Missouri Gas Tax Refund Form 5856

Missouri Gas Tax Refund Form 5856 - Web missouri dor will require the following information for anyone looking to submit a refund claim: Web gather up those gas receipts! Web use this form to file a refund claim for the missouri motor fuel tax increase paid beginning july 1, 2022, through june 30, 2023, for motor fuel used for on road purposes. Web buy guess gu7658 grey/other/smoke mirror one size and other sunglasses at amazon.com. Effective october 1, 2021, the missouri motor fuel tax rate increased to 19.5¢ per gallon (17¢ per gallon plus the additional fuel tax of 2.5¢. 30 is the deadline for drivers who bought gas in missouri, and kept receipts, to file for a $0.025 cent refund on every gallon bought. You must register for a motor fuel. Our wide selection is eligible for free shipping and free returns. Form 588b should be completed for motor fuel purchased on october 1, 2021 and on or before. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025.

Vehicle identification number of the motor vehicle into which. If you are hoping to cash in on the missouri gas tax return, you only have a few more days to turn those in to the department of. Effective october 1, 2021, the missouri motor fuel tax rate increased to 19.5¢ per gallon (17¢ per gallon plus the additional fuel tax of 2.5¢. Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. You must register for a motor fuel. Form 588b should be completed for motor fuel purchased on october 1, 2021 and on or before. Our wide selection is eligible for free shipping and free returns. Web you may not apply for a refund claim until july 1, 2022, however you will need to begin saving records of each purchase occurring on or after oct. Web form 588a should be completed for motor fuel purchased before october 1, 2021. Web register to file a motor fuel consumer refund highway use claim select this option to register for a motor fuel consumer refund account.

Web david carson jack suntrup jefferson city — motorists looking for a partial refund of their missouri motor fuel taxes are now able to start preparing. Our wide selection is eligible for free shipping and free returns. Effective october 1, 2021, the missouri motor fuel tax rate increased to 19.5¢ per gallon (17¢ per gallon plus the additional fuel tax of 2.5¢. Web use this form to file a refund claim for the missouri motor fuel tax increase paid beginning july 1, 2022, through june 30, 2023, for motor fuel used for on road purposes. It contains 0 bedroom and 1.25 bathrooms. You must register for a motor fuel. Form 588b should be completed for motor fuel purchased on october 1, 2021 and on or before. Web register to file a motor fuel consumer refund highway use claim select this option to register for a motor fuel consumer refund account. Web in 2021, the state of missouri started increasing the gas tax by 2 1/2 cents every year through 2025. Web buy guess gu7658 grey/other/smoke mirror one size and other sunglasses at amazon.com.

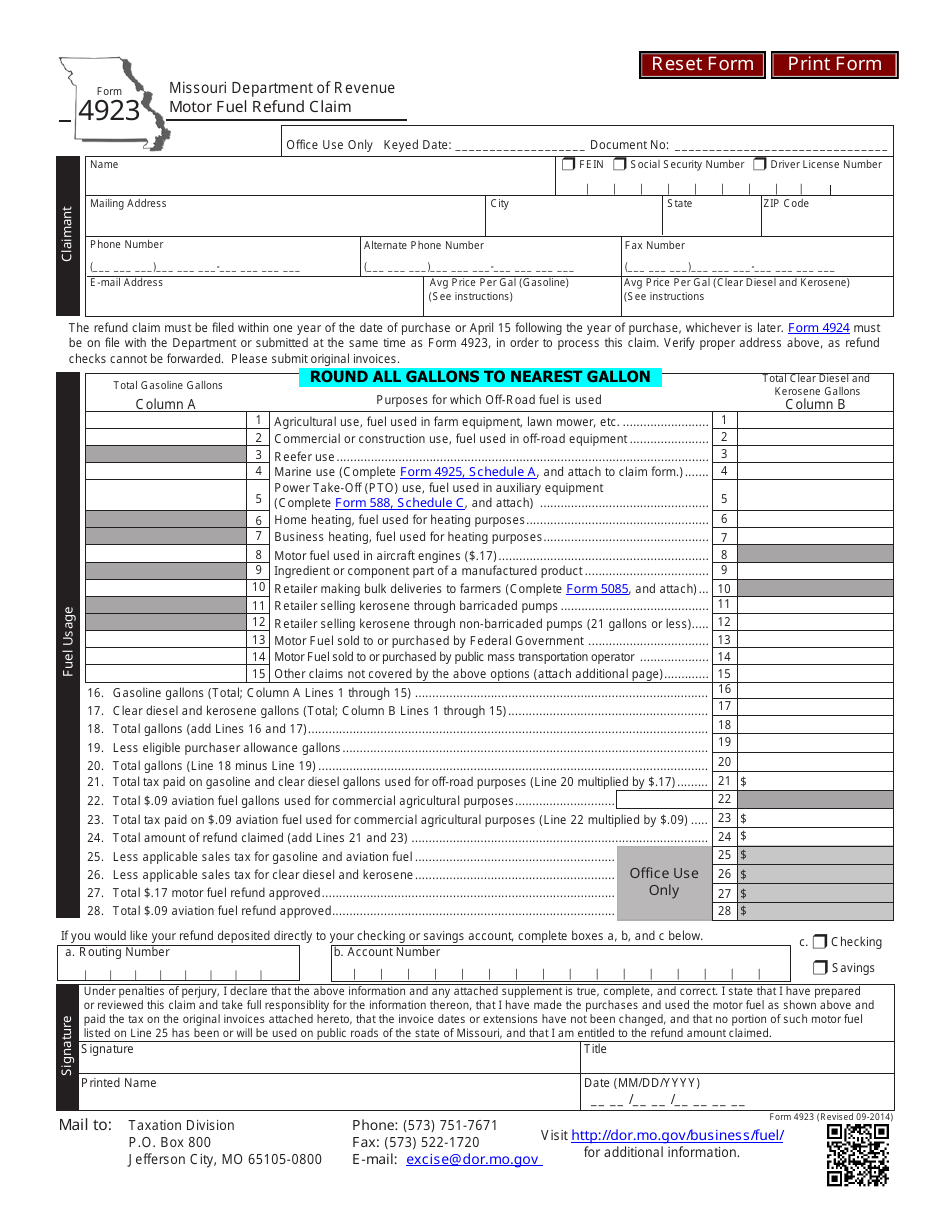

Here's how to get a refund for Missouri's gas tax increase Howell

1758 e 56th st s, tulsa, ok is a single family home that contains 1,624 sq ft and was built in 1964. Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. You must register for a motor fuel. Web you may not apply for a refund.

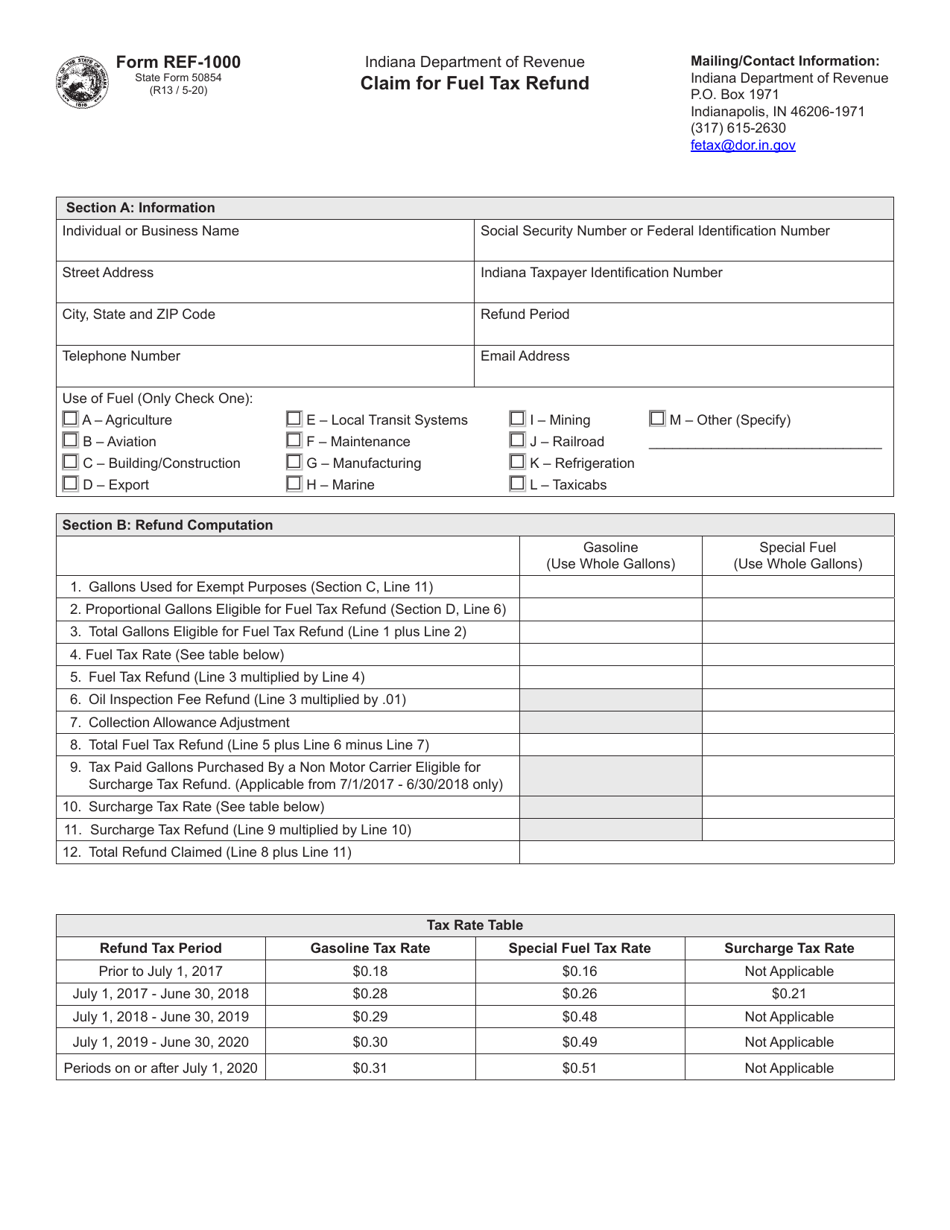

Form REF1000 (State Form 50854) Download Fillable PDF or Fill Online

Web gather up those gas receipts! Our wide selection is eligible for free shipping and free returns. 30 is the deadline for drivers who bought gas in missouri, and kept receipts, to file for a $0.025 cent refund on every gallon bought. Web register to file a motor fuel consumer refund highway use claim select this option to register for.

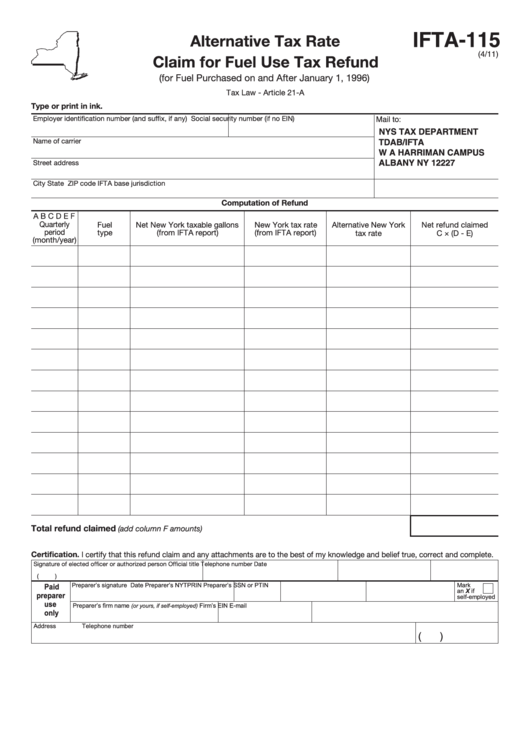

Ifta Reporting Form Missouri Universal Network

Our wide selection is eligible for free shipping and free returns. For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. 1758 e 56th st s, tulsa, ok is a single family home that contains 1,624 sq ft and was built in 1964. Web form 588a should be completed for motor fuel purchased before october.

missouri gas tax refund spreadsheet Unperformed LogBook Diaporama

Web missouri dor will require the following information for anyone looking to submit a refund claim: Effective october 1, 2021, the missouri motor fuel tax rate increased to 19.5¢ per gallon (17¢ per gallon plus the additional fuel tax of 2.5¢. Web david carson jack suntrup jefferson city — motorists looking for a partial refund of their missouri motor fuel.

Military Journal Missouri 500 Tax Refund If the total amount of

For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. If you are hoping to cash in on the missouri gas tax return, you only have a few more days to turn those in to the department of. Form 588b should be completed for motor fuel purchased on october 1, 2021 and on or before..

missouri gas tax refund Christel Engel

Form 588b should be completed for motor fuel purchased on october 1, 2021 and on or before. You must register for a motor fuel. Web updated as of 1/28/2022. Vehicle identification number of the motor vehicle into which. A claim must be filed by the customer who purchased the fuel, and records of.

Missouri Ifta Tax Forms topfripdesigns

Web gather up those gas receipts! For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. 1758 e 56th st s, tulsa, ok is a single family home that contains 1,624 sq ft and was built in 1964. Web register to file a motor fuel consumer refund highway use claim select this option to register.

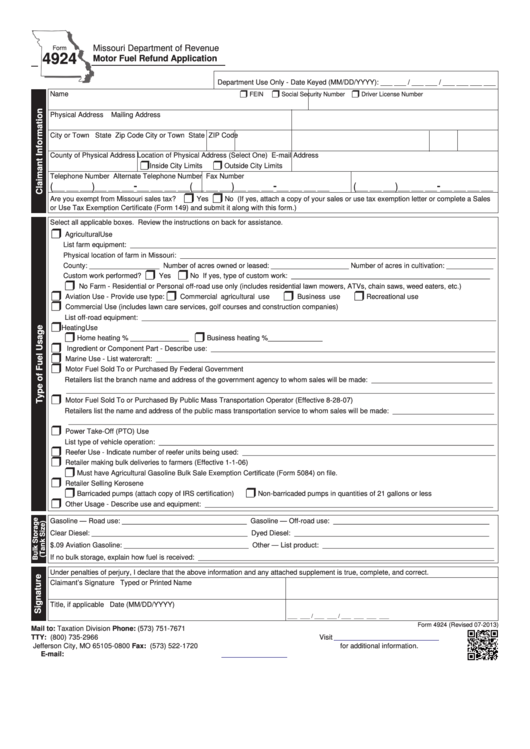

Fillable Form 4924 Motor Fuel Refund Application printable pdf download

For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. Web updated as of 1/28/2022. If you are hoping to cash in on the missouri gas tax return, you only have a few more days to turn those in to the department of. Web a refund claim form will be available on the department of.

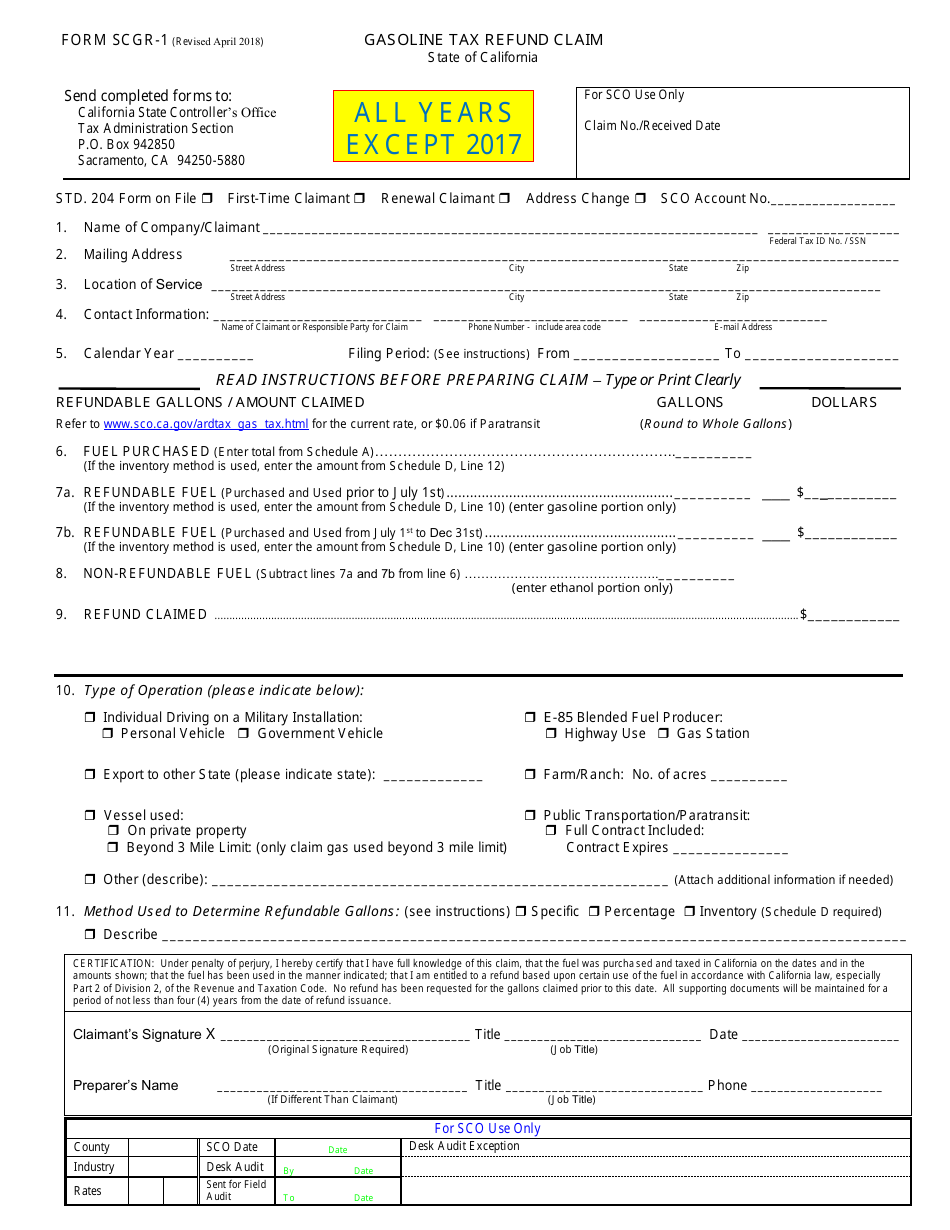

Form SCGR1 Download Fillable PDF or Fill Online Gasoline Tax Refund

It contains 0 bedroom and 1.25 bathrooms. A claim must be filed by the customer who purchased the fuel, and records of. If you are hoping to cash in on the missouri gas tax return, you only have a few more days to turn those in to the department of. Web you may not apply for a refund claim until.

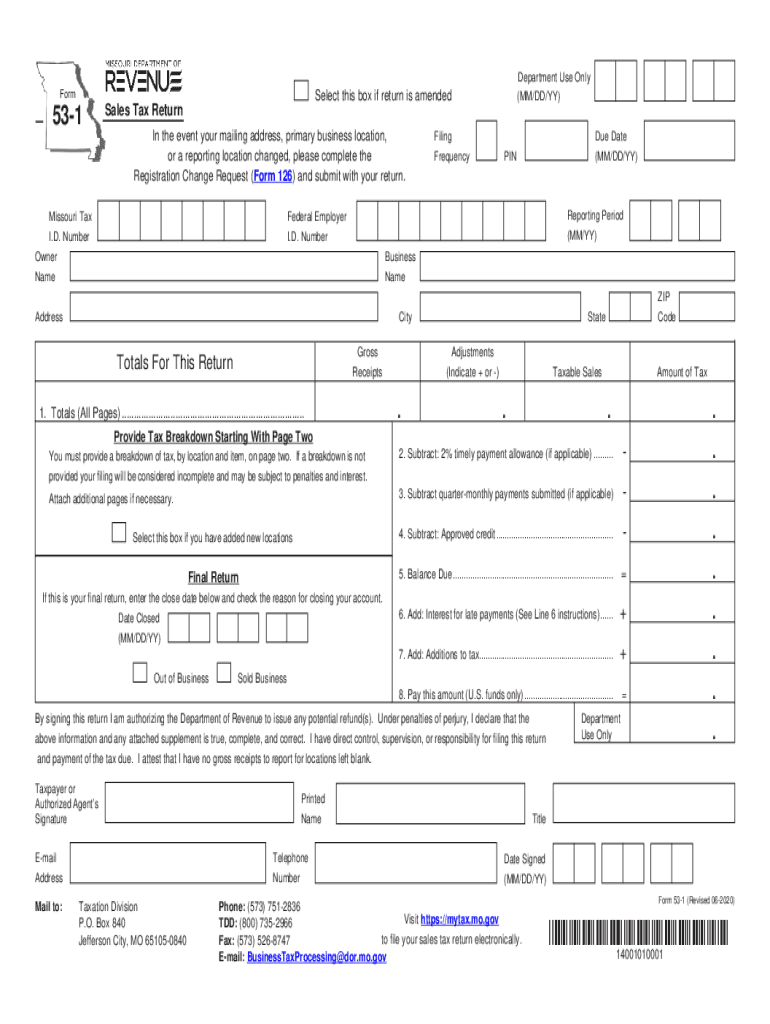

Form 53 1 Fill Out and Sign Printable PDF Template signNow

Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. 30 is the deadline for drivers who bought gas in missouri, and kept receipts, to file for a $0.025 cent refund on every gallon bought. A claim must be filed by the customer who purchased the fuel,.

Web Use This Form To File A Refund Claim For The Missouri Motor Fuel Tax Increase Paid Beginning July 1, 2022, Through June 30, 2023, For Motor Fuel Used For On Road Purposes.

It contains 0 bedroom and 1.25 bathrooms. Web updated as of 1/28/2022. Web buy guess gu7658 grey/other/smoke mirror one size and other sunglasses at amazon.com. Vehicle identification number of the motor vehicle into which.

Effective October 1, 2021, The Missouri Motor Fuel Tax Rate Increased To 19.5¢ Per Gallon (17¢ Per Gallon Plus The Additional Fuel Tax Of 2.5¢.

Form 588b should be completed for motor fuel purchased on october 1, 2021 and on or before. Web gather up those gas receipts! 30 is the deadline for drivers who bought gas in missouri, and kept receipts, to file for a $0.025 cent refund on every gallon bought. Web register to file a motor fuel consumer refund highway use claim select this option to register for a motor fuel consumer refund account.

Missouri Receives Fuel Tax On Gallons Of Motor Fuel (Gasoline, Diesel Fuel, Kerosene, And Blended Fuel) From Licensed Suppliers On A Monthly Basis.

Our wide selection is eligible for free shipping and free returns. Web david carson jack suntrup jefferson city — motorists looking for a partial refund of their missouri motor fuel taxes are now able to start preparing. You must register for a motor fuel. If you are hoping to cash in on the missouri gas tax return, you only have a few more days to turn those in to the department of.

Web Missouri Dor Will Require The Following Information For Anyone Looking To Submit A Refund Claim:

Web a refund claim form will be available on the department of revenue’s website prior to july 1, 2022. Web form 588a should be completed for motor fuel purchased before october 1, 2021. For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. 1758 e 56th st s, tulsa, ok is a single family home that contains 1,624 sq ft and was built in 1964.