Ny Tax Extension Form

Ny Tax Extension Form - Web personal income tax extension you can only access this application through your online services account. Web commonly used income tax forms and instructions; Web efile a personal federal tax extension. Web request for additional extension of time to file (for franchise/business taxes, mta surcharge, or both) you can file all other extension requests online. To apply for an extension, new york residents must. File your personal tax extension now! Documents on this page are provided in pdf format. Web new yorkers needing an extension for state tax returns can file an extension online via tax.ny.gov or by mail. April 15 (for calendar year taxpayers). Complete irs tax forms online or print government tax documents.

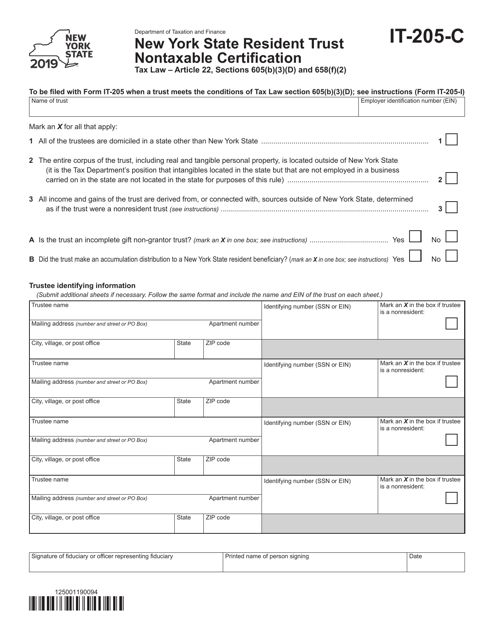

Web 2022 business corporation tax. Web new york tax extension form: Web the following security code is necessary to prevent unauthorized use of this web site. If you are using a screen reading program, select listen to have the number announced. Web income tax applications for filing extensions. Individuals in new york need to complete the state’s request for free using online service for requesting an extension request. Web efile a personal federal tax extension. Taxpayers who need more time can fill out a. Documents on this page are provided in pdf format. Get more information if you need to apply for an extension of time to file your return.

April 15 (for calendar year taxpayers). Get more information if you need to apply for an extension of time to file your return. If you are receiving this message, you have either attempted to use a. Web efile a personal federal tax extension. Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s. Ad access irs tax forms. Complete irs tax forms online or print government tax documents. Documents on this page are provided in pdf format. If you are using a screen reading program, select listen to have the number announced. Web new york tax extension form:

Ny State Tax Extension Form It 201 Form Resume Examples erkKMqB5N8

Web commonly used income tax forms and instructions; Web efile a personal federal tax extension. Complete, edit or print tax forms instantly. Web the following security code is necessary to prevent unauthorized use of this web site. April 15 (for calendar year taxpayers).

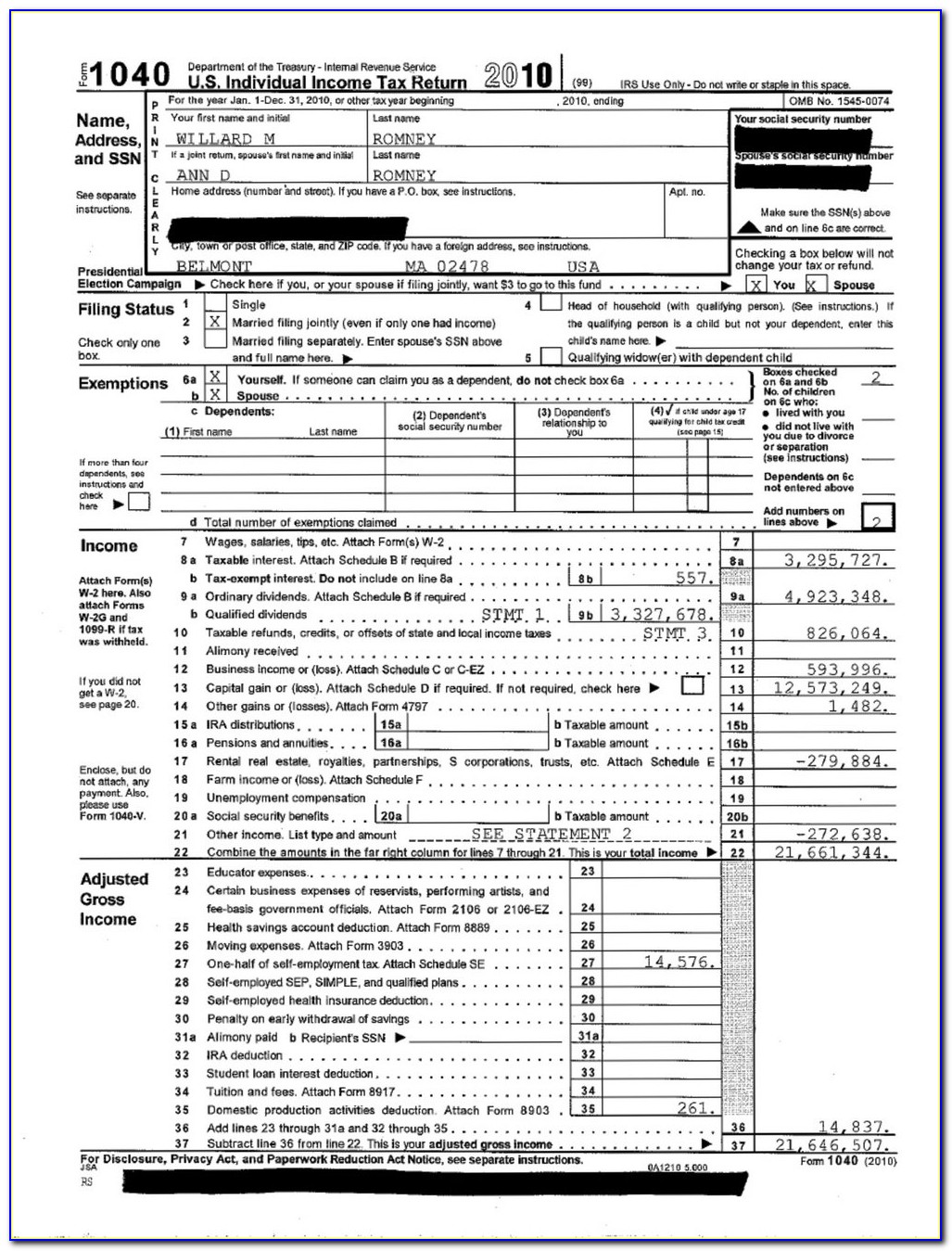

New York State Withholding Tax Rate 2019 carfare.me 20192020

Individuals in new york need to complete the state’s request for free using online service for requesting an extension request. To apply for an extension, new york residents must. Web efile a personal federal tax extension. File your personal tax extension now! Web income tax applications for filing extensions.

How to File a 2019 Tax Return Extension by July 15

Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s. If you are using a screen reading program, select listen to have the number announced. Web the following security code is necessary to prevent unauthorized use of this web site. If you are receiving this message, you have either attempted to use.

Considering Filing A Tax Extension In the South Bronx, West Farm, or

Web personal income tax extension you can only access this application through your online services account. Individuals in new york need to complete the state’s request for free using online service for requesting an extension request. Get more information if you need to apply for an extension of time to file your return. Documents on this page are provided in.

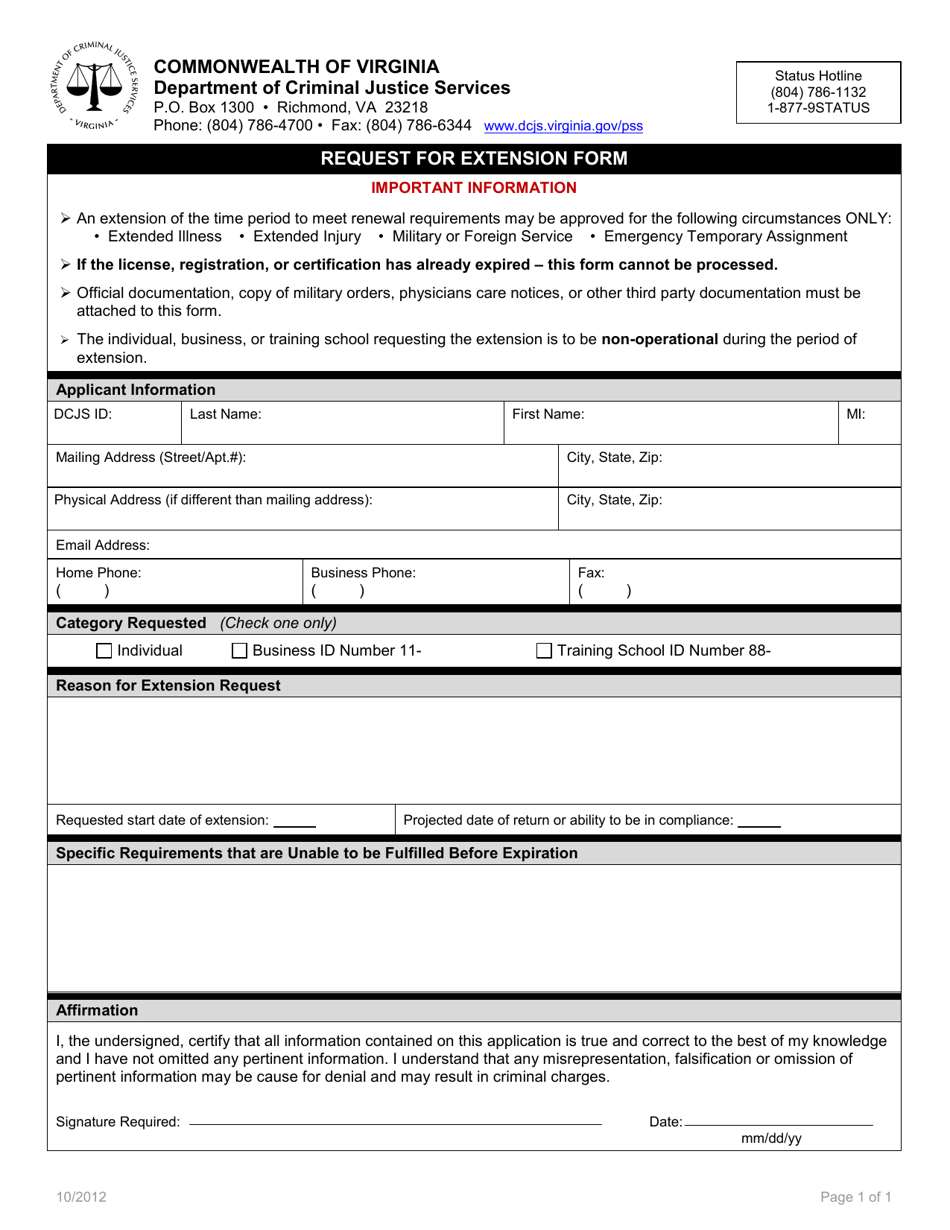

Virginia Request for Extension Form Download Fillable PDF Templateroller

To apply for an extension, new york residents must. Individuals in new york need to complete the state’s request for free using online service for requesting an extension request. Web commonly used income tax forms and instructions; Web new yorkers needing an extension for state tax returns can file an extension online via tax.ny.gov or by mail. Ad access irs.

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

April 15 (for calendar year taxpayers). Individual income tax return special rules. Web income tax applications for filing extensions. Web new yorkers needing an extension for state tax returns can file an extension online via tax.ny.gov or by mail. Get more information if you need to apply for an extension of time to file your return.

File 1120 Extension Online Corporate Tax Extension Form for 2020

Documents on this page are provided in pdf format. File your personal tax extension now! If you are receiving this message, you have either attempted to use a. April 15 (for calendar year taxpayers). Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s.

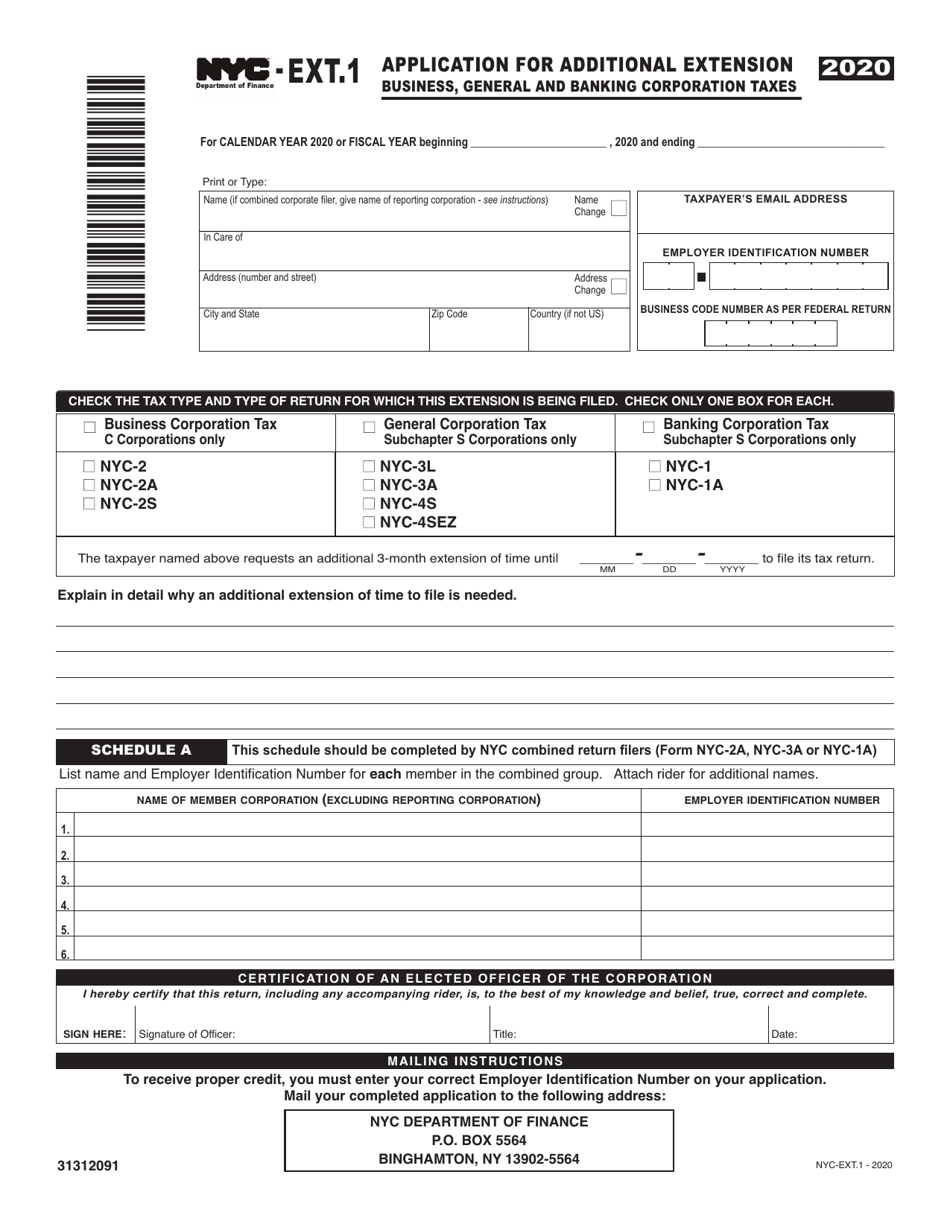

Form NYCEXT.1 Download Printable PDF or Fill Online Application for

Web commonly used income tax forms and instructions; April 15 (for calendar year taxpayers). Get more information if you need to apply for an extension of time to file your return. Web extension forms by filing status individuals form 4868, application for automatic extension of time to file u.s. Web the following security code is necessary to prevent unauthorized use.

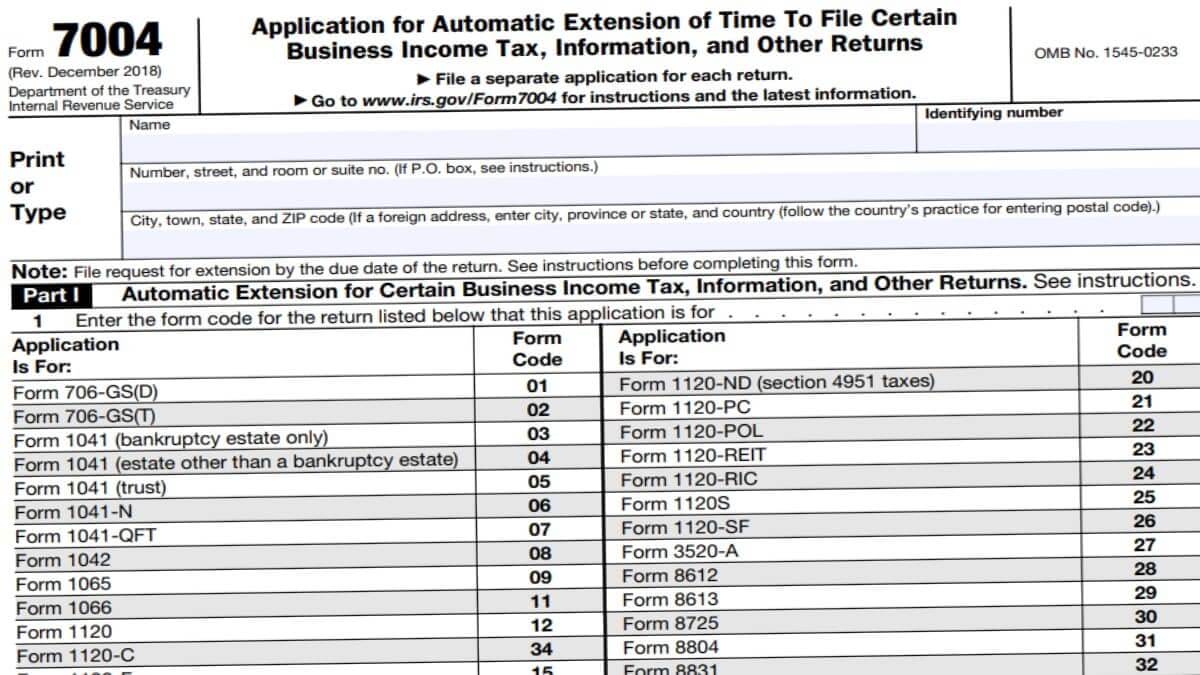

Business Tax Extension 7004 Form 2021

Web 2022 business corporation tax. Web new york tax extension form: Web request for additional extension of time to file (for franchise/business taxes, mta surcharge, or both) you can file all other extension requests online. Web new yorkers needing an extension for state tax returns can file an extension online via tax.ny.gov or by mail. If you are receiving this.

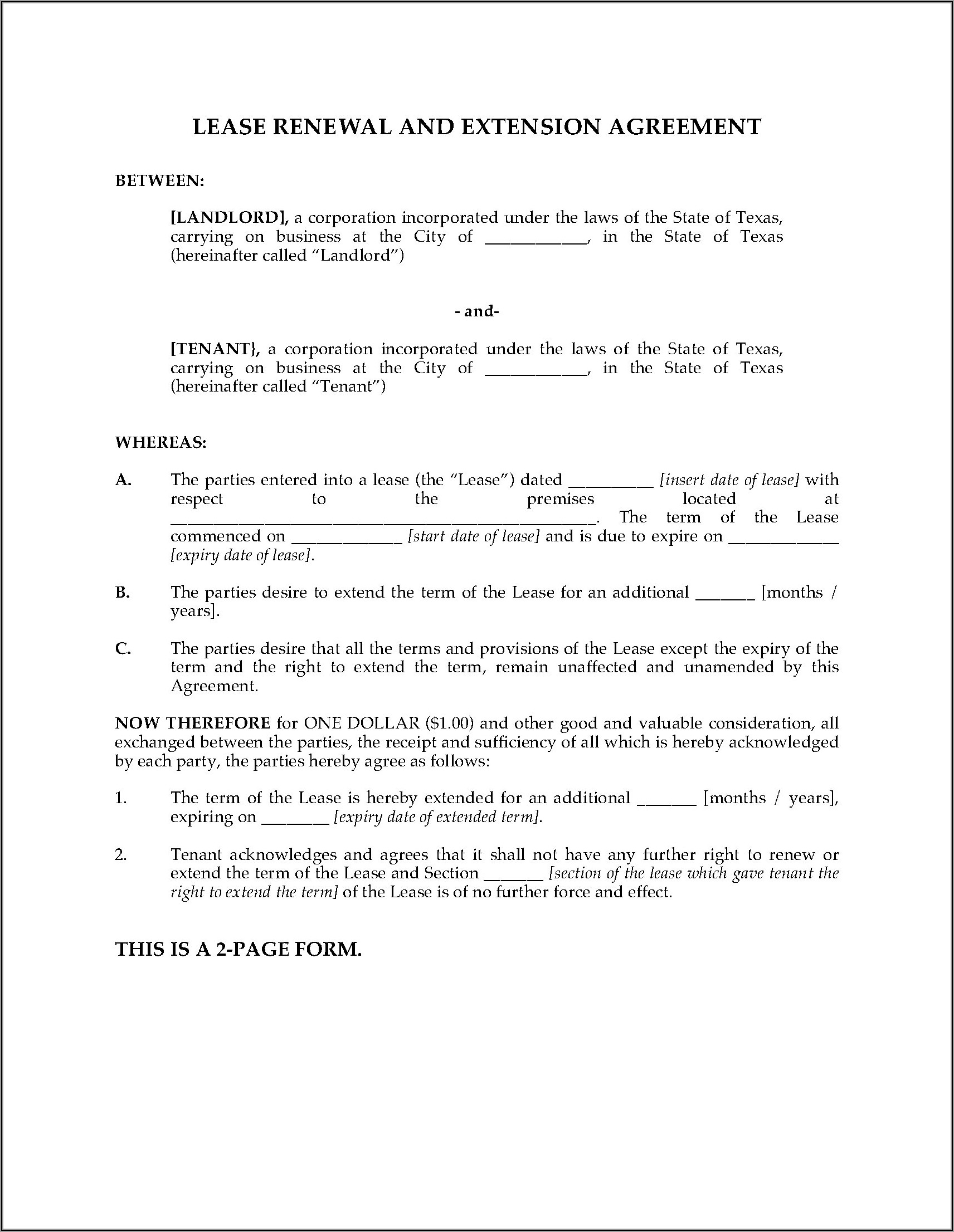

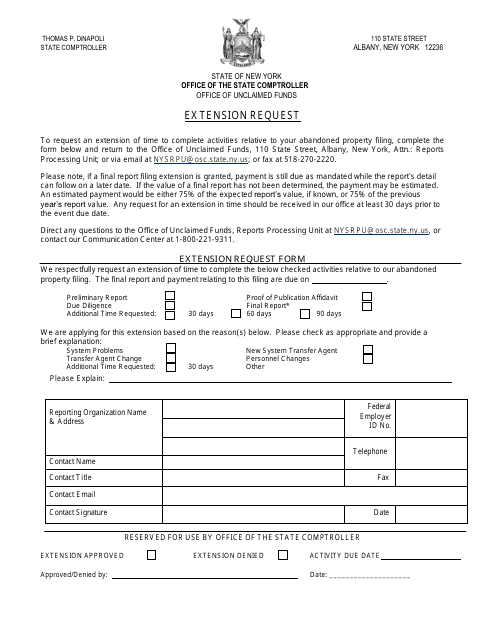

New York Extension Request Form Download Printable PDF Templateroller

If you are receiving this message, you have either attempted to use a. Web new yorkers needing an extension for state tax returns can file an extension online via tax.ny.gov or by mail. Web new york tax extension form: Taxpayers who need more time can fill out a. Complete, edit or print tax forms instantly.

Web New York Tax Extension Form:

If you are receiving this message, you have either attempted to use a. To apply for an extension, new york residents must. April 15 (for calendar year taxpayers). Web commonly used income tax forms and instructions;

Complete, Edit Or Print Tax Forms Instantly.

Web new yorkers needing an extension for state tax returns can file an extension online via tax.ny.gov or by mail. Web personal income tax extension you can only access this application through your online services account. Web welcome to nyc.gov | city of new york Individual income tax return special rules.

Web Extension Forms By Filing Status Individuals Form 4868, Application For Automatic Extension Of Time To File U.s.

Taxpayers who need more time can fill out a. Web efile a personal federal tax extension. Ad access irs tax forms. If you are using a screen reading program, select listen to have the number announced.

Get More Information If You Need To Apply For An Extension Of Time To File Your Return.

Web income tax applications for filing extensions. Individuals in new york need to complete the state’s request for free using online service for requesting an extension request. Documents on this page are provided in pdf format. Web request for additional extension of time to file (for franchise/business taxes, mta surcharge, or both) you can file all other extension requests online.