Where To Report Ppp Loan Forgiveness On Form 990

Where To Report Ppp Loan Forgiveness On Form 990 - Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of. Web the irs recently released updated the form 990 and instructions for the 2020 tax year, including instructions for the form 990, schedule a. Web community hosting for lacerte & proseries how to enter forgiven ppp loans for individual returns this article will help you report paycheck protection program. To enter a ppp loan statement on a 1040: Web it should report the amounts in part ii or part iii using the cash method. For instance, if you provide a draft tax filing, you will be required. Web in three revenue procedures (rev. Web submit the forgiveness form and documentation to sba or your ppp lender: If the organization filed a 2021 schedule a (form 990) using the cash method, it should report in the 2018. Corporations should report certain information related to a ppp loan.

Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. An adjustment for the loans will. Web report the amount of qualifying forgiveness with respect to covered loans made under the paycheck protection program (ppp) administered by the small business administration. Web it should report the amounts in part ii or part iii using the cash method. Web in three revenue procedures (rev. Loan amounts forgiven under the paycheck protection program (ppp), established under the coronavirus aid, relief and economic security act (cares act),. Taxpayers should also report instances of irs. Web community hosting for lacerte & proseries how to enter forgiven ppp loans for individual returns this article will help you report paycheck protection program. To enter a ppp loan statement on a 1040: Web submit the forgiveness form and documentation to sba or your ppp lender:

For instance, if you provide a draft tax filing, you will be required. Corporations should report certain information related to a ppp loan. Web report the amount of qualifying forgiveness with respect to covered loans made under the paycheck protection program (ppp) administered by the small business administration. If the organization filed a 2021 schedule a (form 990) using the cash method, it should report in the 2018. Taxpayers should also report instances of irs. Web community hosting for lacerte & proseries how to enter forgiven ppp loans for individual returns this article will help you report paycheck protection program. Web the irs recently released updated the form 990 and instructions for the 2020 tax year, including instructions for the form 990, schedule a. Web it should report the amounts in part ii or part iii using the cash method. For a second draw ppp loan amount of $150,000 or less, the borrower must provide documentation substantiating the reduction in gross receipts before or at the time. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of.

Business Report PPP loan CARES Act funding,

For instance, if you provide a draft tax filing, you will be required. An adjustment for the loans will. Web it should report the amounts in part ii or part iii using the cash method. If the organization filed a 2021 schedule a (form 990) using the cash method, it should report in the 2018. Taxpayers should also report instances.

IRS Expands on Reporting Expenses Used to Obtain PPP Loan

Taxpayers should also report instances of irs. For instance, if you provide a draft tax filing, you will be required. Web sba may require additional documentation when you apply for forgiveness of your ppp loan or 2nd draw ppp loan. Web the irs recently released updated the form 990 and instructions for the 2020 tax year, including instructions for the.

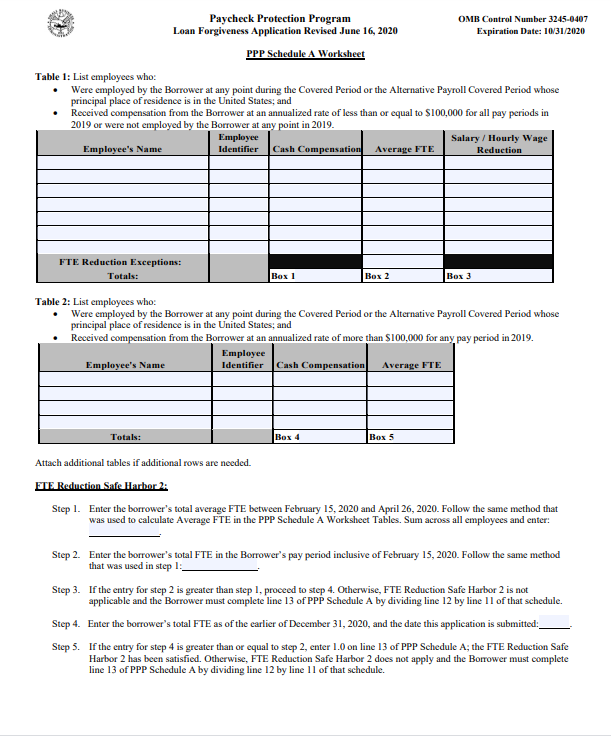

A Simple Guide to Fill Out Your PPP Application Form

Loan amounts forgiven under the paycheck protection program (ppp), established under the coronavirus aid, relief and economic security act (cares act),. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. Web community hosting for lacerte & proseries how to.

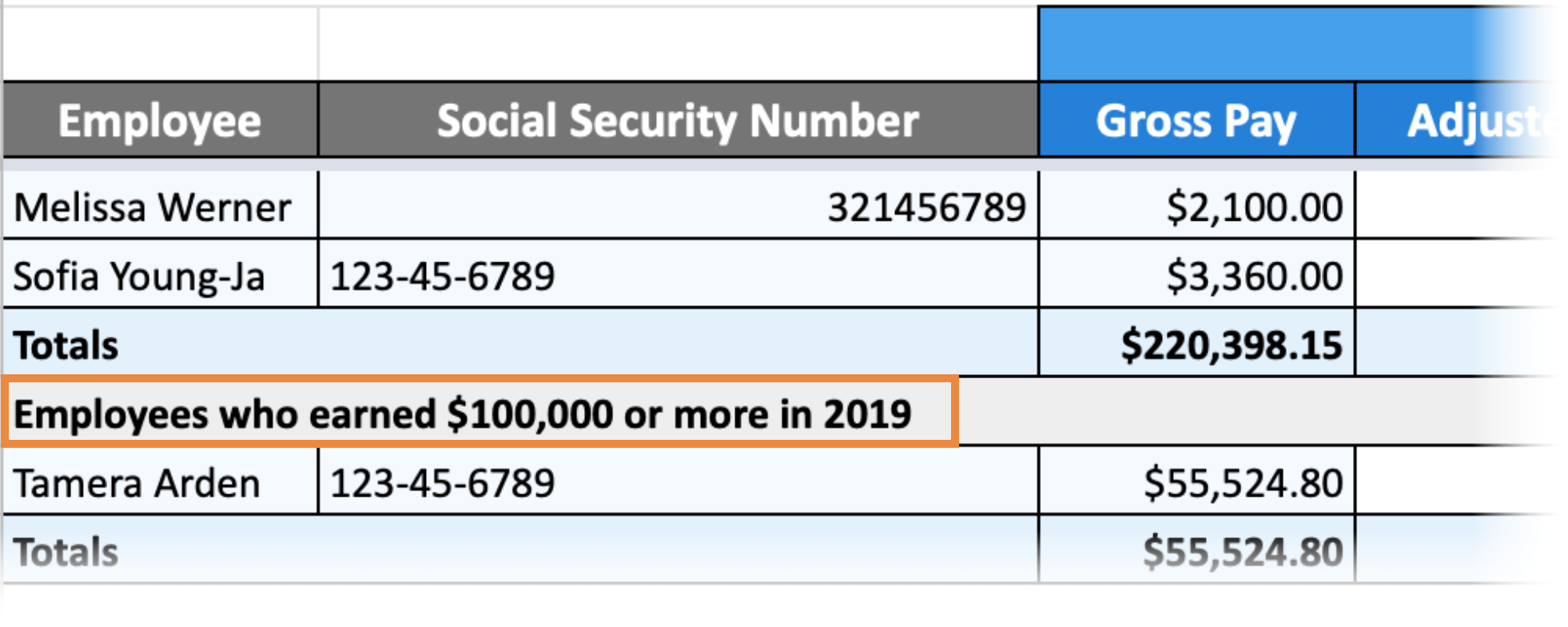

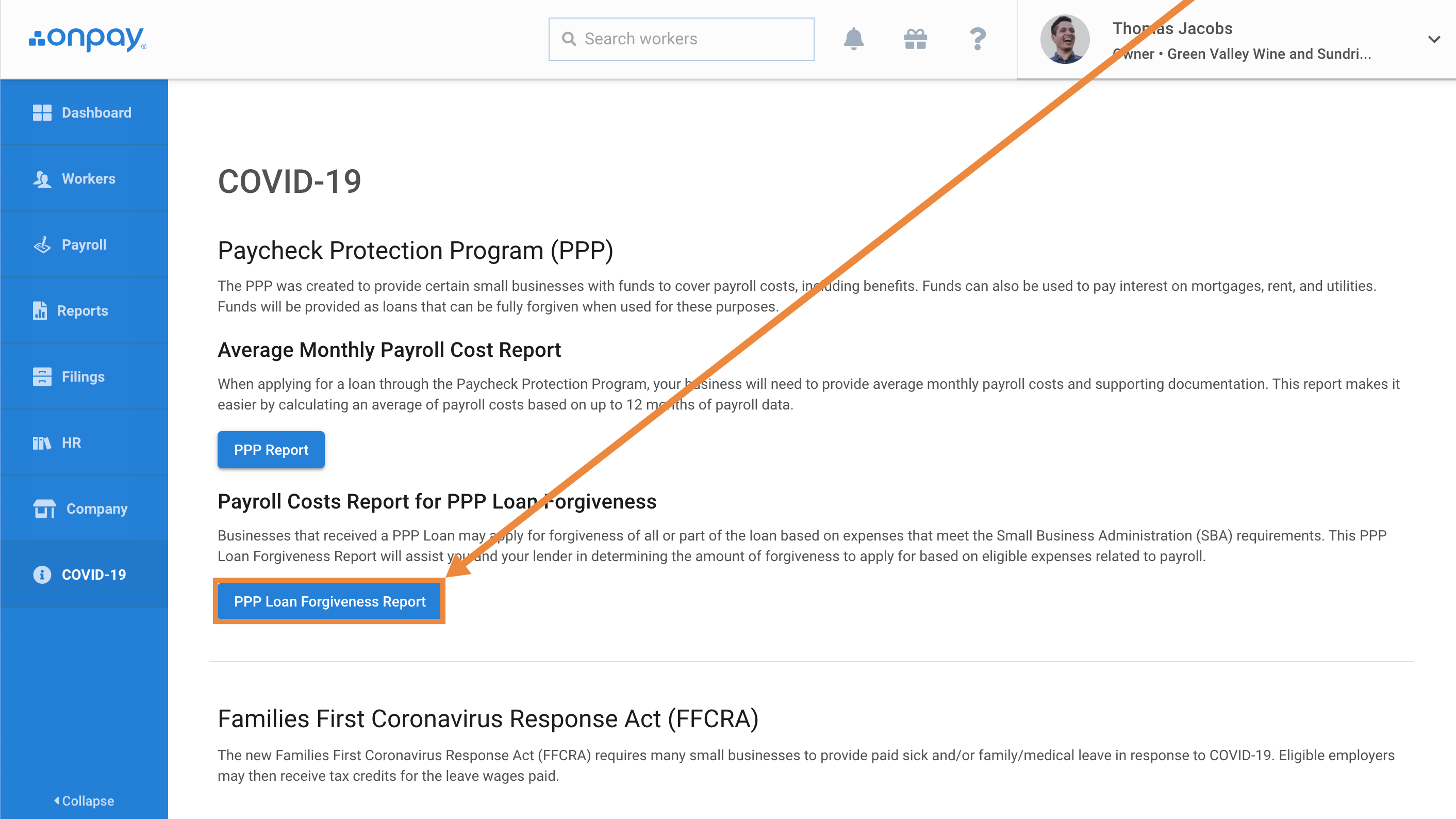

How to run a PPP Loan Report in OnPay Help Center Home

Web sba may require additional documentation when you apply for forgiveness of your ppp loan or 2nd draw ppp loan. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of. An adjustment for the loans will. For instance, if you provide.

How To Report Ppp Loan On Form 990

Taxpayers should also report instances of irs. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. Web report the amount of qualifying forgiveness with respect to covered loans made under the paycheck protection program (ppp) administered by the small.

Government Clarifies PPP Loan for the SelfEmployed.

Web submit the forgiveness form and documentation to sba or your ppp lender: Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a.

Understanding PPP Loan Application and Instructions

Web part viii, line 1e: Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. Web sba may require additional documentation when you apply for forgiveness of your ppp loan or 2nd draw ppp loan. Web it should report the.

Feds Release PPP Loan Application YourSource News

An adjustment for the loans will. Web part viii, line 1e: Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of. Web community hosting for lacerte & proseries how to enter forgiven ppp loans for individual returns this article will help.

Loan Documentation

Web the irs recently released updated the form 990 and instructions for the 2020 tax year, including instructions for the form 990, schedule a. If the organization filed a 2021 schedule a (form 990) using the cash method, it should report in the 2018. Web the instructions to the irs form 990 state that these funds may only be reported.

How to run a PPP Loan Report in OnPay Help Center Home

For a second draw ppp loan amount of $150,000 or less, the borrower must provide documentation substantiating the reduction in gross receipts before or at the time. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption) if it has either. Web it should.

Taxpayers Should Also Report Instances Of Irs.

Web sba may require additional documentation when you apply for forgiveness of your ppp loan or 2nd draw ppp loan. Depending on whether your lender is participating in direct forgiveness, complete your loan. For instance, if you provide a draft tax filing, you will be required. Web the instructions to the irs form 990 state that these funds may only be reported on part viii, line 1e as a contribution from a governmental unit in the tax year.

If The Organization Filed A 2021 Schedule A (Form 990) Using The Cash Method, It Should Report In The 2018.

Web the irs recently released updated the form 990 and instructions for the 2020 tax year, including instructions for the form 990, schedule a. Web report the amount of qualifying forgiveness with respect to covered loans made under the paycheck protection program (ppp) administered by the small business administration. Web in three revenue procedures (rev. Loan amounts forgiven under the paycheck protection program (ppp), established under the coronavirus aid, relief and economic security act (cares act),.

Web Form 990 Must Be Filed By An Organization Exempt From Income Tax Under Section 501(A) (Including An Organization That Hasn't Applied For Recognition Of Exemption) If It Has Either.

Web submit the forgiveness form and documentation to sba or your ppp lender: Web the 2020 form 990 instructions explain that ppp loans may be reported as contributions from a government unit in the year the loans are forgiven for purposes of. Web part viii, line 1e: For a second draw ppp loan amount of $150,000 or less, the borrower must provide documentation substantiating the reduction in gross receipts before or at the time.

Web It Should Report The Amounts In Part Ii Or Part Iii Using The Cash Method.

To enter a ppp loan statement on a 1040: Web community hosting for lacerte & proseries how to enter forgiven ppp loans for individual returns this article will help you report paycheck protection program. An adjustment for the loans will. Corporations should report certain information related to a ppp loan.