Missouri Rent Rebate Form 2022

Missouri Rent Rebate Form 2022 - Missouri property tax credit claim allows seniors and disabled people to claim credit for part of their real estate taxes and rent for the past year. Web 2022 certification of rent paid. Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. *22344010001* 22344010001 failure to provide the following attachments will result in denial or delay of your claim: Date and still receive your credit. Rental begin date (mm/dd/yyyy) rental end date (mm/dd/yyyy) gross rent paid for the year Web to apply for rent rebate in missouri, you will need to gather the following documents: The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Department use only (mm/dd/yy) tenant’s name. This information is for guidance only and does.

Date and still receive your credit. Web april 10, 2022 by fredrick. Not state the complete law. *22344010001* 22344010001 failure to provide the following attachments will result in denial or delay of your claim: Web 2022 property tax credit claim print in black ink only and do not staple. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. You must provide the contact information for the individual filing this return. Rental period during year from: A 2019 claim must be filed by july 15, 2023, or a refund will not be issued. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year.

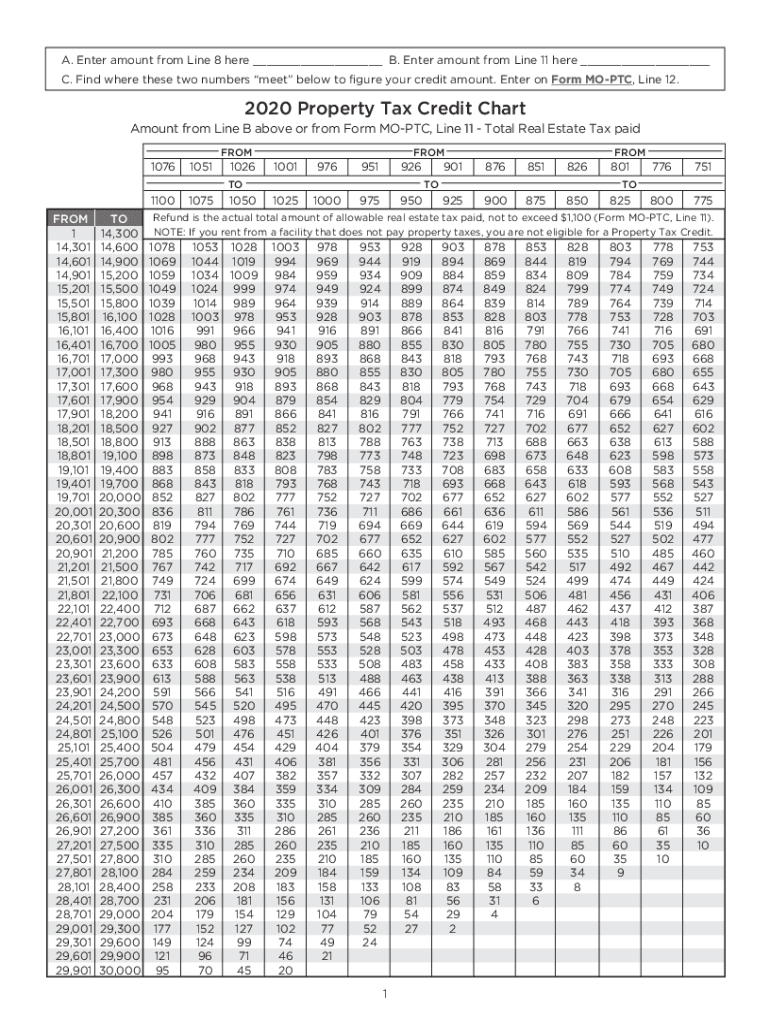

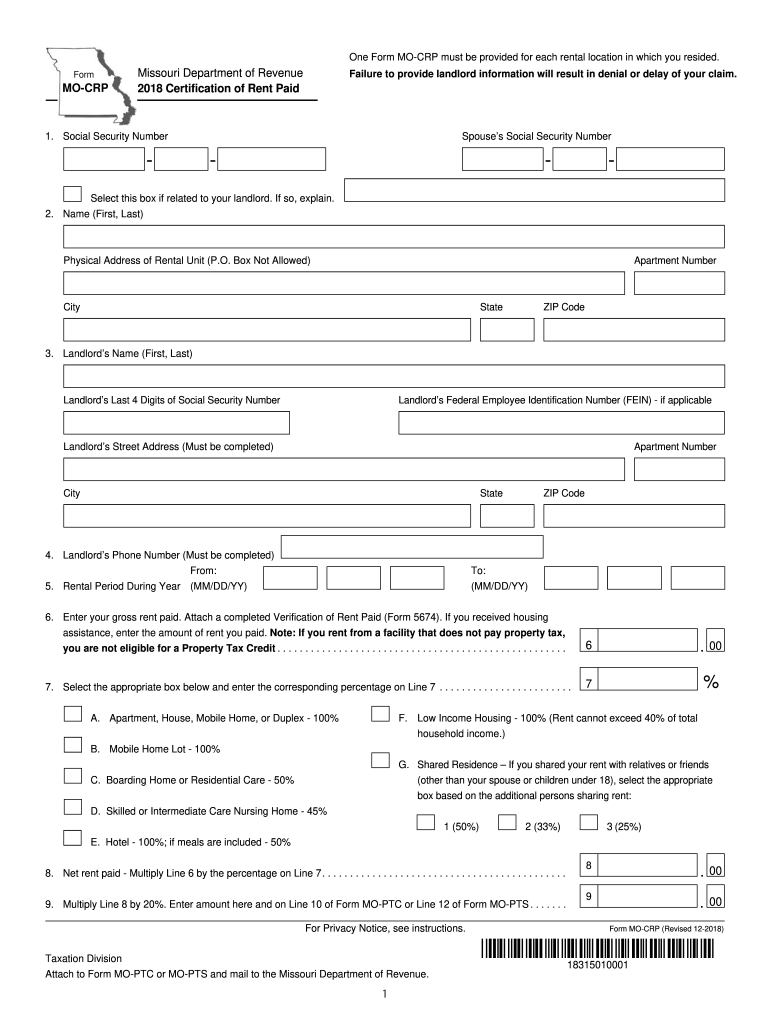

Missouri property tax credit claim allows seniors and disabled people to claim credit for part of their real estate taxes and rent for the past year. This information is for guidance only and does. If you rent from a facility that does not pay property taxes, you are not eligible for a property tax credit. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. When to file a claim. Where to submit your claim. For privacy notice, see instructions. Landlord must complete this form each year. Web april 10, 2022 by fredrick. You must provide the contact information for the individual filing this return.

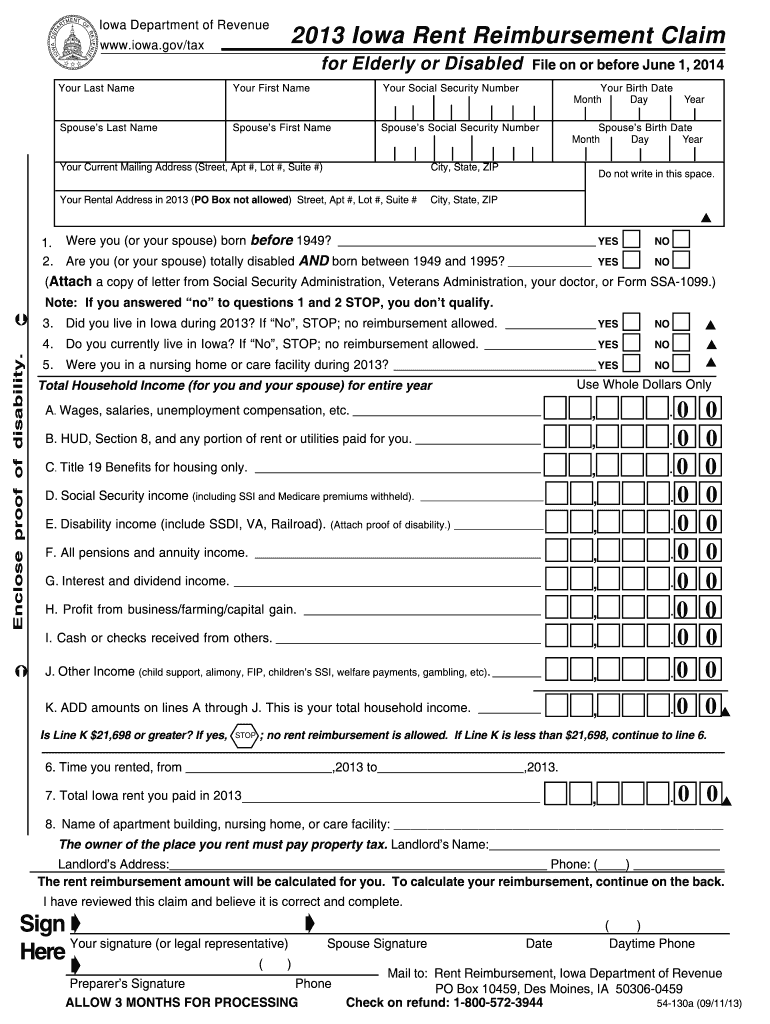

Rent Reimbursement Forms Fill Out and Sign Printable PDF Template

Department use only (mm/dd/yy) tenant’s name. This information is for guidance only and does. Rental begin date (mm/dd/yyyy) rental end date (mm/dd/yyyy) gross rent paid for the year Rental period during year from: For privacy notice, see instructions.

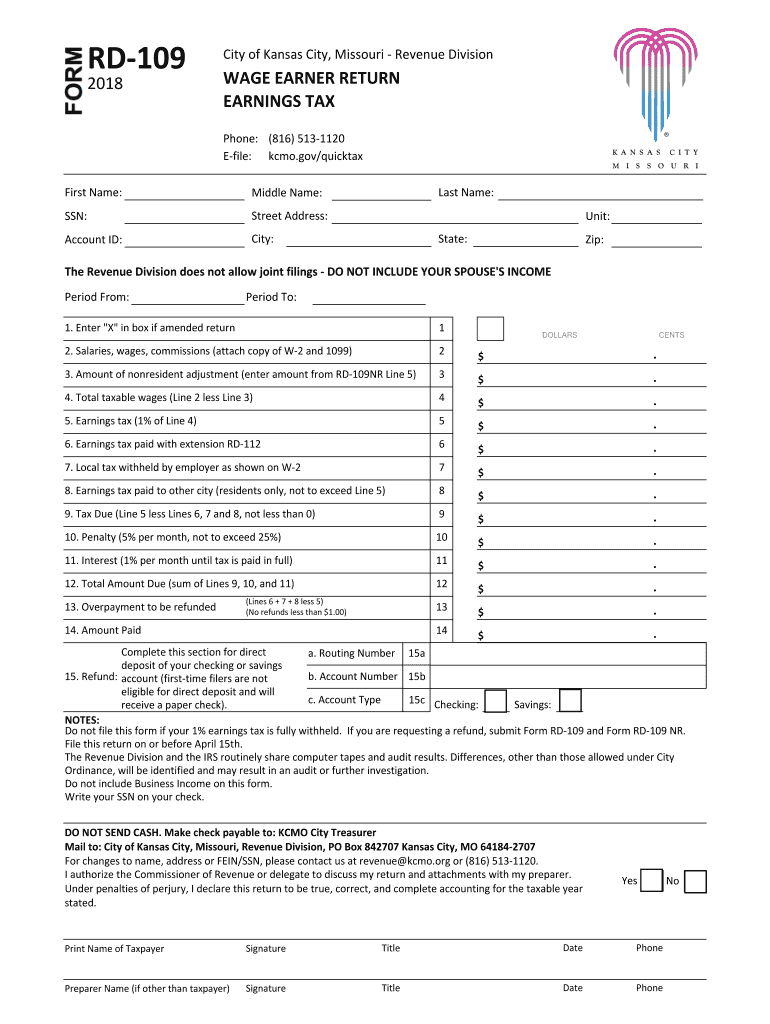

Form Rd 109 2019 Fill Out and Sign Printable PDF Template signNow

Missouri property tax credit claim allows seniors and disabled people to claim credit for part of their real estate taxes and rent for the past year. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. If you rent from a.

Missouri property tax credit chart Fill out & sign online DocHub

Landlord must complete this form each year. Web april 10, 2022 by fredrick. When to file a claim. If you rent from a facility that does not pay property taxes, you are not eligible for a property tax credit. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

What do i need to do to get my missouri renters rebate back

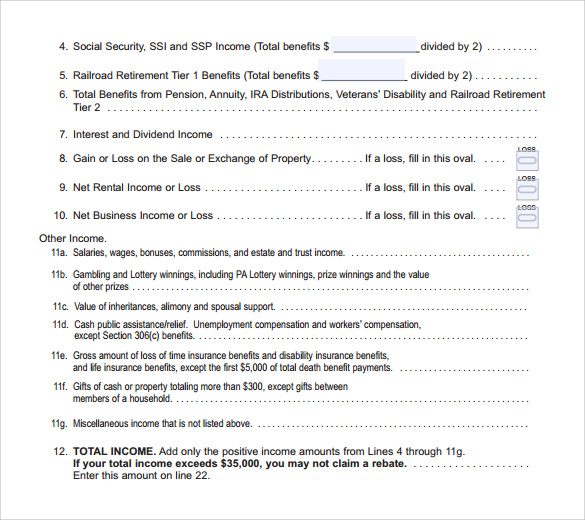

Missouri property tax credit claim allows seniors and disabled people to claim credit for part of their real estate taxes and rent for the past year. You must provide the contact information for the individual filing this return. Web april 10, 2022 by fredrick. Get rent rebate form missouri 2022 here on our website so that you can claim tax.

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. Web april 10, 2022 by fredrick. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year..

FREE 7+ Sample Rent Rebate Forms in PDF

Rental begin date (mm/dd/yyyy) rental end date (mm/dd/yyyy) gross rent paid for the year Date and still receive your credit. Web april 10, 2022 by fredrick. Landlord must complete this form each year. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or.

FREE 7+ Sample Rent Rebate Forms in PDF

Not state the complete law. Web 2022 property tax credit claim print in black ink only and do not staple. You must provide the contact information for the individual filing this return. Web 2022 certification of rent paid. Web verification of rent paid.

2018 Form MO MOCRP Fill Online, Printable, Fillable, Blank pdfFiller

You must provide the contact information for the individual filing this return. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. Web 2022 certification of rent paid. Where to submit your claim. When to file a claim.

2019 Rent Rebate Form Missouri justgoing 2020

This information is for guidance only and does. You must provide the contact information for the individual filing this return. Not state the complete law. Landlord must complete this form each year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

R.I.P. property tax and rent rebate The Money Edge Biz The Maine Edge

*22344010001* 22344010001 failure to provide the following attachments will result in denial or delay of your claim: Web 2022 property tax credit claim print in black ink only and do not staple. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and.

Get Rent Rebate Form Missouri 2022 Here On Our Website So That You Can Claim Tax Credit Up To $750.

Landlord must complete this form each year. Web april 10, 2022 by fredrick. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. A 2019 claim must be filed by july 15, 2023, or a refund will not be issued.

This Information Is For Guidance Only And Does.

Please note, direct deposit of a property tax credit refund claim is not an option with this filing method. Multiply line 8 by 20%. Not state the complete law. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

Web 2022 Property Tax Credit Claim Print In Black Ink Only And Do Not Staple.

For privacy notice, see instructions. Web certain individuals are eligible to claim up to $750 if they pay rent or $1,100 if they pay real estate tax on the home they own and occupy. Where to submit your claim. When to file a claim.

Missouri Property Tax Credit Claim Allows Seniors And Disabled People To Claim Credit For Part Of Their Real Estate Taxes And Rent For The Past Year.

Date and still receive your credit. *22344010001* 22344010001 failure to provide the following attachments will result in denial or delay of your claim: Web verification of rent paid. Web 2022 certification of rent paid.