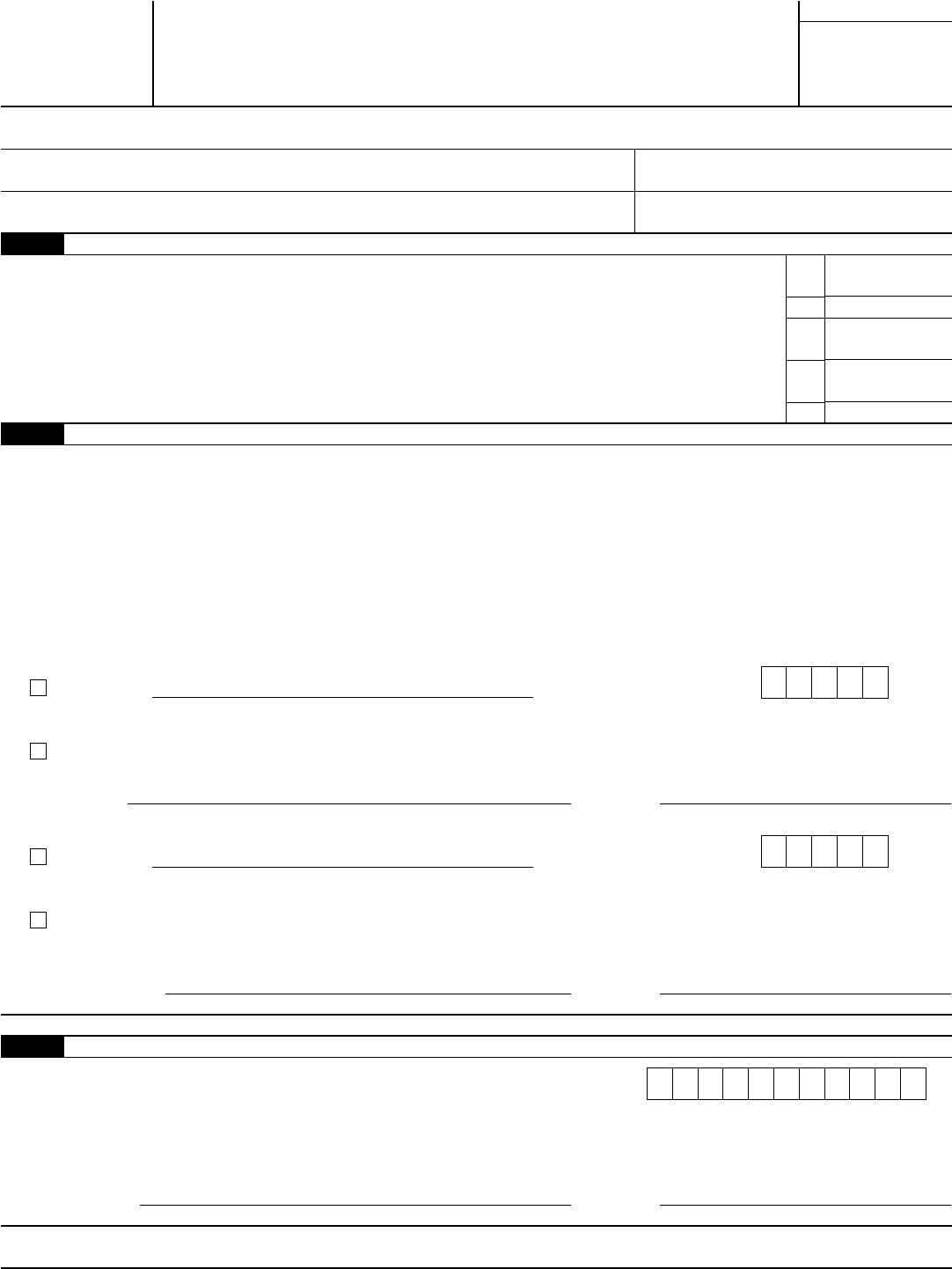

Form 8879-F

Form 8879-F - Go to www.irs.gov/form8879 for the latest information. Identity verification must be completed every time a taxpayer electronically signs form 8878 or 8879, with two exceptions. Web complete form 8879 when the practitioner pin method is used or when the taxpayer authorizes the ero to enter or generate the taxpayer's personal identification number. Use this form 8879 (rev. Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax. Fiduciary’s (pin) mark one oval only. • inspect the paper copy of the return and ensure the information is correct. You can download or print. Web use this form 8879 (rev. • inspect the paper copy of the return and ensure the information is correct.

• inspect the paper copy of the return and ensure the information is correct. Web complete form 8879 when the practitioner pin method is used or when the taxpayer authorizes the ero to enter or generate the taxpayer's personal identification number. Fiduciary’s (pin) mark one oval only. Authenticate the electronic form 1041, u.s. • inspect the paper copy of the return and ensure the information is correct. I authorize to enter my pin as. You can download or print. Web use this form 8879 (rev. Use this form 8879 (rev. Go to www.irs.gov/form8879 for the latest information.

• inspect the paper copy of the return and ensure the information is correct. I authorize to enter my pin as. Use this form 8879 (rev. Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax. You can download or print. Web complete form 8879 when the practitioner pin method is used or when the taxpayer authorizes the ero to enter or generate the taxpayer's personal identification number. Web use this form 8879 (rev. Go to www.irs.gov/form8879 for the latest information. Web ero must obtain and retain completed form 8879. Authenticate the electronic form 1041, u.s.

Form 8879 Edit, Fill, Sign Online Handypdf

• inspect the paper copy of the return and ensure the information is correct. Use this form 8879 (rev. Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax. • inspect the paper copy of the return and ensure the.

2018 2019 IRS Form 8879 Editable Online Blank in PDF

Web use this form 8879 (rev. Use this form 8879 (rev. You can download or print. Identity verification must be completed every time a taxpayer electronically signs form 8878 or 8879, with two exceptions. Authenticate the electronic form 1041, u.s.

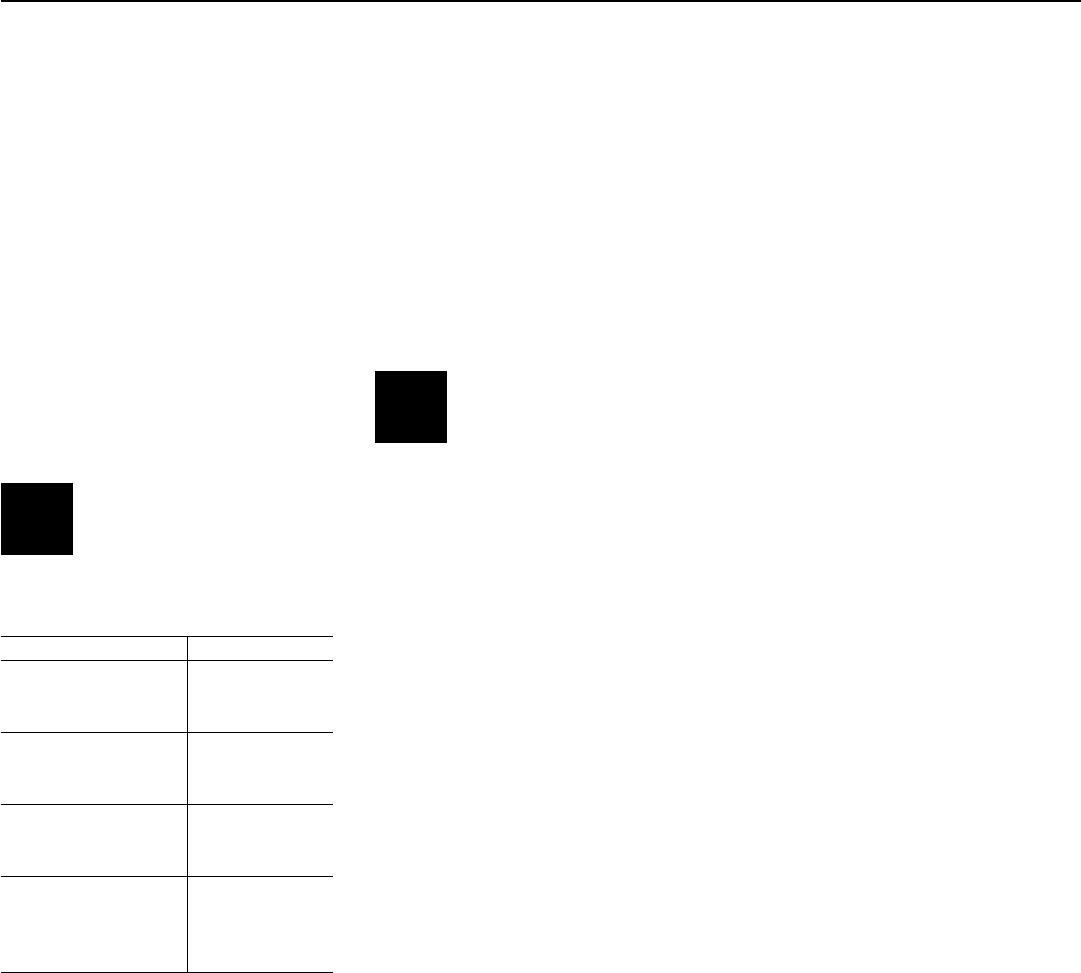

Fillable Form Pa8879F Pennsylvania EFile Signature Authorization

Use this form 8879 (rev. • inspect the paper copy of the return and ensure the information is correct. You can download or print. Web ero must obtain and retain completed form 8879. Web use this form 8879 (rev.

Form 8879EX IRS efile Signature Authorization for Forms 720, 2290

Web use this form 8879 (rev. • inspect the paper copy of the return and ensure the information is correct. Fiduciary’s (pin) mark one oval only. Web ero must obtain and retain completed form 8879. Web complete form 8879 when the practitioner pin method is used or when the taxpayer authorizes the ero to enter or generate the taxpayer's personal.

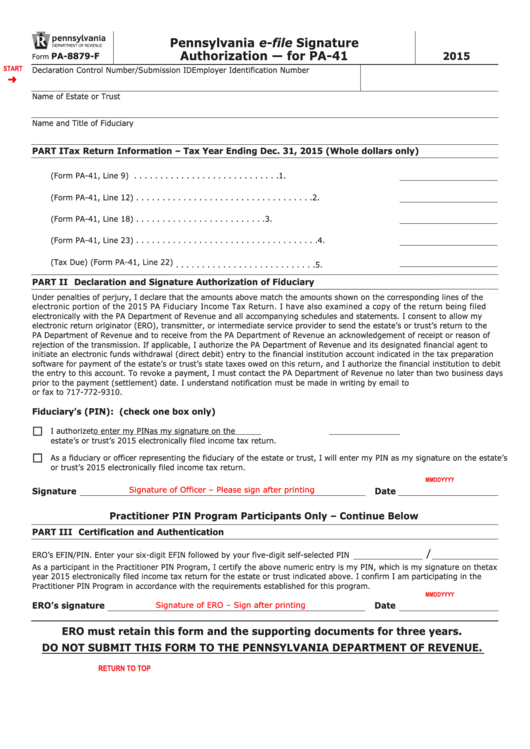

Form 8879VtF Vermont Fiduciary Tax Declaration For

Web ero must obtain and retain completed form 8879. Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax. Web complete form 8879 when the practitioner pin method is used or when the taxpayer authorizes the ero to enter or.

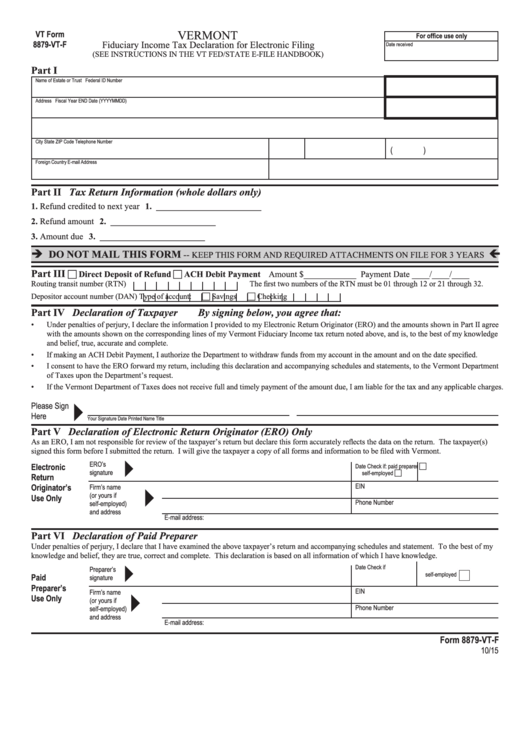

Fillable Form 8879S Irs EFile Signature Authorization For Form

Use this form 8879 (rev. Web ero must obtain and retain completed form 8879. • inspect the paper copy of the return and ensure the information is correct. Identity verification must be completed every time a taxpayer electronically signs form 8878 or 8879, with two exceptions. Web complete form 8879 when the practitioner pin method is used or when the.

2016 Form 8879 Edit, Fill, Sign Online Handypdf

• inspect the paper copy of the return and ensure the information is correct. Web ero must obtain and retain completed form 8879. Authenticate the electronic form 1041, u.s. Go to www.irs.gov/form8879 for the latest information. I authorize to enter my pin as.

IRS Form 8879F Download Fillable PDF or Fill Online IRS EFile

Use this form 8879 (rev. Fiduciary’s (pin) mark one oval only. Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax. You can download or print. Web use this form 8879 (rev.

Form 8879F IRS efile Signature Authorization for Form 1041 (2015

• inspect the paper copy of the return and ensure the information is correct. I authorize to enter my pin as. Web complete form 8879 when the practitioner pin method is used or when the taxpayer authorizes the ero to enter or generate the taxpayer's personal identification number. Web use this form 8879 (rev. Use this form 8879 (rev.

Form 8879I IRS efile Signature Authorization for Form 1120F (2015

Web complete form 8879 when the practitioner pin method is used or when the taxpayer authorizes the ero to enter or generate the taxpayer's personal identification number. Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax. • inspect the.

Web Ero Must Obtain And Retain Completed Form 8879.

Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax. Go to www.irs.gov/form8879 for the latest information. Web complete form 8879 when the practitioner pin method is used or when the taxpayer authorizes the ero to enter or generate the taxpayer's personal identification number. Authenticate the electronic form 1041, u.s.

• Inspect The Paper Copy Of The Return And Ensure The Information Is Correct.

Fiduciary’s (pin) mark one oval only. Use this form 8879 (rev. Web use this form 8879 (rev. I authorize to enter my pin as.

• Inspect The Paper Copy Of The Return And Ensure The Information Is Correct.

Identity verification must be completed every time a taxpayer electronically signs form 8878 or 8879, with two exceptions. You can download or print.