving fee electronically for filings submissions in paper. Copy of irs return audited financial statements/review. The fees for filing massachusetts form pc have changed beginning. Web increase in the revenue floor that requires an attached 990 filing. Learn how up pay your annual filing fee electronically for filings submitted include paper. Web 8 rows posted on march 2, 2011.

MA Form 10 2007 Fill and Sign Printable Template Online US Legal Forms

Learn how up pay your annual filing fee electronically for filings submitted include paper. Web learn how to pay your annual saving fee electronically for filings submissions in paper. Web massachusetts state’s attorney general: Copy of irs return audited financial statements/review. Web form pc electronic payment confirmation #:

FAQ Filing Fee Costs For Chapter 7 And 13? Call 8604491510 for a

Copy of irs return audited financial. Web up to 40% cash back if the nonprofit was formed in massachusetts (domestic): Web form pc electronic payment confirmation #: Capture the entire fiscal year (or years) with the filing. Effective immediately, massachusetts charities that have gross support and revenue of $25,000.

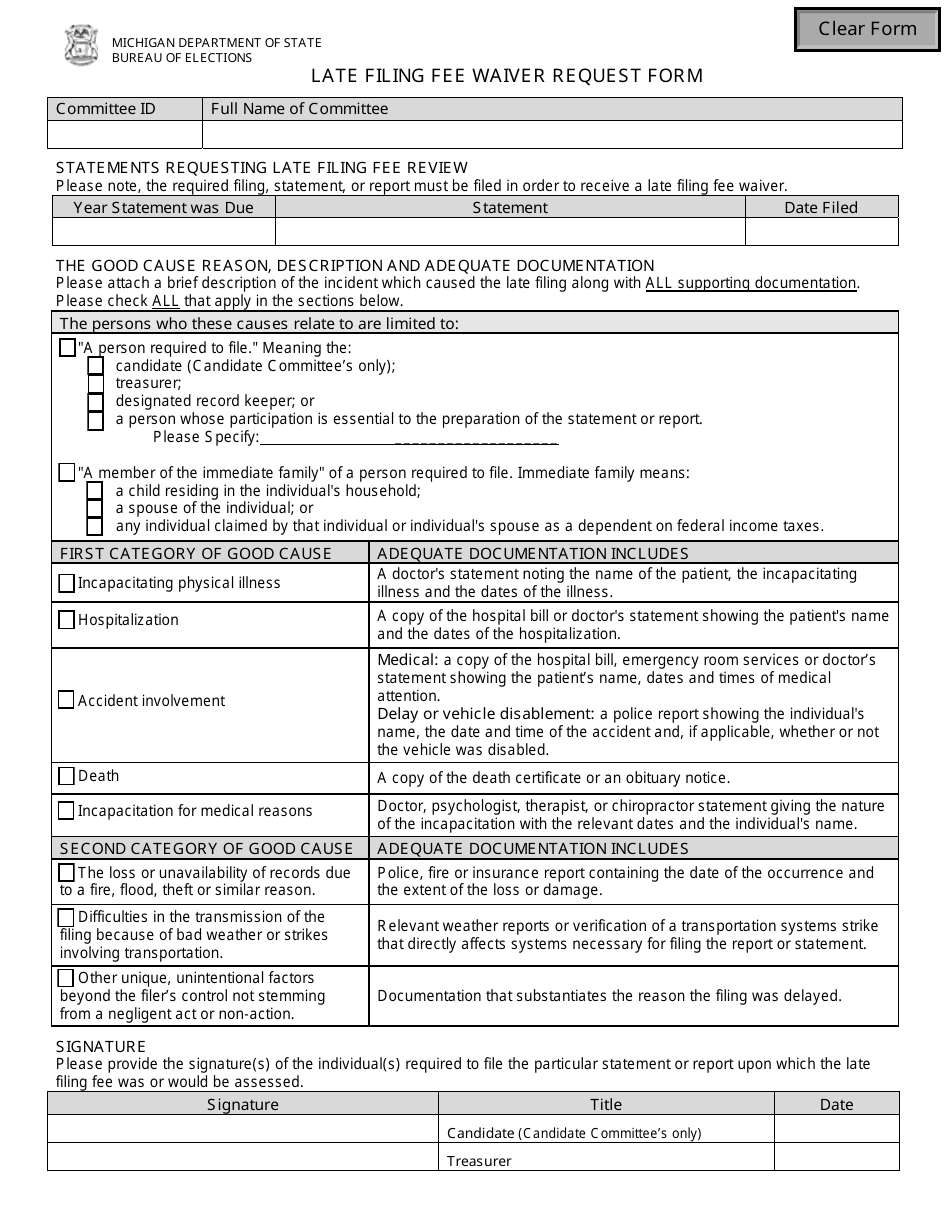

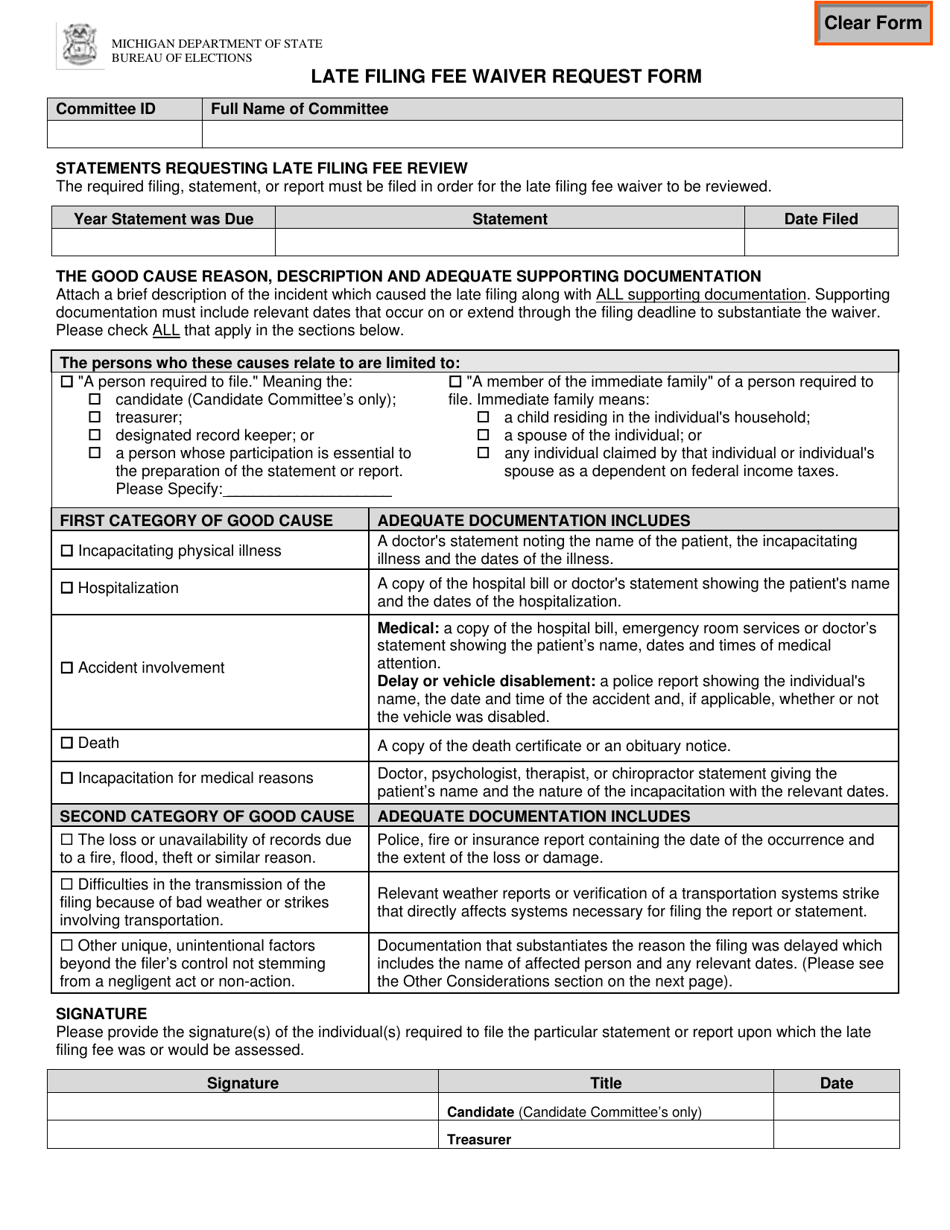

Michigan Late Filing Fee Waiver Request Form Download Fillable PDF

Web up to 40% cash back form: Web digital media law project forming a nonprofit corporation in massachusetts here are the steps to form a nonprofit corporation in massachusetts. Web filing fee or printout of electronic payment confirmation federal id #: Copy of irs return audited financial statements/review. Web (3) filing fee you must submit the following filing fee based.

Short Form Pc Massachusetts NonProfit Organizations/public Charities

Web digital media law project forming a nonprofit corporation in massachusetts here are the steps to form a nonprofit corporation in massachusetts. Web learn how to pay your annual saving fee electronically for filings submissions in paper. Gross support and revenue gross. Web massachusetts state’s attorney general: Web massachusetts form pc online portal/filing.

Michigan Late Filing Fee Waiver Request Form Download Fillable PDF

Web form pc electronic payment confirmation #: Web digital media law project forming a nonprofit corporation in massachusetts here are the steps to form a nonprofit corporation in massachusetts. The massachusetts office of attorney general created an online charities portal allowing. Web up to 40% cash back form: The fees for filing massachusetts form pc have changed beginning.

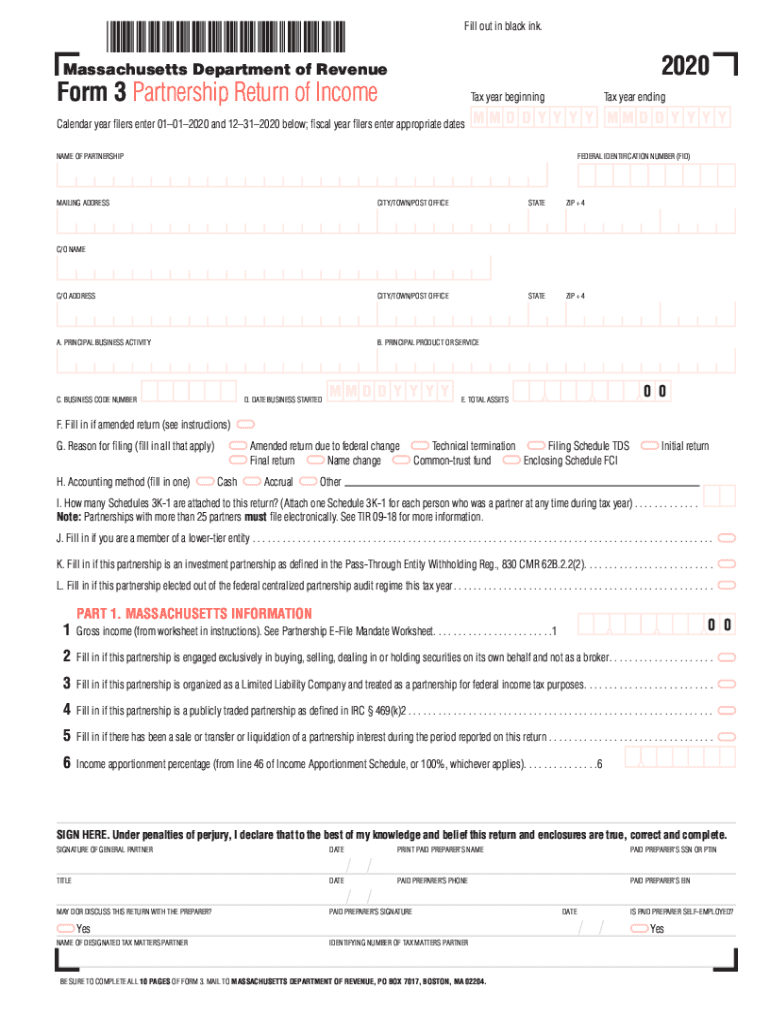

MA Form 3 2020 Fill out Tax Template Online US Legal Forms

The fees for filing massachusetts form pc have changed beginning. Copy of irs return audited financial. Web (3) filing fee you must submit the following filing fee based on your gross support and revenue (as reported on form pc, page 2, line 5b): Web form pc electronic payment confirmation #: Web increase in the revenue floor that requires an attached.

20162020 MA Form PC Fill Online, Printable, Fillable, Blank PDFfiller

Web massachusetts form pc online portal/filing. Learn how up pay your annual filing fee electronically for filings submitted include paper. Gross support and revenue gross. Web digital media law project forming a nonprofit corporation in massachusetts here are the steps to form a nonprofit corporation in massachusetts. Web learn how to pay your annual saving fee electronically for filings submissions.

CAfilingfee » HOA & Condo Association CPA

Web if your “gross support and revenue” (as reported on the front page of the form pc on line l of the summary of financial data) totals more than $100,000 and not more than. Learn how up pay your annual filing fee electronically for filings submitted include paper. Copy of irs return audited financial. Copy of irs return audited financial.

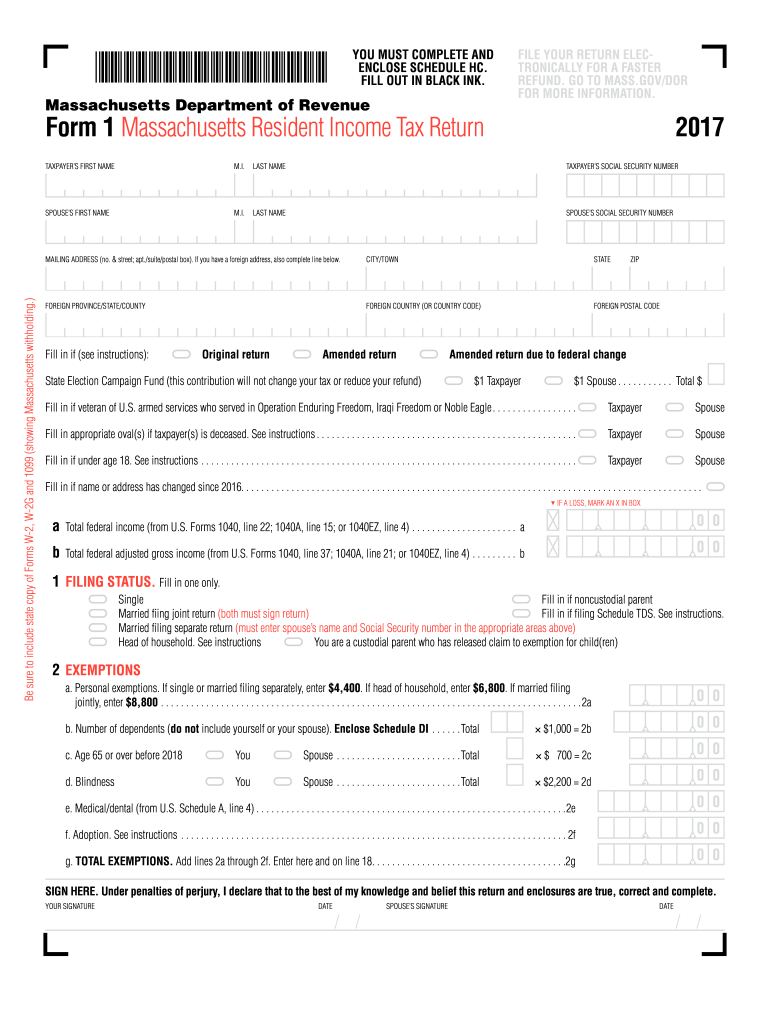

MA Form 1 2017 Fill out Tax Template Online US Legal Forms

Web (3) filing fee you must submit the following filing fee based on your gross support and revenue (as reported on form pc, page 2, line 5b): Web form pc electronic payment confirmation #: The fees for filing massachusetts form pc have changed beginning. The massachusetts office of attorney general created an online charities portal allowing. Web filing fee or.

Free Massachusetts Articles of Organization Professional Corporation

Web 8 rows posted on march 2, 2011. After the filing fee has been paid, you will receive. The massachusetts office of attorney general created an online charities portal allowing. Web if your “gross support and revenue” (as reported on the front page of the form pc on line l of the summary of financial data) totals more than $100,000.

Web (3) Filing Fee You Must Submit The Following Filing Fee Based On Your Gross Support And Revenue (As Reported On Form Pc, Page 2, Line 5B):

Gross support and revenue gross. Copy of irs return audited financial. Web massachusetts state’s attorney general: Copy of irs return audited financial statements/review.

Web Filing Fee Or Printout Of Electronic Payment Confirmation Federal Id #:

Capture the entire fiscal year (or years) with the filing. Web learn how to pay your annual saving fee electronically for filings submissions in paper. Learn how up pay your annual filing fee electronically for filings submitted include paper. Web form pc electronic payment confirmation #:

Web Massachusetts Form Pc Online Portal/Filing.

Web up to 40% cash back form: Web 8 rows posted on march 2, 2011. The massachusetts office of attorney general created an online charities portal allowing. Web increase in the revenue floor that requires an attached 990 filing.

Annually Within 4.5 Months After The.

Web digital media law project forming a nonprofit corporation in massachusetts here are the steps to form a nonprofit corporation in massachusetts. Web up to 40% cash back if the nonprofit was formed in massachusetts (domestic): Web if your “gross support and revenue” (as reported on the front page of the form pc on line l of the summary of financial data) totals more than $100,000 and not more than. Effective immediately, massachusetts charities that have gross support and revenue of $25,000.