Texas Rendition Form

Texas Rendition Form - General aviation aircraft owners must plan for the annual ad valorem (business personal property) tax, which applies at the county level. Web business personal property rendition form. Web a person required to render property or to file a report as provided by this chapter shall use a form that substantially complies with the appropriate form prescribed. Web this form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or manage and control as a fiduciary on. Automatic payment deduction consent form. Standard rendition filing requirements a person or business who owns tangible personal property with an aggregate value of $20,000 or more is. This form is for use in rendering aircraft property used for the production of income that was owned or managed and controlled as a fiduciary on jan. Complete, edit or print tax forms instantly. Web tarrant appraisal district documents and publications, available in pdf version to review and download. Please sign in the signature section.

Please sign in the signature section. Standard rendition filing requirements a person or business who owns tangible personal property with an aggregate value of $20,000 or more is. Web texas businesses must file property tax renditions by april 15 (austin) — texas comptroller glenn hegar reminds business owners that for many property. Rendition of stored products confidential (harris county appraisal district) form 22.15 veh (1220):. Web a rendition is a form that provides the appraisal district with taxable business property information. Web until the acfr grants it official status, the xml rendition of the daily federal register on federalregister.gov does not provide legal notice to the public or judicial. Web the property tax ssistance ivision at the texas omptroller of public ccounts provides property tax information and resources for taxpayers local taxing entities appraisal. Web tarrant appraisal district documents and publications, available in pdf version to review and download. (a) a person required to render property or to file a report as provided by this chapter shall use a form that substantially complies with the appropriate. This form is for use in rendering aircraft property used for the production of income that was owned or managed and controlled as a fiduciary on jan.

Web a person required to render property or to file a report as provided by this chapter shall use a form that substantially complies with the appropriate form prescribed. Standard rendition filing requirements a person or business who owns tangible personal property with an aggregate value of $20,000 or more is. Please sign in the signature section. Web rendition submitted for january 1, , for the same tarrant appraisal district account number as this continues to be complete and accurate, in accordance with texas property tax. Complete, edit or print tax forms instantly. Web rendition and report forms. This form is to render tangible personal property qualified for allocation of value owned or managed and controlled as fiduciary on jan. Automatic payment deduction consent form. Web this form is for use in rendering, pursuant to tax code §22.01, tangible personal property used for the production of income that you own or manage and control as a fiduciary on. Return the completed, abbreviated rendition to bexar.

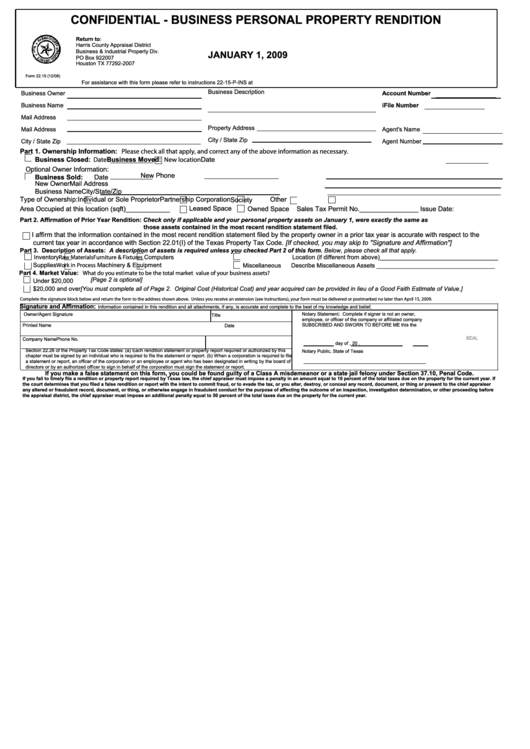

Fill Free fillable Harris County Appraisal District PDF forms

Complete, edit or print tax forms instantly. Edit, sign and print tax forms on any device with signnow. Web rendition and report forms. Web we recommend all dealers set up multiple users. Standard rendition filing requirements a person or business who owns tangible personal property with an aggregate value of $20,000 or more is.

Fillable Form 22.15 Confidential Business Personal Property

Web tarrant appraisal district documents and publications, available in pdf version to review and download. A person or business who owns tangible. This form is to render tangible personal property qualified for allocation of value owned or managed and controlled as fiduciary on jan. Complete, edit or print tax forms instantly. Web to do so, check the box titled “same.

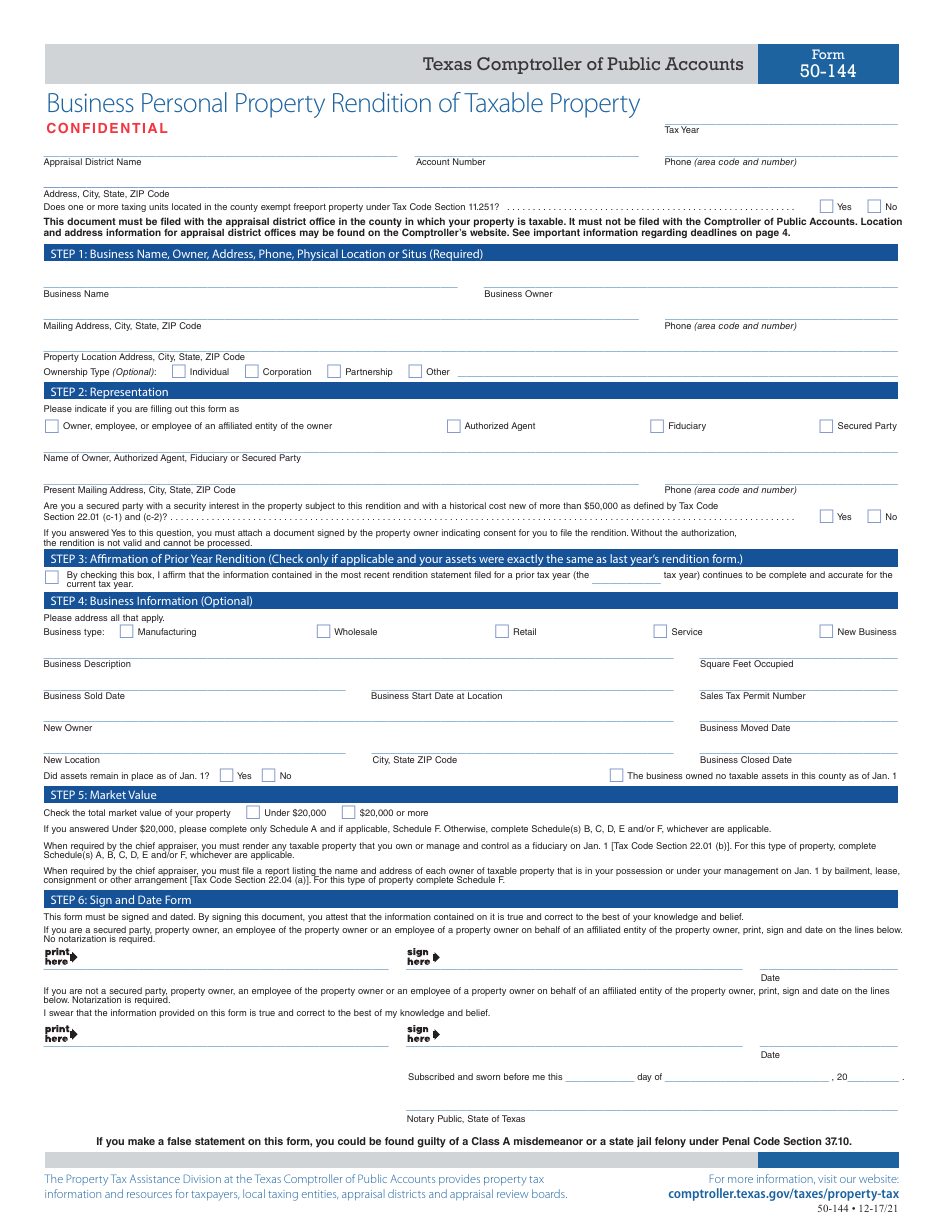

Form 50144 Fill Out, Sign Online and Download Fillable PDF, Texas

Complete, edit or print tax forms instantly. Web rendition submitted for january 1, , for the same tarrant appraisal district account number as this continues to be complete and accurate, in accordance with texas property tax. Standard rendition filing requirements a person or business who owns tangible personal property with an aggregate value of $20,000 or more is. Web we.

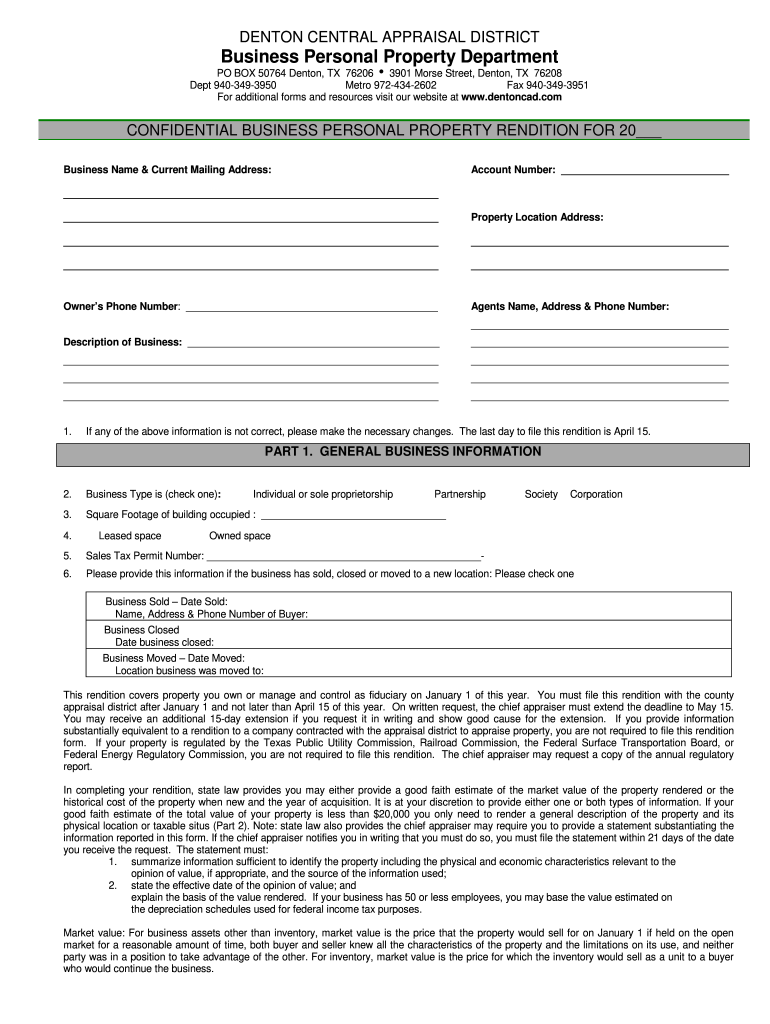

Denton County Business Personal Property Tax Fill Online, Printable

Complete, edit or print tax forms instantly. Return the completed, abbreviated rendition to bexar. Web to do so, check the box titled “same as 2021” in the first page of the rendition form. Web texas businesses must file property tax renditions by april 15 (austin) — texas comptroller glenn hegar reminds business owners that for many property. Web a person.

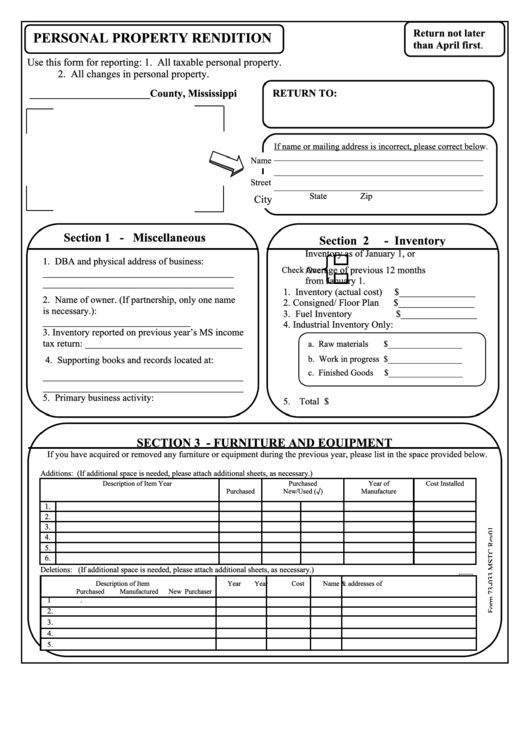

Top Property Rendition Form Templates free to download in PDF format

Web until the acfr grants it official status, the xml rendition of the daily federal register on federalregister.gov does not provide legal notice to the public or judicial. Web texas businesses must file property tax renditions by april 15 (austin) — texas comptroller glenn hegar reminds business owners that for many property. Web rendition submitted for january 1, , for.

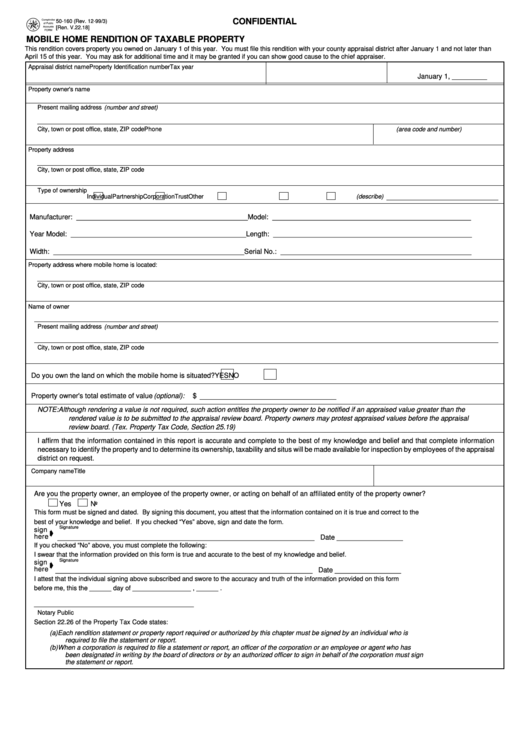

Form 50160 Mobile Home Rendition Of Taxable Property 1999

This form is for use in rendering aircraft property used for the production of income that was owned or managed and controlled as a fiduciary on jan. Web a rendition is a form that provides the appraisal district with taxable business property information. Return the completed, abbreviated rendition to bexar. Web business personal property rendition form. Web the property tax.

Fill Free fillable Form 50141 General Real Property Rendition of

Web rendition and report forms. This form is for use in rendering aircraft property used for the production of income that was owned or managed and controlled as a fiduciary on jan. Web business personal property rendition form. (a) a person required to render property or to file a report as provided by this chapter shall use a form that.

Business Personal Property Rendition of Taxable Property Fill out

Web the ad valorem tax. Web a rendition is a form that provides the appraisal district with taxable business property information. Please sign in the signature section. Web a person required to render property or to file a report as provided by this chapter shall use a form that substantially complies with the appropriate form prescribed. Web the property tax.

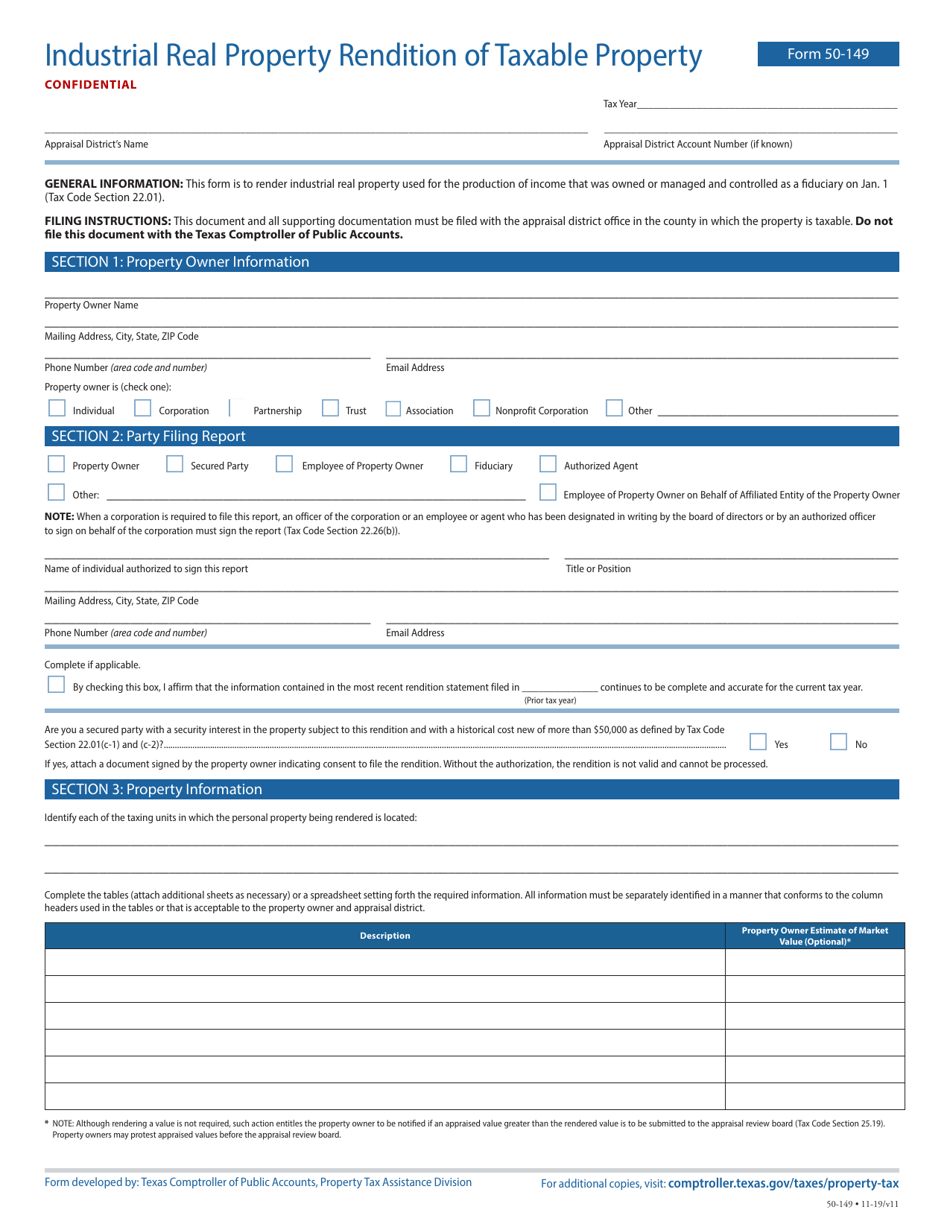

Form 50149 Download Fillable PDF or Fill Online Industrial Real

Web the ad valorem tax. Web tarrant appraisal district documents and publications, available in pdf version to review and download. Please sign in the signature section. Web to do so, check the box titled “same as 2021” in the first page of the rendition form. Web this form is for use in rendering, pursuant to tax code §22.01, tangible personal.

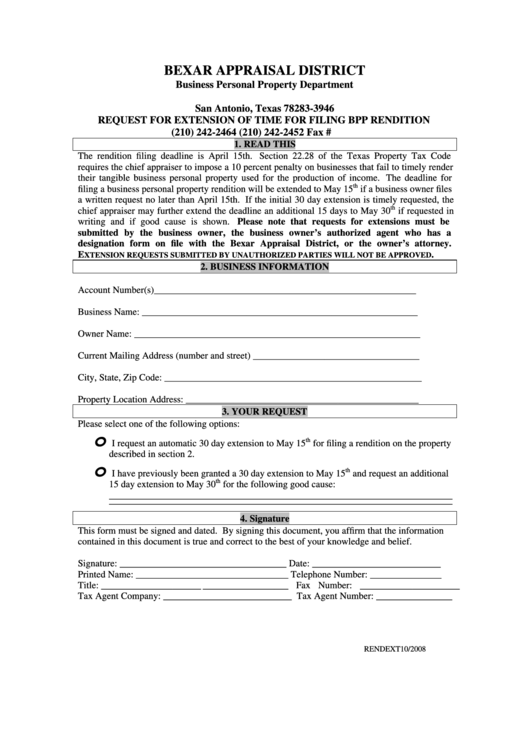

Request For Extension Of Time For Filing Bpp Rendition Form Bexar

General aviation aircraft owners must plan for the annual ad valorem (business personal property) tax, which applies at the county level. (a) a person required to render property or to file a report as provided by this chapter shall use a form that substantially complies with the appropriate. Web this form is for use in rendering, pursuant to tax code.

Web We Recommend All Dealers Set Up Multiple Users.

Return the completed, abbreviated rendition to bexar. Rendition of stored products confidential (harris county appraisal district) form 22.15 veh (1220):. Standard rendition filing requirements a person or business who owns tangible personal property with an aggregate value of $20,000 or more is. Web tarrant appraisal district documents and publications, available in pdf version to review and download.

Web This Form Is For Use In Rendering, Pursuant To Tax Code §22.01, Tangible Personal Property Used For The Production Of Income That You Own Or Manage And Control As A Fiduciary On.

Web until the acfr grants it official status, the xml rendition of the daily federal register on federalregister.gov does not provide legal notice to the public or judicial. Automatic payment deduction consent form. Web the property tax ssistance ivision at the texas omptroller of public ccounts provides property tax information and resources for taxpayers local taxing entities appraisal. Web the ad valorem tax.

Web Business Personal Property Rendition Form.

Web rendition submitted for january 1, , for the same tarrant appraisal district account number as this continues to be complete and accurate, in accordance with texas property tax. Web texas businesses must file property tax renditions by april 15 (austin) — texas comptroller glenn hegar reminds business owners that for many property. This form is for use in rendering aircraft property used for the production of income that was owned or managed and controlled as a fiduciary on jan. Web rendition and report forms.

A Person Or Business Who Owns Tangible.

Please sign in the signature section. Edit, sign and print tax forms on any device with signnow. Web to do so, check the box titled “same as 2021” in the first page of the rendition form. This form is to render tangible personal property qualified for allocation of value owned or managed and controlled as fiduciary on jan.