Where Do I File Form 7004

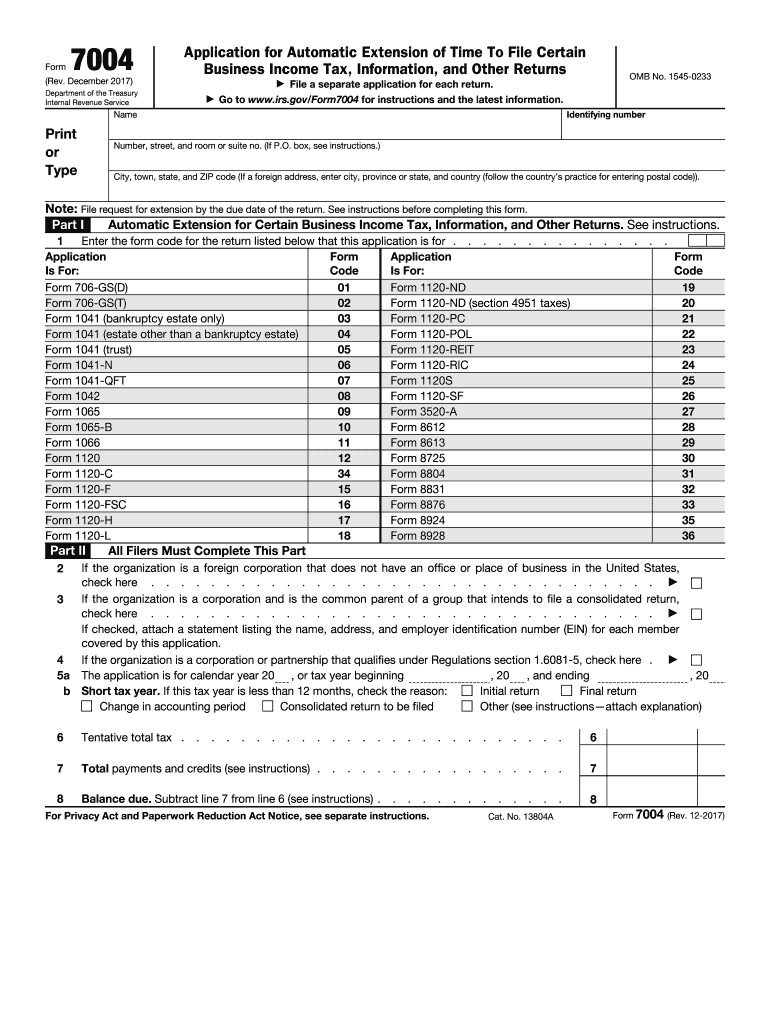

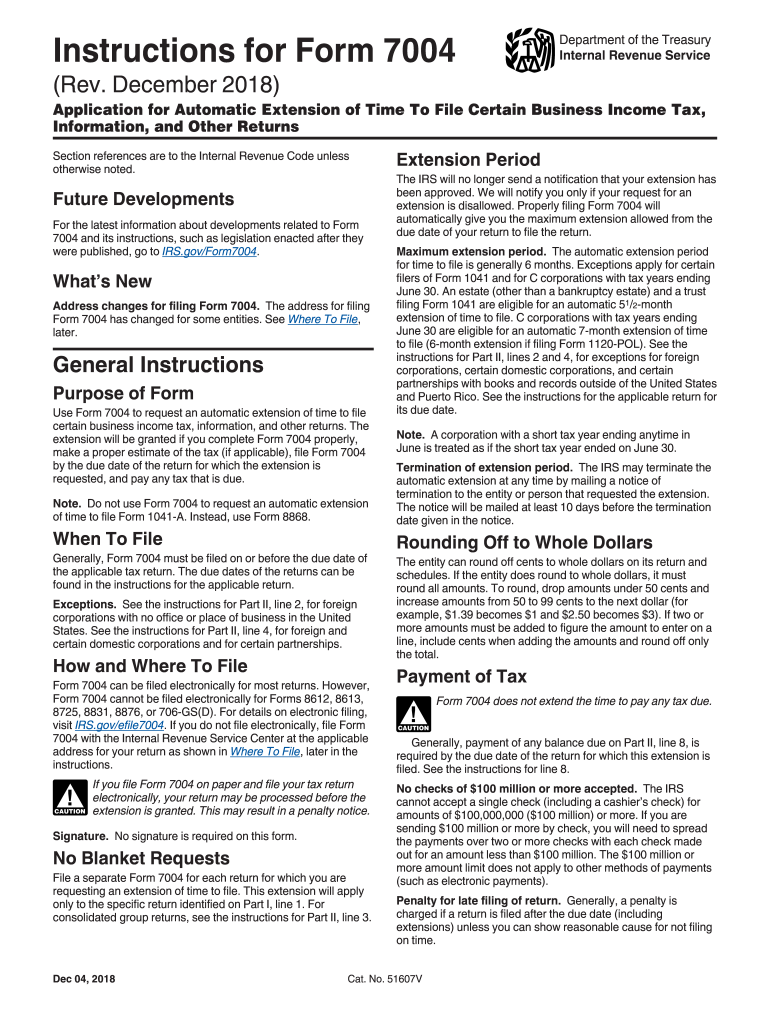

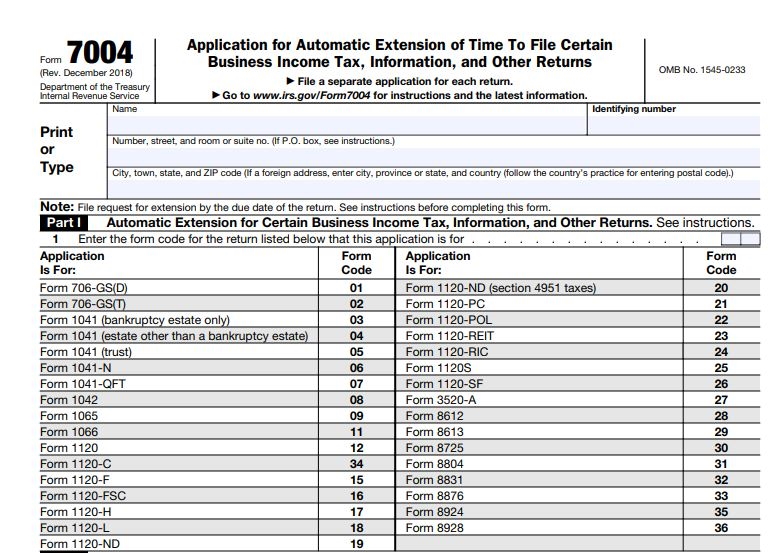

Where Do I File Form 7004 - See the form 7004 instructions for a list of the exceptions. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form 7004?. Web how to complete form 7004 add your name, address, and the company's tax id number. Determine the state under the and your principal business,. Select extension of time to. Filing form ssa 7004 is completely optional. See where to file, later. Web follow these steps to print a 7004 in turbotax business: Download or email irs 7004 & more fillable forms, register and subscribe now! Transmit your form to the irs ready to e.

Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. Web you can file an irs form 7004 electronically for most returns. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form 7004?. Enter business details step 2: Form 7004 can be filed electronically for most returns. Select the tax year step 4: Web go to the irs where to file form 7004 webpage. Transmit your form to the irs ready to e. Web and you are filing a form. See where to file, later.

See the form 7004 instructions for a list of the exceptions. Enter tax payment details step 5: File your 2290 online & get schedule 1 in minutes. And you are not enclosing a payment, then use this address. Download or email irs 7004 & more fillable forms, register and subscribe now! Web in this guide, we cover it all, including: Web how and where to file form 7004 can be filed electronically for most returns. Enter code 25 in the box on form 7004, line 1. However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706. Transmit your form to the irs ready to e.

Last Minute Tips To Help You File Your Form 7004 Blog

Find the applicable main form under the if the form is. Web how and where to file form 7004 can be filed electronically for most returns. Enter tax payment details step 5: Web go to the irs where to file form 7004 webpage. You may obtain a record of your earnings history by establishing an online social.

Free Fillable Irs Form 7004 Printable Forms Free Online

What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form 7004?. To file form 7004 using taxact ® :. Select extension of time to. The request for mail order forms may be used to order one copy or. Web 1 min read you can extend.

Form 7004 Where To Sign Fill Out and Sign Printable PDF Template

And you are not enclosing a payment, then use this address. Form 7004 can be filed electronically for most returns. Enter tax payment details step 5: Transmit your form to the irs ready to e. Web 1 min read you can extend filing form 1120s when you file form 7004.

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

Complete, edit or print tax forms instantly. Find the applicable main form under the if the form is. Select the tax year step 4: And you are not enclosing a payment, then use this address. With your return open, select search and enter extend;

Where to file Form 7004 Federal Tax TaxUni

Select the tax year step 4: And you are enclosing a payment, then use this address. Filing form ssa 7004 is completely optional. With your return open, select search and enter extend; Web and you are filing a form.

efile form 7004 Blog ExpressExtension Extensions Made Easy

Web how and where to file form 7004 can be filed electronically for most returns. With your return open, select search and enter extend; Download or email irs 7004 & more fillable forms, register and subscribe now! Select the tax year step 4: Enter business details step 2:

Form 7004 For Form 1065 Nina's Soap

Web how and where to file form 7004 can be filed electronically for most returns. Transmit your form to the irs ready to e. Web how to complete form 7004 add your name, address, and the company's tax id number. Enter tax payment details step 5: Form 7004 can be filed electronically for most returns.

When is Tax Extension Form 7004 Due? Tax Extension Online

See where to file, later. Transmit your form to the irs ready to e. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form 7004?. Web do i need to file ssa 7004? Web the address for filing form 7004 has changed for some entities.

Efile Form 7004 & get extension up to 6 months. in 2021 Business tax

File your 2290 online & get schedule 1 in minutes. Enter tax payment details step 5: See the form 7004 instructions for a list of the exceptions. See where to file, later. Web how to complete form 7004 add your name, address, and the company's tax id number.

How to Fill Out Tax Form 7004 Tax forms, Irs tax forms,

Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. And you are enclosing a payment, then use this address. Find the applicable main form under the if the form is. Transmit your form to the irs ready to e. And you are.

Web You Can File An Irs Form 7004 Electronically For Most Returns.

However, form 7004 cannot be filed electronically for forms 8612, 8613, 8725, 8831, 8876, or 706. With your return open, select search and enter extend; Web 1 min read you can extend filing form 1120s when you file form 7004. Enter tax payment details step 5:

Select The Tax Year Step 4:

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates,. Select extension of time to. Web generally, form 7004 must be filed on or before the regular due date of the applicable tax return and can be filed electronically for most returns. Complete, edit or print tax forms instantly.

To File Form 7004 Using Taxact ® :.

Select business entity & form step 3: File your 2290 online & get schedule 1 in minutes. Web do i need to file ssa 7004? And you are enclosing a payment, then use this address.

See Where To File, Later.

Web go to the irs where to file form 7004 webpage. Use the specific code for the type of tax return you wish to postpone. Web in this guide, we cover it all, including: Web how to complete form 7004 add your name, address, and the company's tax id number.