Oregon 1099 Form

Oregon 1099 Form - From the latest tech to workspace faves, find just what you need at office depot®! Web does oregon require state 1099 tax filing? Find them all in one convenient place. View all of the current year's forms and publications by popularity or program area. Web independent contractors receive a form 1099 at the end of the year and are solely responsible for reporting and paying taxes, including state and federal income taxes, self. The state of oregon also mandates the filing of. Request for taxpayer identification number (tin) and. You use it when you are filing federal and state income taxes to the internal revenue. We use this form to report interest that we paid you if the amount was $10 or more. Once you subtract the federal and state income.

Web which is correct? Find them all in one convenient place. Web does oregon require state 1099 tax filing? We use this form to report interest that we paid you if the amount was $10 or more. Download and save the form to your computer, then open it in adobe reader to complete and print. Ad success starts with the right supplies. Select a heading to view its forms, then u se the search. Emergency communications tax (e911) file electronically using revenue online and read about emergency. Yes, oregon requires all 1099 forms to be filed with the oregon department of revenue. View all of the current year's forms and publications by popularity or program area.

Web independent contractors receive a form 1099 at the end of the year and are solely responsible for reporting and paying taxes, including state and federal income taxes, self. Find them all in one convenient place. We use this form to report interest that we paid you if the amount was $10 or more. Ad success starts with the right supplies. Web current forms and publications. Web fill out the form and mail it to the address listed on the form. Individual tax return form 1040 instructions; Once you subtract the federal and state income. Emergency communications tax (e911) file electronically using revenue online and read about emergency. Web 2022 forms and publications.

Filing 1099 Forms For Employees Universal Network

Ad get ready for tax season deadlines by completing any required tax forms today. Download and save the form to your computer, then open it in adobe reader to complete and print. Emergency communications tax (e911) file electronically using revenue online and read about emergency. Request for taxpayer identification number (tin) and. Web 2022 forms and publications.

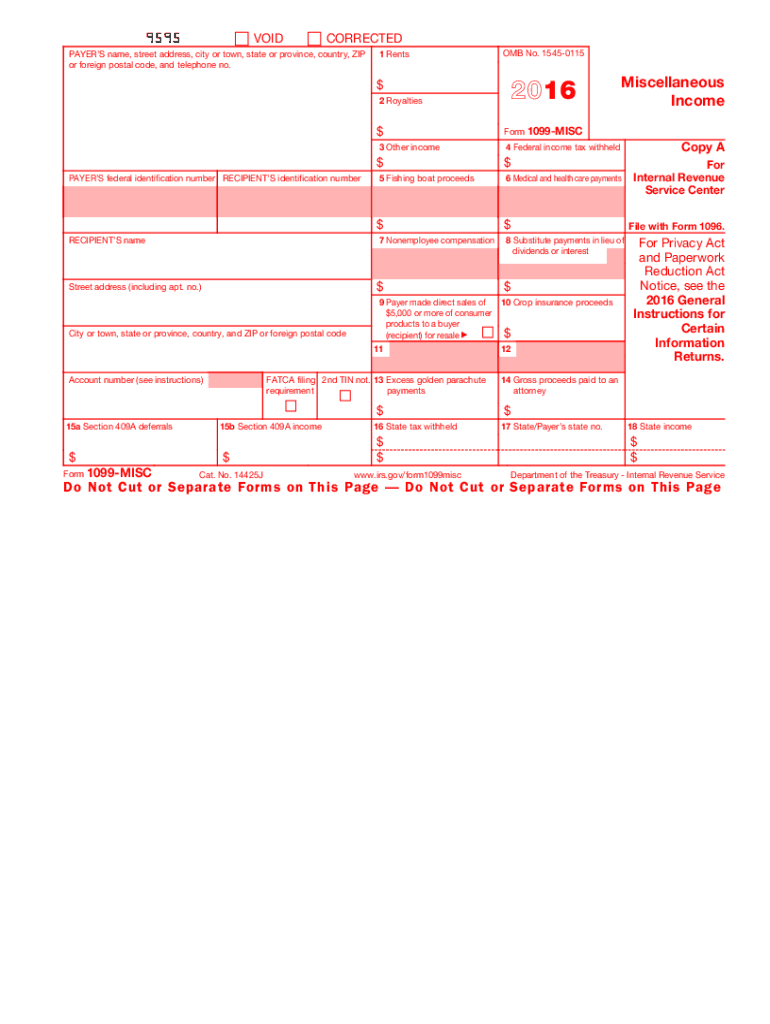

2016 Form IRS 1099MISC Fill Online, Printable, Fillable, Blank pdfFiller

Request for taxpayer identification number (tin) and. Yes, oregon requires all 1099 forms to be filed with the oregon department of revenue. From the latest tech to workspace faves, find just what you need at office depot®! Find them all in one convenient place. Ad success starts with the right supplies.

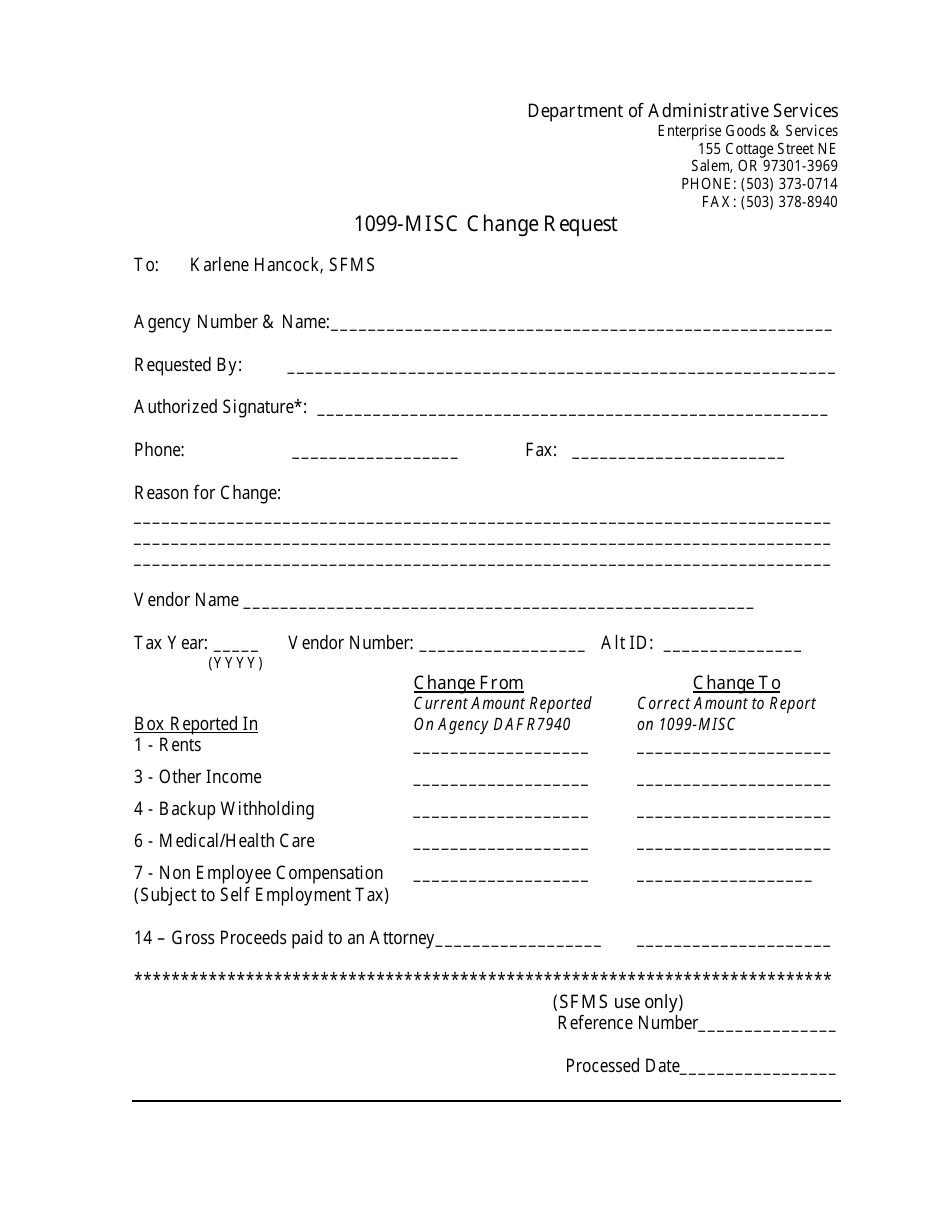

2021 Form OR DAS 1099MISC Training Fill Online, Printable, Fillable

You use it when you are filing federal and state income taxes to the internal revenue. From the latest tech to workspace faves, find just what you need at office depot®! We use this form to report interest that we paid you if the amount was $10 or more. View all of the current year's forms and publications by popularity.

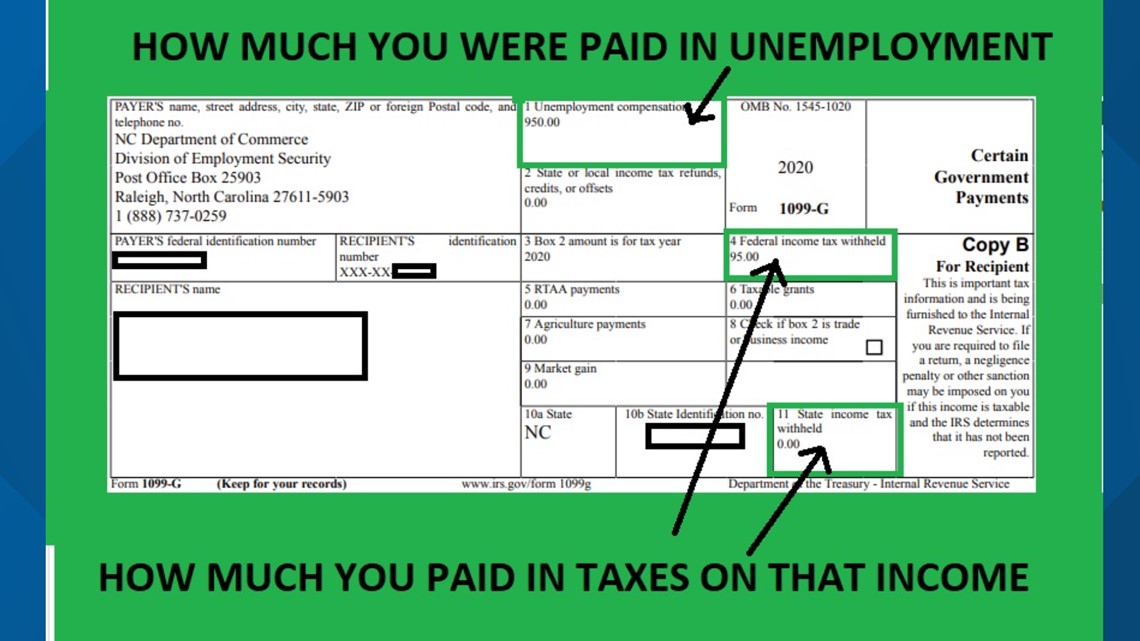

UC1099G Information

Web the 1099g form is used for filing both federal income taxes to the internal revenue service (irs) and state income taxes to the oregon department of revenue. Web 1099g is a tax form sent to people who have received unemployment insurance benefits. This interest is taxable and must be included on both your federal and oregon. Emergency communications tax.

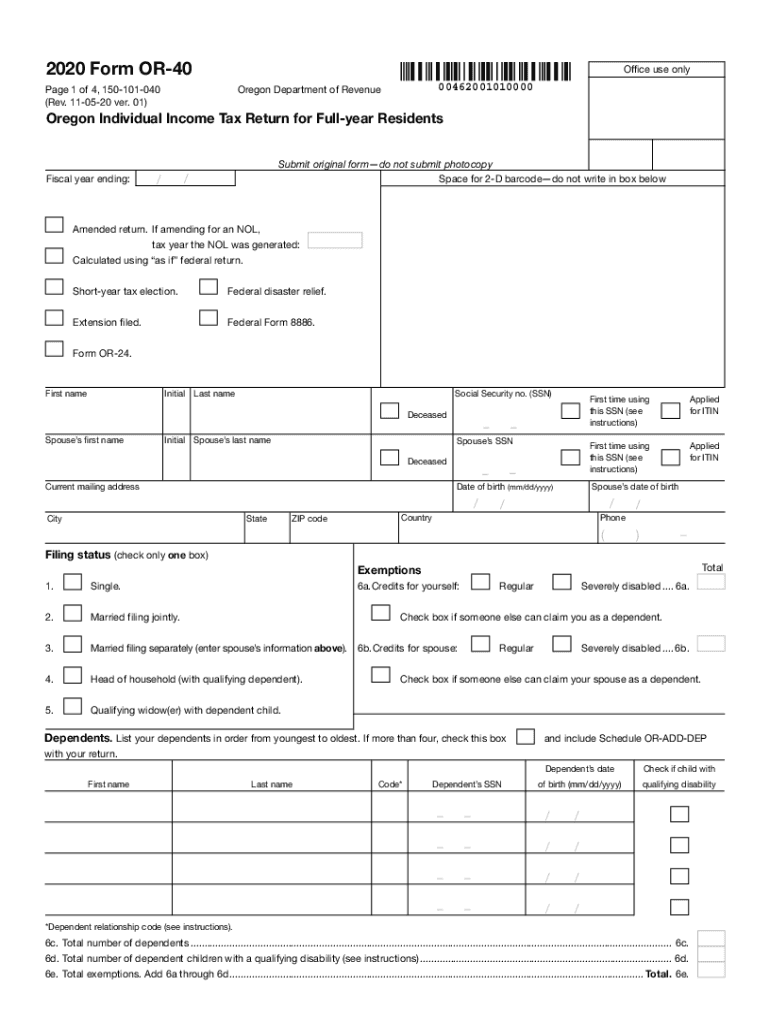

Oregon Form Tax Fill Out and Sign Printable PDF Template signNow

Emergency communications tax (e911) file electronically using revenue online and read about emergency. The state of oregon also mandates the filing of. Web fill out the form and mail it to the address listed on the form. This interest is taxable and must be included on both your federal and oregon. Web * this information replaces fis 412 1099 reporting.

How To File A Corrected Form 1099misc Leah Beachum's Template

Web independent contractors receive a form 1099 at the end of the year and are solely responsible for reporting and paying taxes, including state and federal income taxes, self. Web it does not matter that you no longer live in oregon, you still report the state tax refund received. From the latest tech to workspace faves, find just what you.

oregon divorce forms packet 9 universal network oregon divorce forms

The state of oregon also mandates the filing of. Web does oregon require state 1099 tax filing? Ad success starts with the right supplies. Individual tax return form 1040 instructions; Request for taxpayer identification number (tin) and.

Oregon 1099misc Change Request Download Fillable PDF Templateroller

Ad get ready for tax season deadlines by completing any required tax forms today. Web does oregon require state 1099 tax filing? Yes, oregon requires all 1099 forms to be filed with the oregon department of revenue. Select a heading to view its forms, then u se the search. Web 2022 forms and publications.

How To Get 1099 G Form Online Iowa Nicolette Mill's Template

Individual tax return form 1040 instructions; Web current forms and publications. Web * this information replaces fis 412 1099 reporting 1099 statements are reports of taxable income paid to individuals and companies by oregon state university. Ad success starts with the right supplies. Web the 1099g form is used for filing both federal income taxes to the internal revenue service.

Oregon 1099 Form 2021 Fill Online, Printable, Fillable, Blank pdfFiller

You use it when you are filing federal and state income taxes to the internal revenue. Web 1099g is a tax form sent to people who have received unemployment insurance benefits. Complete, edit or print tax forms instantly. Web independent contractors receive a form 1099 at the end of the year and are solely responsible for reporting and paying taxes,.

Web Current Forms And Publications.

Web fill out the form and mail it to the address listed on the form. Web the 1099g form is used for filing both federal income taxes to the internal revenue service (irs) and state income taxes to the oregon department of revenue. Web it does not matter that you no longer live in oregon, you still report the state tax refund received. Web 2022 forms and publications.

Web * This Information Replaces Fis 412 1099 Reporting 1099 Statements Are Reports Of Taxable Income Paid To Individuals And Companies By Oregon State University.

View all of the current year's forms and publications by popularity or program area. Web 1099g is a tax form sent to people who have received unemployment insurance benefits. Ad success starts with the right supplies. Web which is correct?

We Use This Form To Report Interest That We Paid You If The Amount Was $10 Or More.

Complete, edit or print tax forms instantly. Web does oregon require state 1099 tax filing? The state of oregon also mandates the filing of. From the latest tech to workspace faves, find just what you need at office depot®!

Individual Tax Return Form 1040 Instructions;

Once you subtract the federal and state income. Request for taxpayer identification number (tin) and. Select a heading to view its forms, then u se the search. Find them all in one convenient place.