Tn Vehicle Gift Form

Tn Vehicle Gift Form - Fair market value is determined by referencing the most recent issue of an authoritative automobile pricing manual, such as the n.a.d.a. Power of attorney for vehicle transactions: Seller or transferor (please print) Any entity can also gift a vehicle to an individual. The company will submit the completed affidavit, along with a completed multipurpose use application, to the county clerk to complete title and registration in the company’s name. Web gift, inheritance, name change, minor. If the deceased left a will designating an executor or if an administrator has been appointed by the court, the existing certificate of title must be signed by this person in order to change the vehicle ownership record to reflect the new owner. University of tennessee alumni plate application: Ÿ gift transfer or low selling price to person other than lineal relative (low selling price is considered to be 75% or less of the fair market value by reference to the most recent issue of an authoritative automo tive pricing manual, such as. Web order request for forms or license plates:

Fair market value is determined by referencing the most recent issue of an authoritative automobile pricing manual, such as the n.a.d.a. Registrants can complete a gift affidavit which certifies that the vehicle was gifted. Seller or transferor (please print) The company will submit the completed affidavit, along with a completed multipurpose use application, to the county clerk to complete title and registration in the company’s name. Power of attorney for vehicle transactions: Web order request for forms or license plates: Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. Web gift, inheritance, name change, minor. An individual can give a vehicle as a gift to another individual. Web gift, inheritance, name change, minor.

Registrants can complete a gift affidavit which certifies that the vehicle was gifted. Web gift, inheritance, name change, minor. Web tennessee motor vehicle commission forms and downloads forms and downloads tennessee motor vehicle commission eligibility eligibility verification for entitlements act attestation instructions [pdf] annual sales report annual sales report [online] consignment consignment form [pdf] fees fee schedule manufacturers An individual can give a vehicle as a gift to another individual. A low selling price is 75% or less of the fair market value. Web order request for forms or license plates: Any entity can also gift a vehicle to an individual. Web gift, inheritance, name change, minor. Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. For other gift transfers, the county clerk would examine the transaction at issue to determine whether sales tax is due.

Free Tennessee Motor Vehicle Bill of Sale Form PDF Word (.doc)

Web gift, inheritance, name change, minor. Web tennessee motor vehicle commission forms and downloads forms and downloads tennessee motor vehicle commission eligibility eligibility verification for entitlements act attestation instructions [pdf] annual sales report annual sales report [online] consignment consignment form [pdf] fees fee schedule manufacturers Power of attorney for vehicle transactions: Fair market value is determined by referencing the most.

Tennessee Vehicle Title Donation Questions

A low selling price is 75% or less of the fair market value. Web gift, inheritance, name change, minor. Official used car guide, se edition. Seller or transferor (please print) Web gift, inheritance, name change, minor.

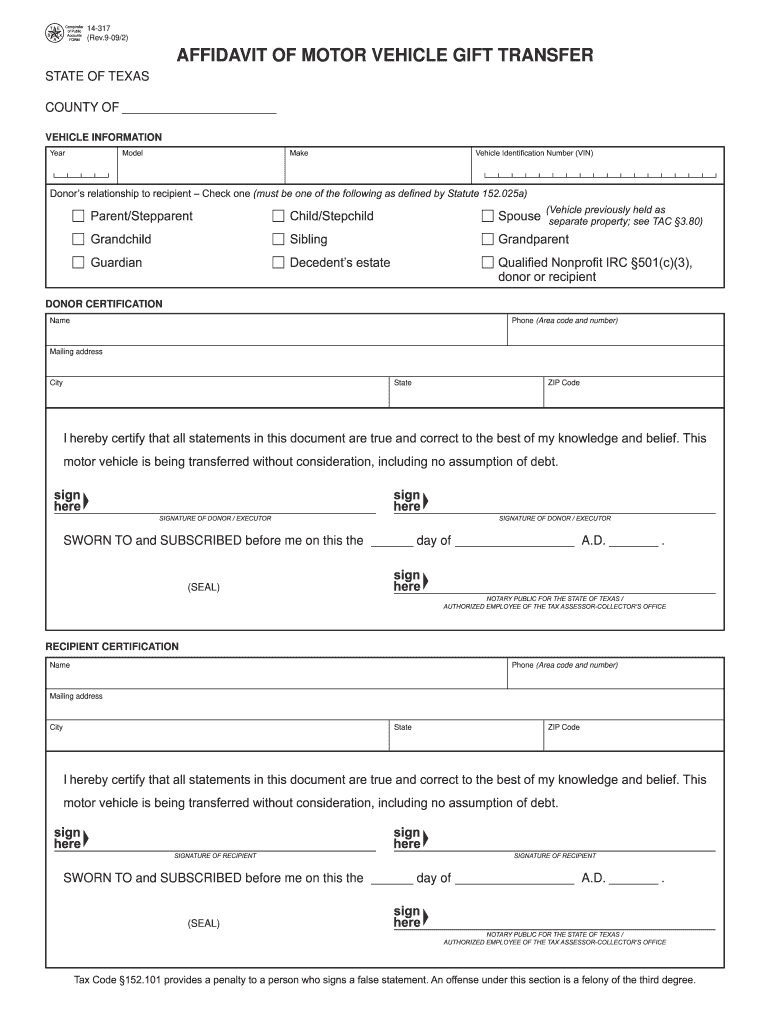

2009 Form TX 14317 Fill Online, Printable, Fillable, Blank pdfFiller

Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. If the deceased left a will designating an executor or if an administrator has been appointed by the court, the existing certificate of title must be signed by this person in order to change the vehicle ownership record to reflect the new.

mv13st Sales Tax Taxes

A low selling price is 75% or less of the fair market value. Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. Any entity can also gift a vehicle to an individual. Web gift, inheritance, name change, minor. The company will submit the completed affidavit, along with a completed multipurpose use.

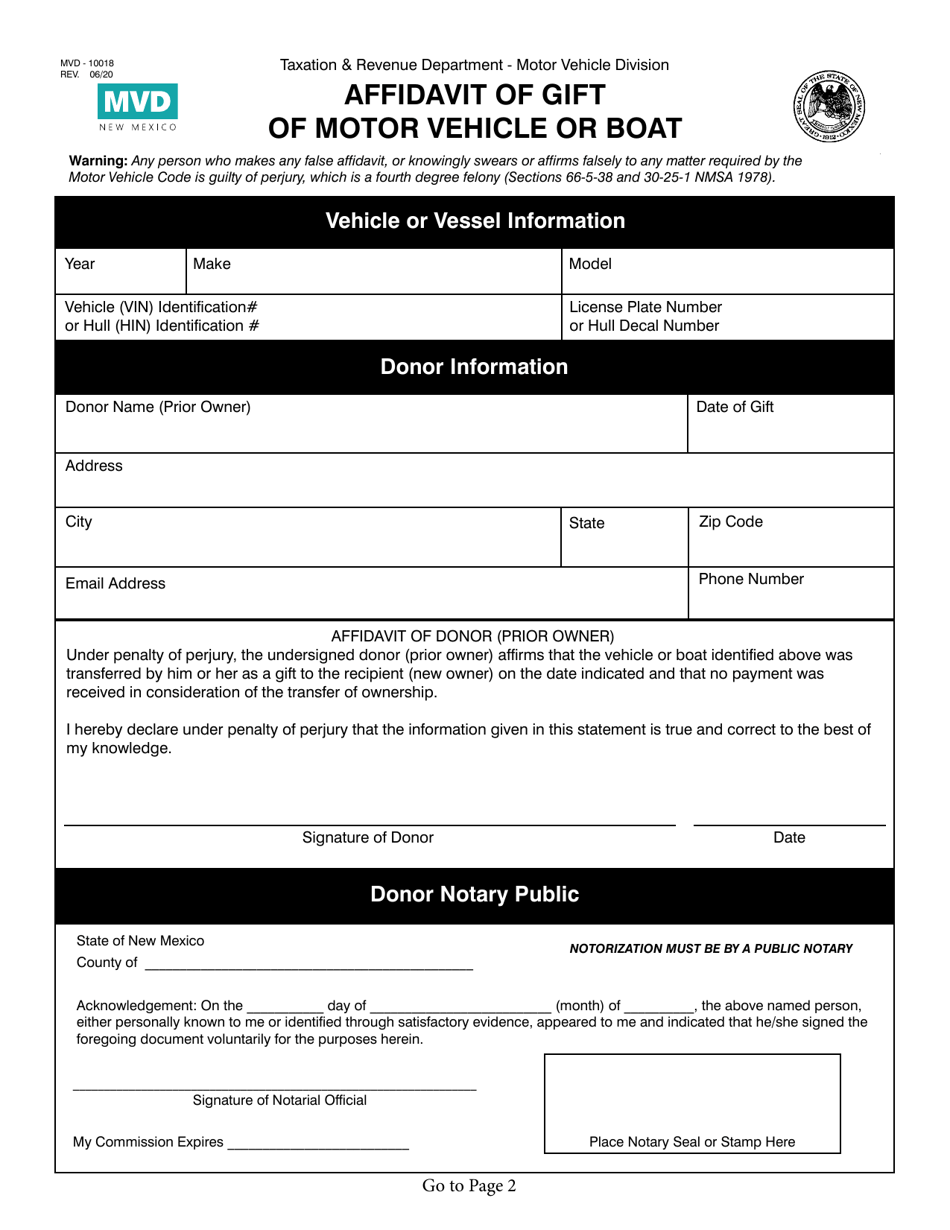

Affidavit Of Gift Motor Vehicle Missouri

An individual can give a vehicle as a gift to another individual. Ÿ gift transfer or low selling price to person other than lineal relative (low selling price is considered to be 75% or less of the fair market value by reference to the most recent issue of an authoritative automo tive pricing manual, such as. Registrants can complete a.

Tennessee Car Title How to transfer a vehicle, rebuilt or lost titles.

Ÿ gift transfer or low selling price to person other than lineal relative (low selling price is considered to be 75% or less of the fair market value by reference to the most recent issue of an authoritative automo tive pricing manual, such as. Registrants can complete a gift affidavit which certifies that the vehicle was gifted. Web tennessee motor.

20142022 Form TN RVF1301201 Fill Online, Printable, Fillable, Blank

Web tennessee motor vehicle commission forms and downloads forms and downloads tennessee motor vehicle commission eligibility eligibility verification for entitlements act attestation instructions [pdf] annual sales report annual sales report [online] consignment consignment form [pdf] fees fee schedule manufacturers Power of attorney for vehicle transactions: Sales tax is not due on vehicle transfers where the vehicle is gifted from one.

Personal Property Tax Tennessee Car PRORFETY

Web order request for forms or license plates: The company will submit the completed affidavit, along with a completed multipurpose use application, to the county clerk to complete title and registration in the company’s name. Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. Web gift, inheritance, name change, minor. Web.

Tennessee Car Title How to transfer a vehicle, rebuilt or lost titles.

Official used car guide, se edition. Web tennessee motor vehicle commission forms and downloads forms and downloads tennessee motor vehicle commission eligibility eligibility verification for entitlements act attestation instructions [pdf] annual sales report annual sales report [online] consignment consignment form [pdf] fees fee schedule manufacturers Sales tax is not due on vehicle transfers where the vehicle is gifted from one.

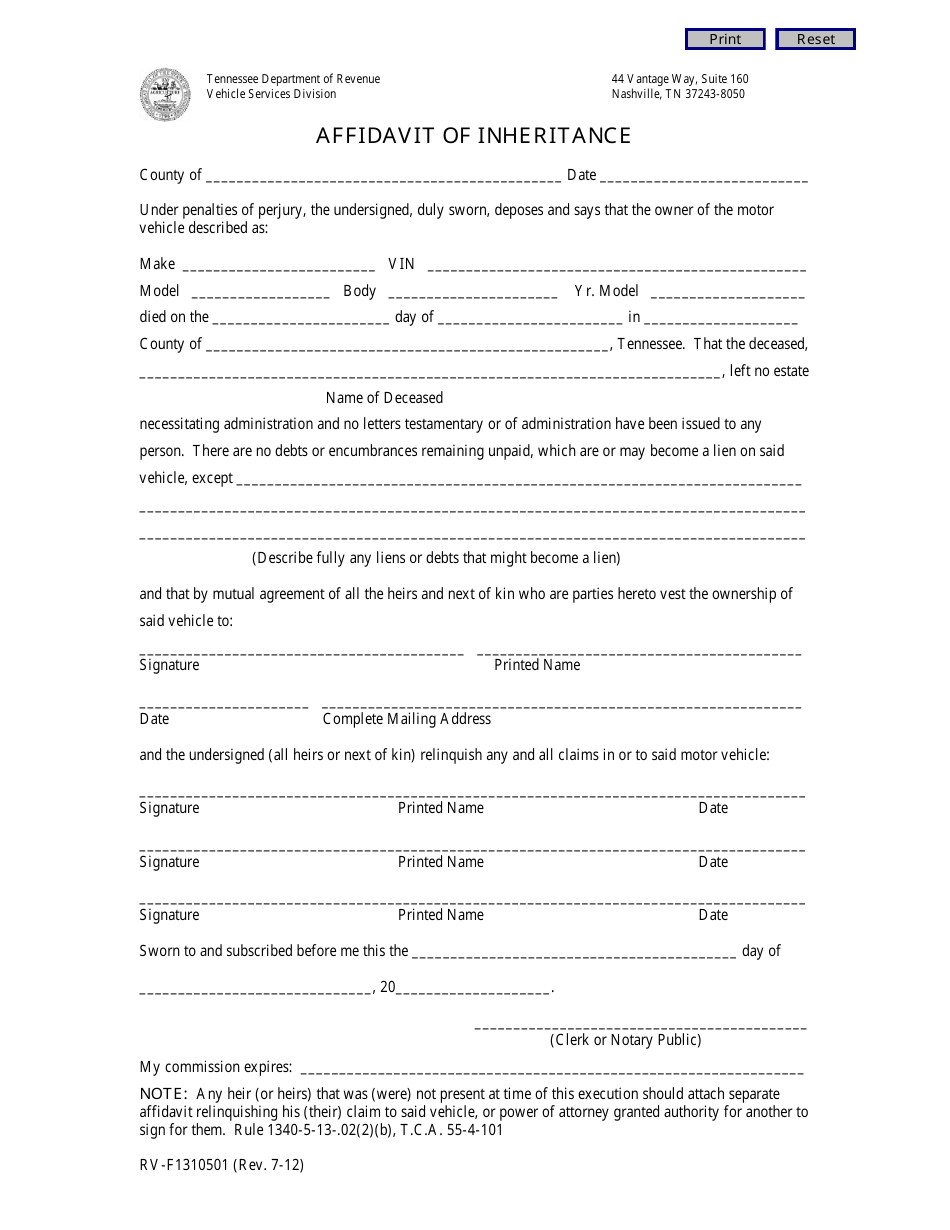

Form RVF1310501 Download Fillable PDF or Fill Online Affidavit of

Power of attorney for vehicle transactions: An individual can give a vehicle as a gift to another individual. A low selling price is 75% or less of the fair market value. Seller or transferor (please print) University of tennessee alumni plate application:

For Other Gift Transfers, The County Clerk Would Examine The Transaction At Issue To Determine Whether Sales Tax Is Due.

Fair market value is determined by referencing the most recent issue of an authoritative automobile pricing manual, such as the n.a.d.a. Sales tax is not due on vehicle transfers where the vehicle is gifted from one individual to another. The company will submit the completed affidavit, along with a completed multipurpose use application, to the county clerk to complete title and registration in the company’s name. Official used car guide, se edition.

Registrants Can Complete A Gift Affidavit Which Certifies That The Vehicle Was Gifted.

University of tennessee alumni plate application: Web gift, inheritance, name change, minor. A low selling price is 75% or less of the fair market value. If the deceased left a will designating an executor or if an administrator has been appointed by the court, the existing certificate of title must be signed by this person in order to change the vehicle ownership record to reflect the new owner.

Power Of Attorney For Vehicle Transactions:

Web order request for forms or license plates: Web tennessee motor vehicle commission forms and downloads forms and downloads tennessee motor vehicle commission eligibility eligibility verification for entitlements act attestation instructions [pdf] annual sales report annual sales report [online] consignment consignment form [pdf] fees fee schedule manufacturers Seller or transferor (please print) Ÿ gift transfer or low selling price to person other than lineal relative (low selling price is considered to be 75% or less of the fair market value by reference to the most recent issue of an authoritative automo tive pricing manual, such as.

Any Entity Can Also Gift A Vehicle To An Individual.

An individual can give a vehicle as a gift to another individual. Web gift, inheritance, name change, minor.